freeamfva's Blog

What is a Pip? Using Pips in Forex Trading

WHAT ARE PIPS IN FOREX TRADING?

A “PIP” – which stands for Point in Percentage - is the unit of measure used by forex traders to define the smallest change in value between two currencies. This is represented by a single digit move in the fourth decimal place in a typical forex quote.However, not all forex quotes are displayed in this way, with the Japanese Yen being the notable exception. Keep reading to find out more about pips and how they’re used in forex trading, with examples from selected major currency pairs.To get more news about pips in forex trading, you can visit wikifx.com official website.

HOW TO CALCULATE THE VALUE OF A PIP?

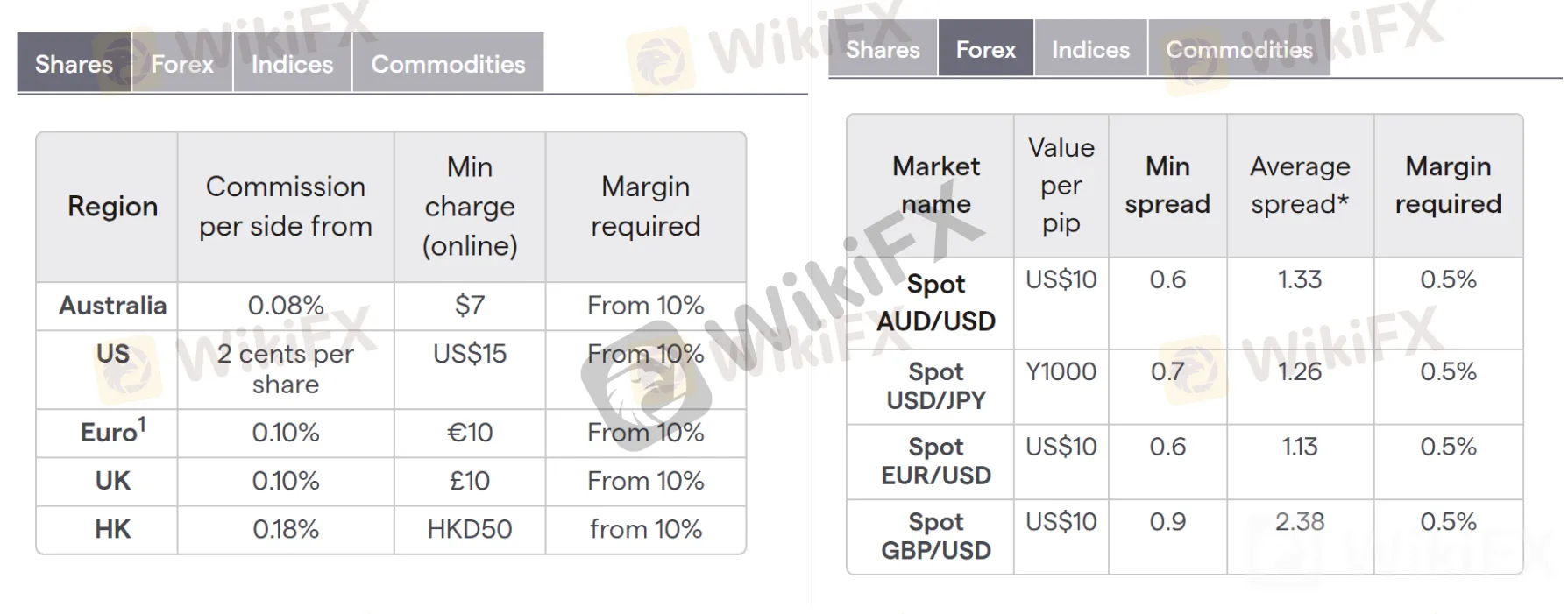

The pip value is calculated by multiplying one pip (0.0001) by the specific lot/contract size. For standard lots this entails 100,000 units of the base currency and for mini lots, this is 10,000 units. For example, looking at EUR/USD, a one pip movement in a standard contract is equal to $10 (0.0001 x 100 000).

Being able to calculate the value of a single pip helps forex traders put a monetary value to their take profit targets and stop loss levels. Instead of simply analysing movements in pips, traders can determine how the value of their trading account (equity) will fluctuate as the currency market moves.

