xysoom's Blog

Ex-RBI Chief Says Insolvency Rules Caused Rift With Government

Moves to dilute a new bankruptcy law caused disagreements between Prime Minister Narendra Modis government and the central bank, according to former Reserve Bank of India Governor Urjit Patel.To get more news about WikiFX, you can visit wikifx news official website.

The rift centered around a February 2018 circular issued by the RBI, which forced banks to immediately classify borrowers as defaulters when they delayed repayments, and which barred defaulting company founders from trying to buy back their firms during insolvency auctions. In a book released Friday, Patel -- who headed the RBI between September 2016 and his unexpected resignation in December 2018 -- said the government seemed to lose enthusiasm for the legislation in the middle of the year he left the central bank.

“Instead of buttressing and future-proofing the gains thus far, an atmosphere to go easy on the pedal ensued,” Patel wrote. “Until then, for the most part, the finance minister and I were on the same page, with frequent conversations on enhancing the landmark legislations operational efficiency.”

Read excerpts from Patels book here

The government was probably of the view that the “deterrence effect -- ‘future defaulters beware, you may lose your business’” had been achieved, Patel said. He adds that “there were requests for rolling back the February circular” and “a canard was spread” to discredit the rules, including by incorrectly suggesting that small businesses would suffer disproportionately.

Patel‘s comments offer a first glimpse into a tussle between the RBI and the government, which led eventually to a U-turn that stunned the Indian business world when the Supreme Court last year struck down the RBI’s February circular. Those subsequent changes in the bankruptcy rules risk reversing gains from the efforts to clean one of the worlds largest bad-loan piles, Patel warned in his book.

WoW Classic’s Ahn’Qiraj raid isn’t out yet

As Wowhead points out, before attempting WoW Classic’s new raid you’re supposed to run Blackwing Lair a second time, ring a gong, and then wait out the Ten Hour War event to give others a chance to hit the gong, too. With Chinese servers resetting earlier than the rest of the world they were able to ring it and start the event first. For some reason, though, they were also able to enter the raid right away.To get more news about Buy WoW Items, you can visit lootwowgold news official website.

One streamer broadcasted the whole on Chinese streaming service Douyu, which was then restreamed on Twitch. As the raid wasn’t ready, there were a host of issues from mobs being stuck in walls to entire boss mechanics being skippable.

Everything is seemingly better now, though, and the new WoW Classic raid is restricted.

Once the weekly reset hits at 11:00 PDT/ 14:00 EDT/ 19:00 BST, five US realms will be able to hit the gong and start the Ten Hour War, and the raid should unlock naturally after that if you’ve hit the requirements.The World of Warcraft: Shadowlands release date isn’t quite here yet, but details are starting to spill out. The WoW Corruption system will be removed in a Shadowlands pre-patch, and Horrific Visions, Island Expeditions, and Warfronts will still be playable when the DLC launches. Oh, and there’s a nifty Witcher 3 easter egg we’re quite fond of.

In the meantime, though, you can check out our best WoW addons list to spice up your game while you wait.

World of Warcraft’s Corruption system will be removed

World of Warcraft’s Corruption system will be removed

Game Director Ion Hazzikostas explains to Twitch Streamer PandaTV (thanks, Icy Veins) in an interview that the team felt the MMORPG game is broken right now as someone could run a build with 100% critical chance. Don’t worry, though, Azerite gear and essence will still work after the pre-patch.To get more news about WoW Classic Gold, you can visit lootwowgold news official website.

“Corruption is completely going away in the 9.0 pre-patch, so as soon as 9.0 drops, canonically, N’Zoth is dead,” Hazzikostas says. “We have destroyed the old god, his corruption has been cleansed from Azeroth, and we may preserve a legacy tooltip on the gear, but it’s a mix of moving the storyline forward, and frankly, the game is pretty broken right now.

“Part of why that’s been okay is that we know it’s for a short time. There’s no way to deal with somebody who has 100% crit rates and all that stuff going into new content.

“Enjoy this silly season, but post-squish, we’ll get back to a normalised space and re-tune all the contents so that people can do everything they were accustomed to doing with all your Corruption, so if you were able to do it before 9.0, you will be able to do it at max level in 9.0. We don’t want to change any of that. Essences and Azerite Armour will continue to work.”

