xysoom: EUR/USD Undecided Ahead Of The ADP Non-Farm Employment Change!

EUR/USD Undecided Ahead Of The ADP Non-Farm Employment Change!

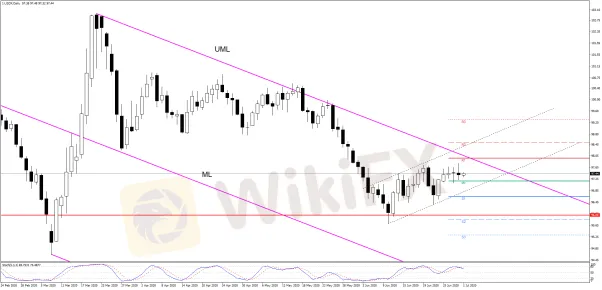

EUR/USD is trading in the red according to the Daily chart, but it is still traded above a major support area, a further drop is far from being confirmed. The pair seems undecided, but I really hope that the US data will give us a clear direction these days.To get more news about WikiFX, you can visit wikifx news official website.

The US ADP Non-Farm Employment Change could shake the markets today, the economic indicator is expected around 2850K in June, versus -2760K in May. The fundamentals will take the lead in the last three days of the current week, so you should be careful because the high volatility could ruin your trading account.

Also, the US is to release the ISM Manufacturing PMI, Final Manufacturing PMI, Construction Spending, and the ISM Manufacturing Prices later today, some good figures could support the USDs growth in the short term. The FOMC Meeting Minutes report will be published as well tonight, you should be ready for significant movements in the US session.

EUR/USD is still undecided because the US Dollar Index has failed once again to resume its short term rebound, to approach and reach the upper median line (UML) of the major descending pitchfork.

The USDX is still traded within the minor up channel, it moves sideways right above the weekly PP (97.18) level and is waiting for the US data to dictate direction. As Ive said in my previous analysis, EUR/USD could drop deeper in the short term only if the USDX will resume its rebound.

A USDX‘s valid breakdown from the minor channel followed by a further decline will push the EUR/USD towards fresh new highs. USDX’s bullish reversal will be validated only by a valid breakout above the upper median line (UML) and above the R1 (97.97) level.

USDX could edge higher if the US data will come in better than expected today, while poor figures will weaken the USD which it could lose significant ground versus its rivals.

EUR/USD continues to move sideways right above the 1.1200 psychological level, it has failed once again to close below this downside obstacle. Still, EUR/USD is under some bearish pressure as long as it is traded below the upper median line (UML) of the descending pitchfork.

Monday‘s failure to reach and retest the upper median line (UML) has signaled a potential further drop, but the sellers weren’t strong enough to force the quote to close below the 1.1200 and to make another lower low.

EUR/USD is trapped between the upper median line (UML) and the 1.1200, a valid breakout from this pattern will bring a great trading opportunity and will validate the short term direction.

A downside breakout and another lower low, a drop below 1.1167, will attract more sellers on the Daily chart, while an upside breakout from this triangle and a valid breakout above the upper median line (UML) will invalidate a further drop and will validate another leg higher.

The minor triangle will be a continuation pattern if EUR/USD will make an upside valid breakout and if the USDX will drop again in the short term. However, a USDX‘s rally will push EUR/USD in the seller’s territory, the pair will extend its corrective phase towards the 1.1 level and towards the median line (ML).

Add comment