It’s important to note that the value of one pip will differ for different currency pairs. This is because the value of one pip will always be shown in the currency of the quote/variable currency and this will differ when trading different currency pairs. When trading EUR/USD, the value of one pip will be displayed in USD, when trading GBP/JPY, this will be in JPY.

Every one pip move in your favor translates into a $10 profit and every one pip move that goes against you translates into a $10 loss. By the same logic, a one pip move in a mini contract translates into a $1 profit or loss (10,000 x 0.0001).

To help understand pips and pip calculations even further you may want to consider doing some practice calculations on your own.

PIP VALUE CONVERSIONS

Now, if your account is based in Great British Pounds (GBP), you would have to convert that $1 (value of a pip for a 10k EUR/USD lot) into Pounds. To do so, just divide the $1 by the current GBP/USD exchange rate, which at the time of writing is 1.2863. It is necessary to divide here because a Pound is worth more than a US dollar, so I know my answer should be less than 1. 1 divided by 1.2863 is 0.7774 Pounds. So now you know that if you have a Pound based account, and profit or lose one pip on one 10k lot of EUR/USD, you will earn or lose 0.7774 Pounds.

THE EXCEPTION - USD/JPY PIPS

When trading major currencies against the Japanese Yen, traders need to know that a pip is no longer the fourth decimal but rather the second decimal. This is because the Japanese Yen has a much lower value than the major currencies.

AMF Issues a Warning against Website Belonging to Omega Pro Ltd

On Thursday, the Autorité des Marchés Financiers (AMF) and Prudential Supervisory and Resolution Authority (ACPR) said that they had blacklisted a website belonging to Omega Pro Ltd.To get more news about omegapro, you can visit wikifx.com official website.

According to the advisory, Businessempire.fr was added to the list by both authorities, as the website allegedly belongs to www.omegapro.world, which was already blacklisted in 2020. The aforementioned site offers Forex trading services without authorization, the AMF noted in the press release.

“Following numerous testimonials and reports from savers, the AMF and the ACPR had placed unauthorized sites on their FOREX’s blacklist of the trading platform www.omegapro.world on August 6, 2020. However, the Overseas Emission Institute (IEOM), which acts as central bank in communities whose currency is the Pacific franc, has informed the two authorities of the existence [of] proactive canvassing by Omega Pro Ltd on the Polynesian territory. The company’s modus operandi described by the testimonies is similar to the aggressive practices of network marketing companies (MLM) selling trading training packs, already denounced by the AMF in June 2020,” the AMF stated.

The authority adds: “The AMF points out that Forex is a risky market, on which individual investors can suffer heavy financial losses, for example through leveraged derivatives such as CFDs (contracts for difference), speculative financial instruments allowing them to bet on upward or downward variations of an index, stock, currency pair, etc., without owning it.”

As of press time, Omega Pro Ltd is not authorized to provide investment services in mainland France, overseas departments, or overseas territories. The authority previously issued a warning on 3 February about the unlicensed status of Omega Pro Ltd and asked people to exercise caution when dealing with this kind of company.

Omega Pro, since it’s inception in 2019, has been navigating towards global financial markets to explore, educate, promote and lead the community into financial freedom. Omega Pro has become the home that successfully births new opportunities that is always ahead of the curve and often supportive and dedicated to your ambition.

With an ever increasing community of over 2,000,000 active members, scaling greater heights as each day goes by now welcomes you to the revolution of tomorrow as she aims to orchestrate a debt-free future.

Introducing you to “The Rise Of Digital Billionaire 2.0,” in Port Harcourt this Sunday 24th July 2022, at EUI Event Centre, Sani Abacha Road GRA, Phase III Port Harcourt. Time 2pm WAT. Featuring a collection of well informed professionals the likes of Dr. Chinwe Ikpe, Maryann Ilorah, Dotun Fatoyinbo, Grace Udoye, Paulo Tuynman, Samuel Ajibare, Tomiwa Orunnipin, Bonaventure Igboanugo, Gift Ajibare, Daniel Onoja, Prince Hezekiah as Host.

OANDA Is the Top Forex Broker For USA Traders

OANDA is a leading global market maker that ranks in our top US FX brokers list for their no minimum deposit policy, comprehensive support for MetaTrader 4, round-the-clock customer support and competitive trading costs.To get more news about regulated forex brokers, you can visit wikifx.com official website.