You can catch the full interview on PandaTV’s Twitch channel.

We got to try some WoW Shadowlands gameplay for ourselves last year and were left feeling excited for what was to come. If you’d like something to spice up your World of Warcraft experience while you wait, why not try out these WoW addons? GTFO is a personal favourite of mine.

If you’re looking for something else entirely, though, then our new PC games list will point you in the right directions. Or, maybe our best MMORPGs list is more your thing if you want something like World of Warcraft.

WoW Classic Summer Bowl

WoW Classic Summer Bowl

The first WoW Classic Esports event has recently been announced by Blizzard. The WoW Classic Summer Bowl is a PvP tournament held this June, everything you need to know about it in this article. To get more news about WoW Gold Classic, you can visit lootwowgold news official website.

Recently leaked on the Chinese website dedicated to WoW Classic, the WoW Classic Summer Bowl has been officialy announced. The Esport event will take place this June 17.

"For the first time in WoW Classic, World of Warcraft Esports presents the Summer Bowl. The WoW Classic Summer Bowl is a 10v10 Warsong Gulch tournament beginning June 17. Over the following three weekends, teams in North America and Europe will compete for a separate prize pool of USD $4,000 in each region!"

The tournament will be split into two regions: North America and Europe. All games will take place on live servers for WoW Classic, using the recently added War Game feature. Here’s how it all works:

Teams of 10 players will sign up for their region. Signups are open to eligible players with a level 60 character on live servers for WoW Classic—check eligibillity and sign up for NA here and EU here!

The tournament will be split into two stages for each region: qualifiers and finals.

The qualifiers are open sign ups.

The finals will feature the top six teams for the region.

Teams will battle against each other on live servers using the War Game feature, allowing players to queue up battlegrounds against other teams in their region.

For the top six teams in North America and Europe, there will be a total of USD $4,000 on offer in separate prizing for each region and bragging rights of winning the WoW Classic Summer Bowl!

More information on the full ruleset can be found on our NA and EU sign-up pages.

Why Pinduoduo Stock Popped Today

Shares of Pinduoduo (NASDAQ:PDD) were climbing to all-time highs today on a broader wave of gains among Chinese tech stocks. Though there was no clear reason for its gains, the stock finished Thursday up 8.8%.To get more Pinduoduo news, you can visit shine news official website.

So what

Today's gains came alongside a number of Chinese e-commerce stocks moving higher, including Baozun and Alibaba. A strong June manufacturing report on Wednesday may have helped lift Chinese stocks. They may also have benefited from better-than-expected second-quarter vehicle deliveries from Tesla, which seemed to show strong demand from the Chinese market, a sign that the country's economy is bouncing back from the pandemic and that Chinese consumers are eager to spend.

Pinduoduo said Wednesday morning that its founder and CEO, Colin Huang, would step down in a surprise move (he is only 40). Huang will stay on as board chairman while Lei Chen, the current chief technology officer, will serve as the next CEO.

Huang said: "Lei Chen has been instrumental to Pinduoduo's growth since inception. With him taking on the role of CEO, I have every confidence that Pinduoduo will be able to take on more responsibility to create value for society."

Investors had little reaction to the news when it came out Wednesday, although it could raise some suspicions. But Huang said that while he will be stepping back from the day-to-day management of the company, he will be focused on fundamental research and long-term strategy.Chinese stocks may also be climbing today as U.S. investors look for options outside of American stocks as signs emerge that the U.S. economic recovery is stalling and coronavirus cases are surging again.

For growth investors, it's easy to see the appeal of Pinduoduo. The company's social commerce model has caught fire as revenue jumped 130% to $4.33 billion, though the company is still unprofitable. Investors currently seem to be hungry for high-growth tech stocks that can withstand the pandemic, and Pinduoduo fits the bill.

Vanke profits grow despite revenue slowdown

China Vanke Co Ltd posted double-digit profit growth despite a moderate decrease in revenue during the first quarter amid the COVID-19 outbreak.To get more Vanke news, you can visit shine news official website.

The Shenzhen and Hong Kong dual-listed real estate giant, which is positioning itself as a city and town developer and service provider, said revenue fell 1.2 percent between January and March from same period a year earlier to 47.77 billion yuan (US$6.73 billion). Net profit attributable to equity shareholders, however, amounted to 1.25 billion yuan, a year-on-year increase of 11.5 percent, according to a filing to the Shenzhen Stock Exchange late Monday.

