freeamfva's Blog

Forgeline shipping Carbon+Forged Series wheels

Forgeline shipping Carbon+Forged Series wheels

Forgeline Motorsports has started fulfilling orders for its hybrid carbon fiber/alloy Carbon+Forged Series wheels after a nine-month ramp-up period at its Dayton wheel factory.To get more news about Car wheel, you can visit nnxwheels.com official website.

Launched at the 2016 Specialty Equipment Market Association (SEMA) Show, the Carbon+Forged Series wheel combines CNC-machined forged aluminum centers with carbon fiber barrels provided by Emergent Carbon Wheels for a custom wheel that's 42-percent lighter than its aluminum equivalent.

The positive reaction to the Carbon+Forged wheel prototype at SEMA was incredible," Forgeline President David Schardt said.

"We worked really hard to bring this to market, and we are proud of the strength and performance of these wheels. Our Carbon+Forged wheels are great to look at and are an exclusive model for our customers who want to set themselves apart from everyone else."

Forgeline claims the hybrid wheel design yields improvements to acceleration, braking, cornering traction, ride quality, NVH (noise, vibration and harshness), driver/passenger comfort and fuel economy because the product's weight reduction is focused on the wheel's critical outer perimeter where it has the greatest reduction in unwanted inertia.The wheels' carbon fiber barrels are engineered and tested to deliver industry-leading levels of fatigue strength, impact and damage resistance and deflection stiffness, Forgeline said, exceeding all existing Society of Automotive Engineers (SAE) and TUV test specifications and surpassing the AK-LH 08 radial impact test standard.

The Carbon+Forged line won a Global Media Award during the 2016 SEMA Show.

The first wheels available in the Carbon+Forged Series are the racing-inspired CF201, featuring a five V-spoke design and aggressive I-beam machining details, and the CF202, featuring a directional sculpted angular spoke design.

Available in 20- and 21-inch rim diameter fitments, the products are targeted at owners of sport and luxury vehicles such as the Corvette Z06, Ferrari 458/488, Audi R8, Acura NSX, Lamborghini Huracan/Aventedor, Porsche 918/GT3/GT3RS as well as Aston Martin, McLaren, Mercedes and BMW applications.Each set of wheels is custom-built. Customers should allow four to six weeks production time.

AMERICAN UNIVERSITY OF AFGHANISTAN (AUAF)

AMERICAN UNIVERSITY OF AFGHANISTAN (AUAF)

The American University of Afghanistan (AUAF) was chartered under the new Afghan Constitution and Civil Code as a private, independent, non-sectarian institution of higher education.To get more news about 美国学历认证, you can visit jzjy001.com official website.

AUAF implements an American model of higher education, replicating a liberal arts, student-centered, critical thinking learning model. The structure of its academic programs, course content, and pedagogy are based on results-oriented, internationally-recognized best practices in education. Experienced faculty members, teaching staff, and administrators are recruited from the United States and international colleges and universities.

Resources that facilitate the learning process, such as the 14,000-volume library, dependable internet, a variety of learning and teaching methodologies and technologies, classrooms, laboratories, and student services are structured to meet international standards for quality.

AUAF opened in September 2006 and became operational for the 2007 – 2008 academic years, with 141 students enrolled as freshmen and sophomores. The first 32 graduates received their degrees in a ceremony on May 26, 2011. In February 2018, AUAF became the first university in Afghanistan to receive institutional accreditation from the Ministry of Higher Education.

ACTIVITIES

Providing the Foundation Studies Program, a college preparatory experience for high school graduates, designed to strengthen English language proficiency and study skills to the level needed for admission to AUAF's undergraduate programs.

Providing equal educational opportunities for women in the regular academic programs, as well as high-demand, market-connected fields of accounting and information and communication technology.

Offering a campus environment that is supportive and intellectually challenging, with world-class services and modern facilities.Increased educational attainment directly correlates to higher levels of employment. But in addition to better employment outcomes, individuals with college degrees are also more likely to earn better wages.

According to data from the Bureau of Labor Statistics, the median weekly salary of an individual with a bachelor's degree is 67% higher than the salary of an individual who’s attained a high school diploma.

So, if furthering your education is still something you’re not too sure about, keep in mind the increased opportunities for employment and higher wages it can bring.

Jordan 1s for the Summer

Jordan 1s for the Summer

A style refresh begins with your feet. Shoes are the first thing many people notice, so investing in a new pair of sneakers is crucial, especially when gearing up for a new season. Consider the Jordan 1, a great go-to sneaker for summer. From OG colorways to one-off collaborations, Michael Jordan’s first sneaker comes in high, low, and every combination in between. To get more news about cheap jordans, you can visit cheapjordanshoesfreeshipping official website.