OANDA Trading Costs

Our review process took into consideration the spread cost built into the bid and ask prices to gauge the fees associated with making a trade. We have found that OANDA’s market maker model offers two types of FX pricing options:

OANDA spread-only model offers average spreads of 1.4 pips on EUR/USD and USD/JPY compared to 0.4 pips average spread on EUR/USD respectively and 0.3 pips on USD/JPY for the core pricing model. While the core pricing model offers reduced spreads, it has an additional commission of $5.00 per side for every 100,000 units traded (or a $10 round-turn commission).

OANDA’s price engine technology connects to an exclusive liquidity pool formed by tier-1 global banks. At OANDA US, the price you see on the feed is the price at which your order gets filled. There are no re-quotes.

OANDA’s American clients can also participate in an attractive rebate program that rewards high-volume traders with cash rebates and commission reductions ranging from USD 5.00 and USD 15.00 per million dollars traded.

Powered by TradingView, OANDA’s proprietary platforms have all the tools a trader might want, including performance analytics, personalized watchlists and advanced charting options. Technical traders accustomed to MetaTrader and cTrader might find themselves pleasantly surprised at how powerful OANDA’s offerings really are.

For those who prefer the Meta family of trading platforms and tools, OANDA allows MetaTrader 4 users to access additional tools, including advanced indicators, mini charts, alert trading, EAs, alert trading and one-cancels-the-other orders, keyboard trading and tick trading via MetaTrader Premium.

For automated trading, OANDA offers US traders a private API, OANDA v20 REST, which allows for automated trades via the OANDA Trade platforms.

Perhaps it’s because OANDA got its start in New York City, but this American broker turns out to be the best choice for, well, Americans. Competitive, transparent trading costs, powerful trading tools and a commitment to customer service ensure that US-based traders have the best of a global brokerage with the unique approach to customer care that characterizes American business.

IG Is The Best Regulated Forex Broker For USA Traders

With over 45 years of experience in the foreign exchange market and over 195,000 retail client accounts worldwide, IG Group is one of the largest forex brokers operating on US soil. IG US LLC complies with the regulatory framework imposed by the US-based financial watchdogs:

Registered as a retail foreign exchange dealer (‘RFED’) and introducing broker (IB) with the CFTC

Approved Forex Dealer Member by the National Futures Association with the NFA ID 0509630

Note* Due to local-state regulatory restrictions, IG US can’t provide its financial services to US residents of Arizona or Ohio.

Regulated by the CFTC, NADEX (IG Group Holdings Plc.) is the only place where US residents can legally speculate on binary options. NADEX gives traders access to 10 FX pairs that are based on the spot exchange rates.

Spot Forex trading with IG Group is the ideal place for US-based traders wanting to speculate on a diverse range of currency pairs. Overall, among all FX brokers we’ve investigated, IG US offers the best average spreads on currency trading. Test your trading strategy in a risk-free environment by opening a demo account.

Additionally, US residents can benefit from a dedicated market strategist with a one-on-one relationship. The market specialist can do live demonstrations of the financial services offered by Forex.com, teach traders how to use both technical and fundamental analysis, and provide ongoing support until the user is fully satisfied with the training.

The Best Way to Learn Forex Trading

If you've looked into trading foreign exchange (forex) online and feel it could be an opportunity to make money, you may wonder about the best way to get started.To get more news about forex education, you can visit wikifx.com official website.

It's important to have an understanding of the markets and methods for forex trading. That way, you can better manage your risk, make winning trades, and set yourself up for success in your new venture.

How to Get Educated About Forex

To trade effectively, it's critical to get a forex education. Spend some time reading up on how forex trading works, making forex trades, active forex trading times, and managing risk, for starters. There are plenty of websites, books, and other resources you can take advantage of to learn more about forex trading.

As you may learn over time, nothing beats experience, and if you want to learn forex trading, experience is the best teacher. When you first start out, you can open a forex demo account and try out some dry-run trading. It will give you a good technical foundation on the mechanics of making forex trades, as well as help you get used to working with a specific trading platform.

It is very easy for traders to think the market will come back around in their favor when they make a trading mistake. You might be surprised how many traders fall prey to this trap, and they are often upset when the market only presses further against the direction of their original trade.

Think about this famous—and painfully true—statement from John Maynard Keynes about investing: "The market can stay irrational, longer than you can stay solvent." In other words, it does little good to say the market is acting irrationally and that it will come around—meaning in the direction of your trade. That's because extreme moves define capital markets in the first place.