Operating revenue from property development and related business, which accounted for almost 96 percent of the company's revenue last year, dropped 6.4 percent year over year to 39.36 billion yuan during the latest three-month period.

In terms of Vanke's property development business, contracted sales totaled 8.848 million square meters and 137.88 billion yuan by value during the first quarter, marking year-over-year declines of 4.3 percent and 7.7 percent, respectively.

By area, the Shanghai region, which consists of 15 cities including those in neighboring Zhejiang, Jiangsu, Anhui and Jiangxi provinces, accounted for one-third of the company's total sales area and 45.9 percent of value.

During the first three months, Vanke acquired 11 new projects into its development pipeline with a planned gross floor area of 2.39 million square meters, among which 1.876 million square meters are attributable to the company's equity holding, according to the quarterly report.

The coronavirus outbreak also slowed Vanke's pace in commencement. A total of 7.08 million square meters of space kicked off construction during the three-month period, a year-over-year drop of 30.5 percent. That represents 24.3 percent of the company's annual target, compared with 28.2 percent registered in the first quarter of 2019.

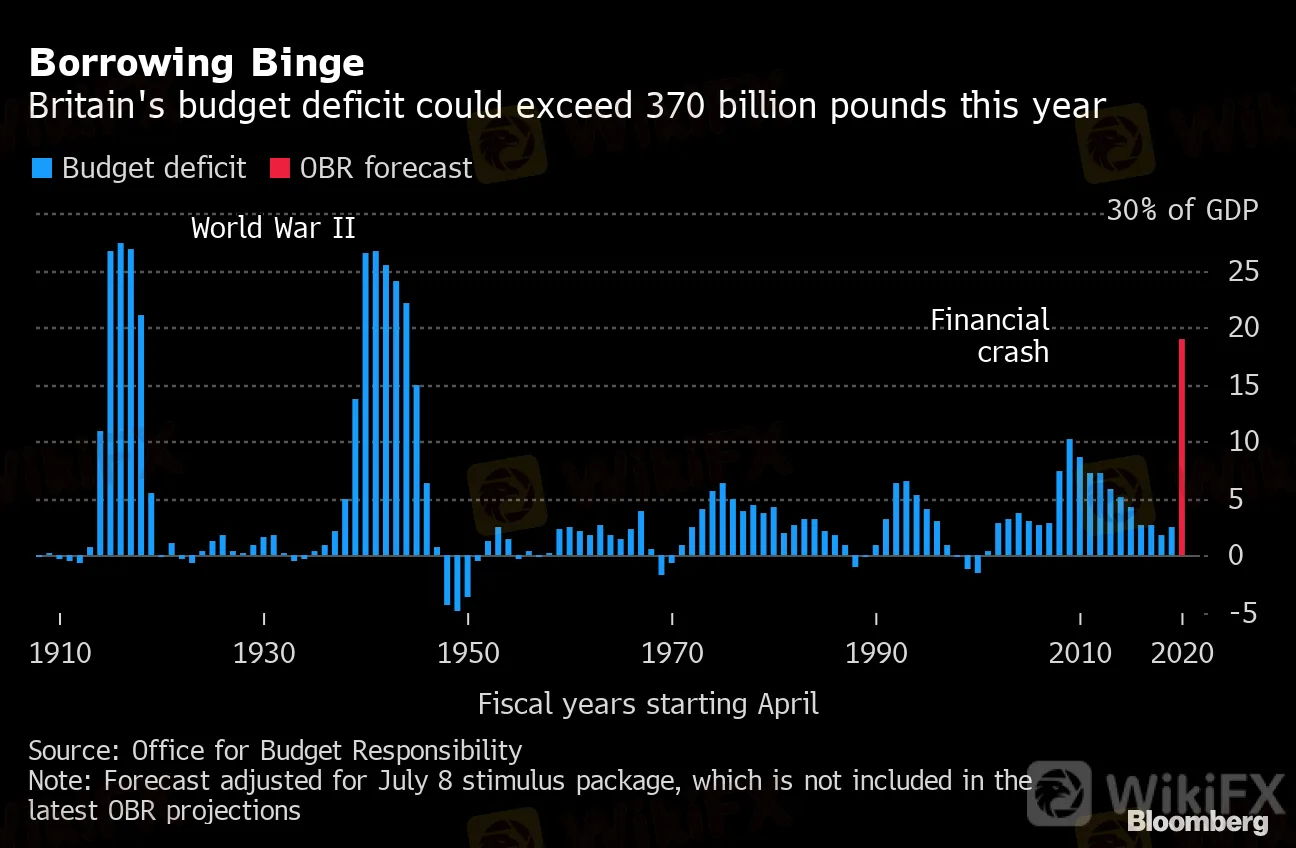

U.K. Budget Deficit Swells to Record on Coronavirus Stimulus

Supply Lines is a daily newsletter that tracks COVID-19s impact on trade. Sign up here, and subscribe to our Covid-19 podcast for the latest news and analysis on the pandemic.To get more news about Binary option, you can visit wikifx news official website.

U.K. government borrowing soared to almost 130 billion pounds ($165 billion) in the first three months of the fiscal year amid the towering cost of supporting the economy through the coronavirus crisis.

The Office for National Statistics said Tuesday that the budget deficit stood at 35.5 billion pounds in June alone, leaving debt at 99.6% of GDP -- the highest since 1961.

Chancellor of the Exchequer Rishi Sunak has committed more than 190 billion pounds of government spending and tax cuts in an effort to save jobs and keep businesses afloat. Combined with the damage inflicted by the worst recession for at least a century, that means a deficit that was forecast to be just 55 billion pounds this year is now on course to exceed 370 billion pounds, according to the Office for Budget Responsibility.

The pound was at $1.2689 following the report, up 0.2% on the day. Ten-year gilt yields were at 0.15%, close to a record low.

At around 19% of GDP, the deficit projected for 2020-21 would be the highest since World War II and almost double the levels reached after the financial crisis a decade ago. And its not the most pessimistic scenario outlined by the fiscal watchdog last week.