The Air Jordan 1 High University Blue pays homage to the greatest NBA player of all time’s alma mater, University of North Carolina (UNC). The upper is composed of a white and black tumbled leather with University Blue Durabuck overlays, and is complemented by a white midsole and University Blue outsole. Following the traditional detailing of the shoe, an Air Jordan Wings logo is debossed on the ankle while the tongue features a Nike Air woven label. MJ fan or not, this is a sneaker perfect for summer.To get more news about cheap jordan shoes, you can visit cheapjordanshoesfreeshipping official website.

Released in November 2021, the Jordan 1 Mid Linen may have rainy springtime grey and white colorway vibes, but the tones are anything but dreary. The sneaker features a white leather upper with College Grey overlays and Swooshes. A slight contrast – and one of the defining, unique traits of this particular Jordan 1 – is prominently featured at the collar from the hints of linen. Matching woven tongue labels and soles round out this versatile shoe.To get more news about cheap air jordan, you can visit cheapjordanshoesfreeshipping official website.

The women’s Air Jordan 1 High Seafoam presents in a smooth white leather construction with Swooshes and Seafoam Durabuck overlays. Crisp bronze trimming on the laces seem to be almost illuminated against the shoe’s understated coloration, resulting in an eye-catching contrast. If you’re in the market for a minimal sneaker with a pop, this is the Air Jordan for you.

You might think of pastels when you think of springtime, and you certainly wouldn’t be wrong. Enter the Air Jordan 1 Mid Barely Rose, featuring Barely Rose and white leather overlays on the upper that give the sneaker an overall pastel appearance. A matching black Swoosh on each side of the sneaker is a stark contrast from the otherwise subdued sneaker. The retro sneaker is completed by a matching black inner lining and an “Air” Jumpman tongue tag.

Much like the aforementioned Air Jordan 1 Retro High University Blue, the Jordan 1 Retro Low Golf UNC is inspired by the original Air Jordan 1 High UNC from 1985. A smooth white leather upper, along with University Blue overlays and Swooshes, give the sneaker a classic feel, while a deeply grooved sole at the base is ready for any terrain a golfer may meet. If you plan on hitting the green this summer, grab these Low Golfs.

The Air Jordan 1 Low OG Neutral Grey arrives in its original form and features a white leather upper with Neutral Grey Durabuck Swooshes. A Neutral Grey and white sole rounds out the design, making this a sneaker that can go with just about anything and for any occasion this season. It’s a timeless sneaker – hence the “OG.”

Markets.com Review

Thanks to its web-based MarketsX platform, Markets.com is easy to use and new trader friendly. However, Markets.com is pricey and lacks the feature-rich trading tools required to compete with the best trading platforms.To get more news about Markets.com Pros and Cons, you can visit wikifx.com official website.

Top Takeaways

Here are our top findings on Markets.com:

Founded in 1999, Markets.com is a subsidiary of a UK publicly-listed company (LSE: PTEC). Markets.com is regulated in two tier-1 jurisdictions, making it a safe broker (low-risk) for forex and CFDs trading.

Markets.com's MarketsX platform is cleanly designed, easy to use, and includes a respectable offering of features, including integrated research, market analysis, webinars, and educational videos. That said, there is a lack of depth with trading tools to compete with platform leaders such as IG and Saxo Bank.

Spreads on forex pairs are wide (expensive) compared to pricing leaders such as CMC Markets and IG.

Offering of Investments

Overall, compared to the Markets.com Metatrader offering, the MarketsX platform offering would be my choice because of its lower comparable spreads and access to a more significant number of tradeable instruments (57 forex pairs and 2,179 CFDs).

The following table summarizes the different investment products available to Markets.com clients.

Cryptocurrency: Cryptocurrency trading is available through CFDs, but not available through trading the underlying asset (e.g. buying Bitcoin). Note: Crypto CFDs are not available to retail traders from any broker's UK entity, nor to UK residents.

Commissions and Fees

Assessing Markets.com for trading costs is tricky. All in all, our bottom line assessment is that Markets.com is expensive and far from being competitive with industry leaders CMC Markets and IG.

MarketsX: Markets.com offers a premium account called MarketsX for traders who deposit at least $250, where spreads are comparably lower than its primary account offering and with added platform benefits.