Use a Micro Forex Account

The downfall of learning forex trading with a demo account alone is that you don't get to experience what it's like to have your hard-earned money on the line. Trading instructors often recommend that you open a micro forex trading account, or an account with a variable-trade-size broker, that will allow you to make small trades.

Trading small will allow you to put some money on the line, but it will also allow you to expose yourself to very small losses if you make mistakes or enter into losing trades. This will teach you far more than anything that you can read on a site, book, or forex trading forum, and it gives an entirely new angle to anything that you'll learn while trading on a demo account.

Learn About the Currencies You Trade

To get started, you'll also need to understand what you're trading. New traders tend to jump in and start trading anything that looks like it moves. They may use high leverage and trade randomly in both directions, and this can often lead to the loss of money.

Understanding the currencies that you buy and sell can have a big impact on your success.1 For example, a currency may be bouncing upward after a large fall. This may cause new traders to try to "catch the bottom."

The currency itself may have been falling due to bad employment reports for many months in its country. Would you buy something like that? Probably not. This is an example of why you need to know and understand what you buy and sell.

Currency trading is great because you can use leverage, and there are so many different currency pairs to trade.2 But this doesn't mean that you need to trade them all.

Manage Risk and Emotions

Managing risk and managing your emotions go hand in hand. When people feel greedy, fearful, or another emotion, this may be when they're more likely to make mistakes with risk. And this is what often causes failure.

When you look at a trading chart, approach it with a logical mindset that only sees the presence or lack of potential for success. It should never be a matter of excitement.

4 ways to avoid owing money to your brokerage firm

A margin call occurs when the value of your brokerage account falls below a certain level. This level is known as the margin requirement and means that the investor is required to deposit more money into the account, sell off some of the investments, or add more marginable assets if reached.To get more news about margin call, you can visit wikifx.com official website.

"The best way to describe a margin call is that you owe your investment platform or brokerage money," says Robert Farrington, founder of The College Investor.

Within the context of investing, margin is the practice of taking a loan from the brokerage firm for the purpose of buying stocks and other assets. Margin can increase the buying power for an investor by allowing them to make larger investments and higher potential profits. "Margin is an incredible tool to provide investors with access to additional capital," says Dr. Hans Boateng, founder of The Investing Tutor. "It works wonders in an upward market. It becomes dangerous in a downward market if you don't have savings in the event of a margin call."

There are three main types of margin calls: maintenance margin calls, Regulation T calls, and minimum equity calls. Each of these margin calls can be triggered for different reasons. Here's a breakdown of each below.

Maintenance margin call: A maintenance margin call refers to the margin requirement to stay in a position. Once you have met the initial margin requirement of 50%, the Financial Industry Regulatory Authority (FINRA) requires that brokerages set a maintenance requirement of at least 25% for the remainder of the trade and allow brokerages to be even more restrictive. This is sometimes known as the "house requirement" and most brokerages set their maintenance requirements between 30 to 40%.

Let's use an example where you have $10,000 invested in company ABC: If your brokerage sets the maintenance margin requirement at 25%, it means that the equity in your account must not fall below $2,500.

Remember, a margin account will consist of the equity, which is the amount of cash you have plus the amount that was loaned to you. Therefore, the total account balance would have to be $7,500 to receive a margin call ($5,000 margin loan + $2,500 remaining equity) because the value of the loan has not changed.Regulation T call: This type of call refers to the requirements needed to begin a margin trade and can occur when an investor makes a transaction in a margin account without meeting the initial 50% minimum equity requirement. This is sometimes referred to as a Fed Call.

Minimum equity call: This is the lowest amount needed to open and maintain a margin account. This call — sometimes known as an exchange call — occurs when the account balance falls below $2,000 in equity. If you're classified as a pattern day trader, this requirement is $25,000.

How to avoid margin calls

You're not required to have a margin account, and you could easily avoid margin calls by only trading with cash. "The best way to avoid a margin call is to simply not use all your margin limit," says Farrington. Margin is not needed to achieve solid, consistent returns over time, but for those that choose to use it, here are a few things you can do to avoid a margin call:

The bottom line

Using margin in an investing account can help increase gains, but it can also magnify losses. It's important to make sure you're properly managing your risk. "There are really few reasons to use margin," adds Farrington. "It should only be used by experienced investors who have a specific plan and purpose for doing it. Maybe you're investing today while waiting for that ACH deposit next week. Or maybe you're executing a certain options strategy. But you need to have a specific plan."