Government debt could take decades to bring down to more sustainable levels, economists say. But while the stock of debt is high, the cost of servicing it is more affordable than ever, thanks in part to massive Bank of England bond buying in the secondary market which has pushed down gilt yields. Tax rises nonetheless appear inevitable once the crisis has passed.

The latest snapshot of the public finances showed government revenue fell 13% between April and June compared with a year earlier, with receipts down across the board. Spending meanwhile jumped over 40%, driven by a 70% increase in departmental outlays.

A cash measure that determines government bond issuance stood at 47.1 billion pounds in June, taking the total for the fiscal first quarter to 174 billion pounds. The Debt Management Office is on course to sell around half a trillion pounds of gilts for the year as a whole.

U.K. ‘Did Not Want to Know’ If Russia Meddled in Brexit, MPs Say

The British government failed to investigate whether Russia interfered in the Brexit referendum and a full intelligence inquiry must now take place, a panel of lawmakers said.To get more news about Binary option, you can visit wikifx news official website.

Members of Parliaments Intelligence and Security Committee accused ministers of deliberately avoiding the question because they did not want to know whether Russia had tried to interfere in the European Union referendum.

Ministers refused to authorize a retrospective investigation into the 2016 vote on European Union membership.

The recommendation for a full-scale review is a key point in a long-delayed report on Russian involvement in British politics by the watchdog which oversees the work of the U.K. intelligence agencies.

It is a politically explosive subject and one that Prime Minister Boris Johnson will be reluctant to revisit. The aftermath of the Brexit vote split the country, leading to years of turmoil and uncertainty for business and bringing down two prime ministers.

Johnson, who led the controversial pro-Brexit campaign, is now in charge and seeking to negotiate a future trade deal with the EU. He will want to avoid reopening past debates about the vote as he has pledged to move the country on from the past divisions over Brexit.But the panel of politicians said a full inquiry -- with findings made public -- would be essential. “It is important to establish whether a hostile state took deliberate action with the aim of influencing a U.K. democratic process, irrespective of whether it was successful or not,” the ISC report said.

Members of the panel criticized the government for failing to try to establish what had happened sooner.