Variable spreads: In terms of trading costs, spreads at Markets.com changed from being fixed to variable on its forex pairs, bringing the broker in line with most multi-asset brokers that offer variable spreads. That said, the minimum listed spreads are still comparably higher, and I was unable to make an adequate comparison given the lack of average spread data published by the broker.

MetaTrader accounts: It's also worth noting that spreads are generally tighter on the company’s proprietary Web Trader platform, compared to its third-party trading platforms offered, including MT4 and MT5, where the product range is not as extensive.

Average spreads: The firm advertises spreads as low as 1.9 pips on the EUR/USD, and 3.0 pips on its MT4 offering, which are more expensive when compared to other firms with variable (floating) spreads. Summary aside, we would like to see Markets.com share average spread data for its new variable spread offering, to help make a level comparison with other brokers with variable spreads.

Platforms and Tools

Markets.com offers its flagship trading platform, MarketsX, as well as the full MetaTrader suite.

MarketsX charting: In terms of charting in MarketsX, there are nearly 90 indicators available for technical analysis – which is more than the industry average. That said, only four drawing tools are available.

MarketsX usability: Web Trader is very easy to use. Throughout the platform, Markets.com has emphasized providing traders a smooth user experience. For example, alongside pre-defined screeners, module linking is enabled by default.

MetaTrader: Markets.com also offers MetaTrader4 (MT4) and MetaTrader5 (MT5) for algorithmic traders, although pricing is higher compared to its flagship platform.

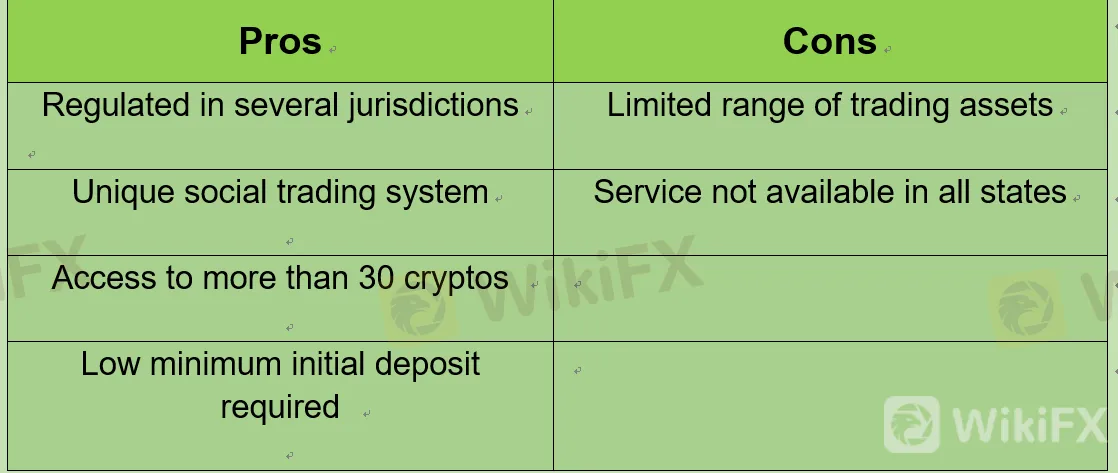

Capital.com Group Review

If you’re searching for an online trading platform to invest in stocks, forex, CFDs, and CFDs on cryptos (crypto derivatives not available for UK retail clients) then Capital.com Group might be right for your trading needs. To get more news about Capital.com Pros & Cons, you can visit wikifx.com official website.

In this Capital.com Group review 2022, we cover everything you need to know about the forex and CFD broker. We analyse key metrics such as fees, commissions, tradable assets, payment options, regulations, and more.

What is Capital.com Group?

Capital.com Group is a popular forex and CFD broker that was established in 2016 and has entities regulated by several major financial authorities including the UK’s Financial Conduct Authority, the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC), and the National Bank of the Republic of Belarus.

Capital.com Group provides access to CFD forex trading as well as heaps of CFD derivatives. When it comes to supported trading platforms, Capital.com Group traders have access to MetaTrader 4 (not available to UK), mobile trading apps, web and desktop platforms, spread betting, TradingView and more.

Capital.com Group provides a user-friendly platform and website, with tons of educational materials that new traders will appreciate. Furthermore, you can also open a demo account in a matter of minutes and practice your trading strategies with $1,000 worth of virtual funds.

With Capital.com Group you can speculate on the future price movements of more than 6,500 markets on a range of platforms and pinpoint unique investment opportunities with more than 75 technical indicators and customizable charts.