Top 10 Forex Trading Books

Why are Forex Trading Books important

Forex trading has taken the world by storm. This is why we, at tixee, have decided to come up with a list of top 10 forex trading books!To get more news about forex trading book, you can visit wikifx.com official website.

Every day more people are investing in forex and many more are looking for ways to enter the market. No matter how much you have “heard” about forex, it is not wise to put your money on the table blindly.

Therefore, we have compiled a list of top 10 best books on forex trading that can help you learn everything about the forex world.

1. Trade Your Way to Financial Freedom – Van K Tharp

“Trade Your Way to Financial Freedom” is inclusive and is a good read for all traders, not just within the FX market. It trains people on how to make trading strategies while making sure that the plans are well put together.

2. The Complete TurtleTrader – Michael Covel

For people who are not into reading, “The Complete TurtleTrader” is an interesting first choice. The book tells a story about a trader who makes a bet that he can make anyone a successful trader if they could get a proven strategy. His disciples were called ‘turtles’ (hence, the title).

Many of the turtles mentioned in the book are real people who grew to be influential and successful traders. The trend trading strategies are detailed in this book.

3. The New Market Wizards – Jack Schwager

“The New Market Wizards” is another book of trading strategies but it is better in a way that its Profitability Analysis adjust to many different trading styles. The author has interviewed several successful traders and taken insider views on what it takes to trade efficiently.

Interviews of people with entirely different trading styles and success stories will help readers understand that there is no one right way.

- Currency Trading for Dummies – Brian Dolan and Kathleen Brooks

“Currency Trading for Dummies” is another book from the “For Dummies” series which explains complex ideas in simple language. You can think of this book as an “All you need to know” guide into forex trading.

It is focused on basics, so it is for people who know nothing about forex trading. If you want an advanced guide, read on for more options.

5. The Little Book of Currency Trading – Kathy Lien

This book focuses on fundamental analysis rather than a technical analysis which focuses on economic conditions and news to predict how the price will fluctuate. Other than the forex strategies a plus point is a conversational style. Therefore, you should read this book to understand how a field professional thinks and acts.

6. Day Trading and Swing Trading the Currency Market – Kathy Lien

This is another book on our list by Kathy Lien. “Day Trading and Swing Trading the Currency Market” is a combination of fundamental and technical analysis trading methods.

The best part is that it covers strategies for short-term trading as well as long-term trading. The book undergoes frequent updates to include the latest strategies and market changes.

7. Trading in the Zone – Mark Douglas

For trading strategies aren’t everything. A trader must exercise patience and consistency to implement the strategy effectively without falling into confusion and self-doubt.

Thus, “Trading in the Zone” helps readers develop and implement strategies without emotional interference. Many traders who felt stuck have found new motivation and better results by reading this book on forex psychology.

- Intermarket Analysis – John Murphy

“Intermarket Analysis” studies how different markets interact to predict price fluctuations. It is a very informative book that explains how forex prices are affected by changes in other assets. - Millionaire Traders – Kathy Lien and Boris Schlossberg

This book is also a collection of interviews. However, the list of people includes successful traders that are not well-known or are under the radar.

“Millionaire Traders” is a very inspirational book because most of the people highlighted here are those who started from humble beginnings and gradually grew their accounts exponentially.

- The Man Who Solved the Market – Gregory Zuckerman

If you are looking to automate your trading, then “The Man Who Solved the Market” might be the best book for you. It tells the story of Jim Simons and his journey to creating Renaissance Technology.

His funds have a consistent track record of above 50% yearly returns which is not very common in the hedge fund world. This will help you automate trading in the best way.

What Is Forex Trading and How Does It Work?

In addition to stock and bond market information, the nightly financial news usually offers information about the currency exchange rate between the U.S. dollar and various foreign currencies, such as the euro and the British pound. This information isn’t important just to tourists heading overseas. Foreign exchange traders try to profit on movements in the market price between foreign currencies. Trading on the foreign exchange market can generate tremendous profits but can also carry significant risk. Here’s a look at the ins and outs of forex trading.To get more news about forex trading, you can visit wikifx.com official website.