“The report reveals that no one in government knew if Russia interfered or sought to influence the referendum because they did not want to know,” Stewart Hosie, a Scottish Nationalist member of Parliaments Intelligence and Security Committee said in a briefing. “The committee found it astonishing that no one in government had sought beforehand to protect the referendum from such attempts or investigate afterwards what attempts to influence it there may have been.”

The study, which was delayed by nine months, threatens to further damage relations between London and Moscow, which have been in deep trouble since the 2018 Salisbury poisonings. Last week, the U.K. accused Russia of trying to interfere in the 2019 election and presented findings, backed by the U.S. and Canada, of Russian hackers attempts to steal coronavirus vaccine research.In its report, the ISC said Russia is so embedded in the British establishment that attempts to curb its influence are focused on damage limitation rather than prevention.

The committee found the British government has failed to tackle the threat to democracy from Russian interference.

The cross-party committee called for a full intelligence report on Russian attempts to influence the 2016 Brexit referendum along similar lines to investigations in the U.S. into meddling in its democracy. Some sections on the ISC report that deal with the Brexit vote were redacted.

In its response, Johnsons government said it had so far seen nothing that warranted an inquiry into Brexit. “We have seen no evidence of successful interference in the EU Referendum,” the government said in a written statement.

Ministers will always consider “new information” and how to use “any intelligence” they receive, the government said. “Given this long standing approach, a retrospective assessment of the EU Referendum is not necessary.”

The ISC report examines the sweeping extent of Russias involvement in British public life. It said the U.K. intelligence services were too focused on counter-terrorism and not enough on protecting democracy.

“Russian influence in the U.K. is ‘the new normal’, and there are a lot of Russians with very close links to Putin who are well integrated into the U.K. business and social scene, and accepted because of their wealth,” the report said. “This level of integration -- in ‘Londongrad’ in particular -- means that any measures now being taken by the Government are not preventative but rather constitute damage limitation.”