Capital.com Group has amassed more than 1,750,000 registered clients globally, which can be justified by its reputation as a free trading platform. This online brokerage firm facilitates commission-free investing, with the trading fees being included in the market-leading spreads.

Capital.com Group supports forex trading and CFD trading. This includes 3,418 share CFDs, 26 indices CFDs, 34 commodities CFDs, 138 forex pairs, as well as cryptocurrency CFD derivatives (not available to UK retail clients).

CFDs or contracts for difference are contracts between sellers and buyers that require the buyer to pay the seller the difference between the current price of an underlying asset and its worth at a predetermined date. CFD traders earn profits and incur losses from price fluctuations that work in their favor or not with the added benefit of not taking ownership of the underlying asset. The value of a CFD contract depends on the difference between the opening and closing price of the trade.

Some of the main advantages of CFD trading include:

Having the ability to go short as you can speculate on markets that are headed both down and upwards.

Access to leverage increases your purchasing power as you are only required to deposit a portion of the trade’s total value.

Seeing as you do not take ownership of the underlying asset you avoid stamp duty tax.

CFDs are used to trade thousands of markets, such as cryptocurrencies (not available to UK retail clients), indices, shares, and more, which can be accessed on one trading account via Capital.com’s web, desktop, or mobile trading platforms.

If you want to speculate on the wider exchanges, Capital.com Group offers more than 30 indices for you to choose from. When it comes to major stock markets this CFD broker covers the FTSE 100, the S&P 500, the Dow Jones Index, the US Tech 100, and the Japan 225 index and many more. You can also trade less popular indices including the Netherlands 25, France 40, and the Swiss 20.

While you do not pay any commission for trading CFDs on Capital.com, the variable spreads differ depending on the asset you choose. So, this is something you need to keep in mind when calculating your overall trading costs.

How to protect your trading account?

It takes only a few seconds to open a demat or trading account, but you must exercise caution when it comes to protecting it from fraudsters. In the event of cybersecurity crisis, it is essential that you have taken all the preventive measures not to allow accounts into the wrong hands. In an attempt to secure your account from fraudsters, the largest stock broker in India Zerodha has shared some best practices and via its Twitter handle the broking company have said that “Here are some common stock market frauds, features of your Zerodha account to protect you, and what you can do to protect yourself."To get more news about Trading Account, you can visit wikifx.com official website.

“Firstly, any measure from our side is helpful only if the customer doesn’t willingly share account access with others by giving in to the lure of quick and easy money. As we have shared many times, fraudulent actors can create artificial losses in the customer account using penny stocks or illiquid options—read more here. The first, most basic step everyone should take is to enable 2FA on email and social media accounts & set up biometric authorisation on the mobile and most importantly ensure that login credentials aren’t shared with anyone else." Zerodha has mentioned on its website.

How to securely login to Zerodha account?

1. There is a two-factor authentication (2FA) login for all Zerodha accounts. You must log in using your client ID and password, followed by a 6-digit pin to confirm your identity.

-

On the Kite mobile app, users should additionally activate biometric identification using their Face ID or Fingerprint to secure their account.

-

In 2020, Zerodha brought a time-based one-time password, or TOTP, as an additional security measure. A temporary OTP, or TOTP, expires after 30 seconds. To replace the 6-digit PIN, users can set TOTP as their secondary factor (2FA).

-

Every time a user signs in from a new IP or address, Zerodha sends an email alert on the registered email ID of the account holder.

- “We don’t have relationship managers call our customers for any reason. So this way it is tough for anyone to spoof they are from Zerodha. Neither do we call users for anything or ask for any account specific information," said Zerodha in a note.

Tips by Zerodha to secure your account

1. Never ever share your Zerodha account details with anyone.

-

Don’t fall for sales pitches by fraudulent actors promising super high returns in a short span of time by offering to manage your account.

-

We never call users asking for any account-specific information. If you get such calls, please ignore them and report them.

-

Ensure that you have TOTP enabled on your Zerodha account as well as your email.

-

Stop using email service providers with poor security.

The Most Common Warning Signs Of A Forex Scam

Foreign exchange fraud is a collective term referring to any scheme that intends to defraud traders through deception, convincing investors of high returns by trading on the forex market. In essence, the foreign exchange market is a zero-sum game, wherein one person experiences gains while another suffers from losses.To get more news about Forex Scams, you can visit wikifx.com official website.

We all know by now that online investments are pretty risky. This is especially true in the foreign exchange landscape. There is an abundance of forex scams online, initiated by scammers who get their confidence from the Internet’s anonymity. Identifying a scam from a legitimate forex trading activity is imperative to protect yourself from financial ruin.

Aggressive forex brokers

Recovery from a forex scam can be arduous and slow for its victims. Before you become one, it is best to recognize the typical warning signs. Legitimate forex traders are not aggressive when marketing their expertise or service to prospective investors. On the other hand, if a few forex brokers or companies persistently contact you whom you do not know personally, it is best to proceed with caution. If you are interested in forex trading, seek references from people you know.

Exaggerated claims of high returns

A classic indicator of a forex fraudster is exaggerated claims of massive returns on modes investments. It is most likely a scam if you are promised guaranteed high returns. The success of your investment is highly dependent on a highly volatile market. You may receive returns quickly, or you may not. But a company that purports consistently high returns is giving you false claims because it is not feasible in the foreign exchange trading market.

High spread offers

The standard spread ranges between two to three points in USD/EUR. Be cautious when approached by a forex trader that offers up to seven points spreads. Bear in mind that major currency pairs have a price of four decimals.

Forex scammers take advantage of their knowledge of the forex exchange market by using complicated jargon when preying on their victims. Terms like risk disclosures and terms of use are often used to limit their liability should investors suffer losses along the way.

Withdrawal restrictions

If you are attempting to withdraw funds from your account and cannot do so, it might be time to start worrying about your investment. If a broker provides you with a vague explanation or unclear apology when this happens, you need to re-consider your investment, or better yet, pull out before losing more money.

Blacklisted broker

Avoid brokers who fail to provide you with the proper credentials at all costs. You want a trustworthy person to manage your account. Do due diligence and check out regulating bodies to verify if a forex broker has a good legal standing in the foreign exchange market.

Conclusion

It is recommended to partner with a regulated broker with a well-established reputation, flawless track record, and has positive feedback from previous and existing investors to avoid becoming a victim of a foreign exchange trading scam. While the allure of quick returns is hard to dismiss, it is best to err on the side of caution and be more thorough in your vetting process.

Opening eToro Demo Account: A Brief Guide

Trading is inherently risky. You have to possess extensive knowledge about various aspects of market behavior before you start earning your first money, and even then, you’re not immune to losses. That’s why many brokers offer their users demo accounts which allow them to train trading skills before entering the real market. One of those brokers is eToro, and we’re going to help you understand whether you should open a demo account there and how to do it.To get more news about eToro Demo Account, you can visit wikifx.com official website.

About eToro

The eToro broker has been around since 2007, and you’ve probably heard about it somewhere. One of the most recognized and reputable brokers in the world, eToro operates in about 150 countries. It is especially popular in European countries, including Italy, Germany, France, Spain, and the UK. The company itself emphasizes its own social trading features, which means you can always look how other traders behave and learn from them in real time.

That social aspect is really convenient, so it’s not a surprise that many novice traders prefer eToro to start their trading career, but that’s not the only reason. The broker is also very secure: for example, the European branch is licensed under the Cypriot financial authority CySEC, and the British office is regulated by FCA. That means eToro follows very strict standards, and you can rest assured your funds won’t just disappear one day.

Opening a demo account

One of the most attractive options the broker has for novice traders is eToro demo account. There are a couple of options, but if you’re just learning to trade, you should choose a Retail demo account. It will give you access to all the real features eToro has, but without any risks. Your leverage will be limited by 30:1 on the most popular currencies, and there may be some additional trading restrictions, but you probably won’t notice them if you just want to practice.

Opening a demo account with eToro is very easy. First, go to the official eToro website and create a new account using an e-mail address or just your Google account. Now you need to make sure you’re using a demo account, not a real one: select the Virtual Portfolio option right under your username. Basically, that’s it. You can start trading with all of the available trading instruments, and the broker will give you virtual $100,000 to trade with.

Bitcoin price clings to $20K as Bollinger Bands close in for volatility

Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it fluctuated just north of $20,000, retaining a pattern characteristic of the week so far.To get more news about Bollinger Band, you can visit wikifx.com official website.

The pair stayed well within a defined range overnight, leading analysts to assume that a break up or down was next as a short-term prospect.

“Bitcoin strong consolidation at $20k, this can't go on forever, triangle primed to break to upside or downside. But RSI bullish divergence tho,” Venturefounder, a contributor to on-chain analytics platform CryptoQuant, told Twitter followers on July 6.