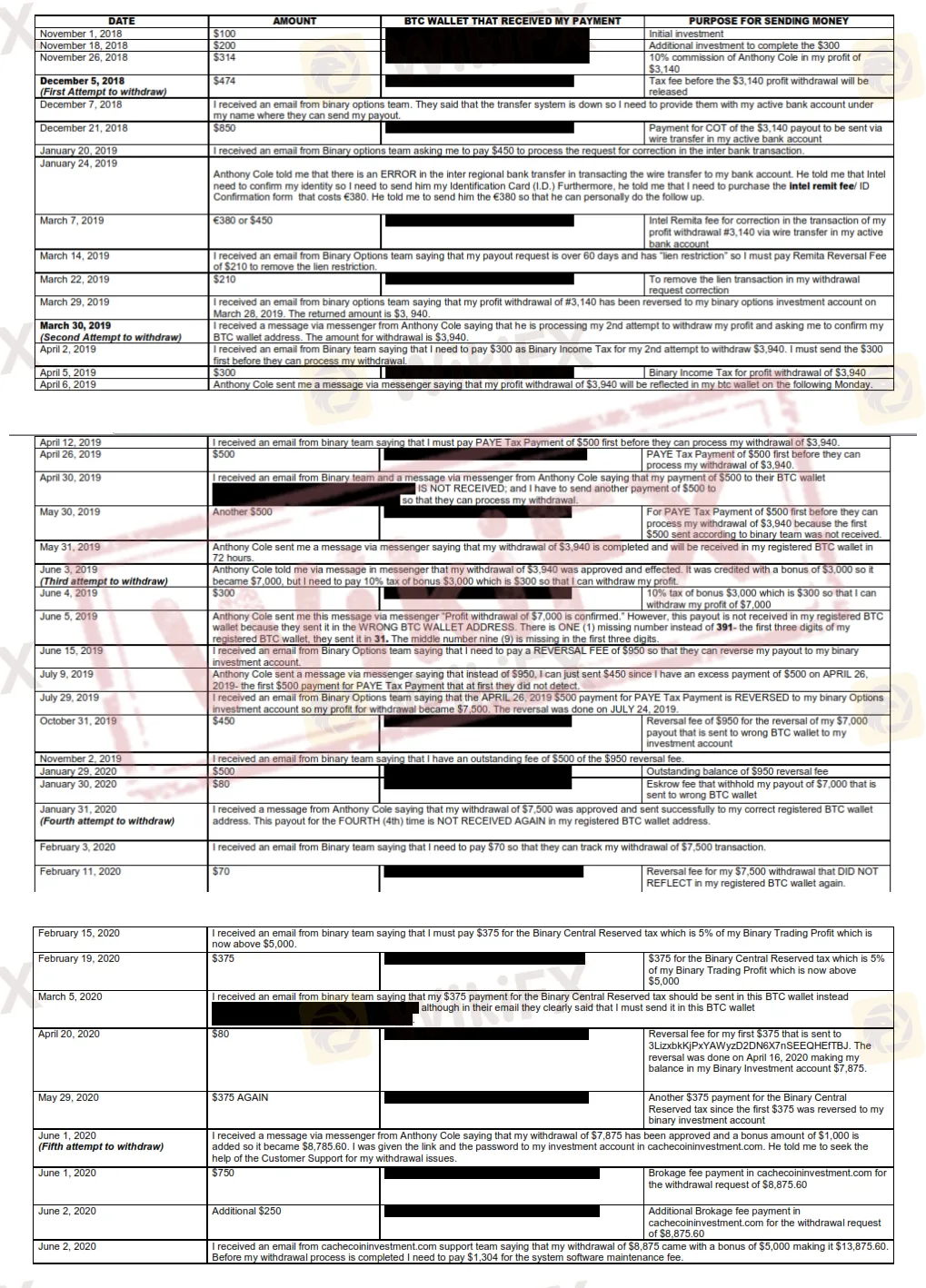

$7,128 Lost Due to a Payout Withdrawal Delayed for 18 Months

It is important to be alert and focused when trading forex. There‘s so many potential scams everyday and everywhere that you’re easily got scammed if you happen to choose some wrong brokers.To get more news about Binary option, you can visit wikifx news official website.

Recently, WikiFX team received an investors complaint against Binary Options, an investment platform based in UK. An investor claimed that she was misled and scammed by this illegal broker and lost $7,128.

The nightmare started when she registered her account at Binary Options in 2018. Then she met a FX/CFD trader of Binary Options, named Anthony Cole on Facebook. According to Anthony, the investor will get $2,190 in seven days if she invests $300.

The investor therefore started to invest on the trading platform Binary Options and gained some profits at the beginning. But when she wanted to withdraw the profits, Binary Options asked her to pay 10% commissions ($1,304) first.

“I have started this very PROLONGED withdrawal since November 2018. To date, I STILL NOT RECEIVE even $1 in my account at Binary Options.” The investor told WikiFX, “Binary Options team and Anthony Cole endlessly asked me to pay too much fees even if the errors in my withdrawal process were not caused by myself. I tried to compromise and paid as they requested. But they never returned my money withdrawn.”

Per investigation, we found that Binary Options is rated at only 1.12 on WikiFX App. According to the latest risk warning, this broker currently has no valid regulatory status. Please stay away from it!

So far, WikiFX App has included profiles of more than 19,000 forex brokers around the world, while integrating broker information query, exposure, news feed and other functions, to protect investors fund in forex trading. Click here to download the WikiFX App, a guide to less risks and safer investment.

Silver Rises Indeed

In last week, WikiFX predicted that silver may gain more upside momentum and suggested bargain hunting. Yesterdays weekly chart shows that silver price has increased nearly 70% since its decline and rebound on March 16.To get more news about Binary option, you can visit wikifx news official website.

According to the weekly chart, the candlestick showed six white soldiers before, with silver price hitting the $19.75 earlier, a new high since the week of October 3, 2016. At the week ended March 16, silver price fell to the lowest dip of $11.64. It rebounded almost 70% after establishing firmer footing, reflecting the bullish long position.

WikiFX holds that if silver price finds some stability over $19.65, in the future trading it may further grow to $20.94, the 1.27XA extension, among which X means the weekly high of $18.95 ended February 24, 2020, while A represents the weekly low of $11.64 ended March 16.

The bull position of silver keeps strengthening and records a 4-year high. However, since multiple cycles indicate demands for adjustment, bargain hunting is suggested in the future trading. On the contrary, once silver price falls below $18.45, market may face the risk of a phased peak. All the above is provided by WikiFX, a platform world-renowned for foreign exchange information. For details, please download the WikiFX App: bit.ly/WIKIFX