Bullish signals on Bitcoin’s relative strength index (RSI), like those referred to by Venturefounder, often precede BTC price followthrough, making the current RSI chart a key reference point on low timeframes.

Confirming the likelihood for volatility to return, meanwhile, Bollinger Bands on the daily chart stayed narrow — a classic prelude to a trend taking shape.Regarding what direction that trend could take, all bets remained off on the day as caution summarized sentiment.

Ninja additionally noted that short interest was building on exchange platform Bybit on the day, advising a hands-off approach until those positions unwound.

Calm before the CPI storm

On macro markets, the U.S. opened to modest gains, with the S&P 500 and Nasdaq Composite Index up 1% and 1.3%, respectively, within the first 30 minutes.

A week before May’s Consumer Price Index (CPI) data release, markets remained free of turbulence over inflation signals, in turn, keeping additional headwinds from impacting crypto-asset performance.

With opinions still mixed over how U.S. economic policy will change through 2023, trader Crypto Tony acknowledged that a true return to form for Bitcoin and altcoins may take longer than many realize.

“Personally on my worst-case scenario update i do not think we see the start of the next impulse until later next year and a new bull run peak until 2024 – 2025,” he tweeted on the day.

The Best Forex Robots You Can Buy

Fully automated foreign exchange (forex) trading software, popularly known as forex robots, has increased in both popularity and sophistication in the past few years. Many people interested in forex trading might wonder how well forex robots work and whether they would be a viable way to trade the currency market profitably. To get more news about Forex Robots Trading, you can visit wikifx.com official website.

In general, forex robots consist of algorithmic or algo trading software that can fully automate the trading process. This sort of automated trading software first scans the market to find forex trade setups that meet certain criteria usually based on technical analysis. The program then automatically executes orders in the currency market in a connected trading account typically via an online forex broker.

Some forex robots can also be used to identify high-probability trade setups without actually executing the trades for you automatically. Rather than always running on autopilot, these robots can instead generate trading signals that might boost your chances of making profitable trades.

While trading profits are never guaranteed, forex robots can seem especially helpful if you lack the experience to generate good trade ideas yourself. Read on to find out more about forex robots, which marketed robots have the best track record and offer good value for money and how using a forex robot might improve your success as a currency trader.

Almost all forex robot software programs employ technical analysis methods to generate buy and sell signals that then trigger automatic trading activity. The software might also have parameters you can adjust based on your trading preferences. Benzinga has reviewed the field of forex robots you can purchase to find the best among them. In addition to reviews of two of the best forex robots currently available, a review of a crypto trading robot and a forex virtual private server (VPS) to run your trading robot on are also included below.

- Forex Fury

Forex Fury is a good place to go when you need help making wise decisions as an investor. You can clearly make the most of your forex investments by allowing Forex Fury to do most of the work. - GPS Forex Robot

GPS Forex Robot consists of expert adviser software written for the MetaTrader platform that you can use to trade the forex market automatically without human intervention. The program was originally written in 2010 and has produced mixed results throughout its long history. The GPS Forex Robot 3 sells for a one-time charge of $149. - 1000pip Climber System

This forex signal robot uses a state-of-the-art algorithm to continually analyze the forex market without human intervention. While the robot does not actually trade for you, it provides clear and precise easy-to-follow trading signals that include entry, stop-loss and take-profit levels for each trade.

The 1000pip Climber System is simple to set up and is designed to be followed 100% mechanically, which completely eliminates any guesswork. Using this forex system to generate signals is one of the easiest ways to follow and trade the forex market. At its current promotional cost of only $97 for a lifetime license, the 1000pip Climber System is one of the more affordable commercial forex signal robots.

4. Coinrule

Coinrule is a fully automated cryptocurrency trading robot that lets you either create your own automated trading rules without having to know how to code or choose from over 150 trading rules provided by the platform to automatically trade cryptos. This bot also seeks the most effective market indicators and lets you automatically allocate your funds to the most profitable cryptocurrency markets.

Some examples of the rules you can implement with Coinrule for single or multiple coins include Stop Loss, Price Based Accumulation and Trend-Following Rebalancing. Coinrule’s web-based trading bot works across several exchanges, including some of the larger exchanges like Coinbase Pro, Binance and BitMex.

5. ForexVPS

While not a forex robot or signal generator, ForexVPS provides a virtual private server (VPS) service specifically geared toward automated trading. The ForexVPS servers are on and maintained 24/7, with no downtime, which makes them ideal for traders running any other forex robot, including automated expert adviser software in MetaTrader 4 or 5.