Every day, foreign currencies go up and down in value relative to one another. As with anything that changes value, traders can profit from these movements. The forex market runs 24 hours a day, making it a very liquid market. What surprises many investors is the size of the forex market, which is actually the largest financial market on Earth. The average daily traded volume is $6.6 trillion, according to the 2019 Triennial Central Bank Survey of FX and OTC derivatives markets. The New York Stock Exchange, on the other hand, trades an average daily volume of just over $1.1 trillion.

Forex trading is similar to buying and selling other types of securities, like stocks. The main difference is that forex trading is done in pairs, such as EUR/USD (euro/U.S. dollar) or JPY/GBP (Japanese yen/British pound). When you make a forex trade, you sell one currency and buy another. You profit if the currency you buy moves up against the currency you sold.

Leverage is commonly used in the forex trading market. Leverage allows traders to purchase a multiple of their original investments. For example, some forex traders will employ leverage of 20:1. This means they can buy $20,000 of foreign currencies for just $1,000, with the brokerage firm lending them the remaining funds. Some firms might allow leverage of up to 500:1.

Leverage in any investment, including the forex market, amplifies both gains and losses. For example, if you buy $20,000 in currency and it moves up 10 percent, you’ll have a $2,000 gain. If you used 20:1 leverage and only invested $1,000, that amounts to a 200 percent gain.

Of course, leverage works both ways. Using the same 20:1 leverage example, if your $20,000 moved down 10 percent, to $18,000, you’d not only lose your entire $1,000 investment, but you’d also have to pay off your loan to the brokerage firm.

What Is Forex Trading?

If you’ve ever traveled internationally, you’ve touched on the world of forex trading, though you may not know it: When you stepped off the airplane, one of your first stops probably was to exchange your money for the local currency.To get more news about forex trading, you can visit wikifx.com official website.

Forex trading definition

Forex — or FX — refers to the foreign exchange market, which is where investors can buy and sell currencies from around the globe. It’s the largest financial market in the world but one in which many individual investors have never dabbled, in part because it’s highly speculative and complex.

A little healthy trepidation serves investors well. Active trading strategies and complex investment products don’t have a place in most portfolios. Financial advisors often strongly recommend low-cost index funds for long-term goals like saving for retirement.

But maybe you have a balanced portfolio in place, and now you’re looking for an adventure with some extra cash. Provided you know what you’re doing — please take those words to heart — forex trading can be lucrative, and it requires a limited initial investment.

Understanding forex trading

The concept of trading forex can be hard to wrap your head around. Here's how it works: Currencies are always traded in pairs, such as the Euro and the U.S. dollar. When you trade forex, you always buy one currency and sell another (which is why currencies are also always quoted in pairs).

Currencies rise and fall at different rates (for example, the Euro may rise while the U.S. dollar falls) based on geopolitical or economic factors such as natural disasters or elections. Based on those kinds of factors, you might think that a related currency — for example, the Euro — will rise in value. You could then buy Euros and sell U.S. dollars. If your prediction panned out, and the Euro did rise in value, you would make a profit. Of course, there are many more nuances that make forex trading complex, which we'll get into below.

Current forex trading rates

The chart below shows two paired currencies and reflects what one unit of the first listed currency is worth in the second listed currency. For example, the first row shows how much one Euro is worth in U.S. dollars.

How to read a forex quote

Being able to read and really understand a forex quote is, unsurprisingly, key to trading forex. Let’s start with an example of an exchange rate: EUR/USD 1.12044.

The number is what the counter currency is worth relative to one unit of the base currency. When that number goes up, it means the base currency has risen in value, because one unit can buy more of the counter currency. When that number goes down, the base currency has fallen. In this example quote, 1€ is equal to $1.12044.

You're always buying or selling the base currency. Within a pair, one currency will always be the base and one will always be the counter — so, when traded with the USD, the EUR is always the base currency. When you want to buy EUR and sell USD, you would buy the EUR/USD pair. When you want to buy USD and sell EUR, you would sell the EUR/USD pair.

Bid and ask prices

As with stock trading, the bid and ask prices are key to a currency quote. They, too, are tied to the base currency, and they get a bit confusing because they represent the dealer's position, not yours. The bid price is the price at which you can sell the base currency — in other words, the price the dealer will “bid,” or pay, for it. The ask price is the price at which you can buy the base currency — the price at which the dealer will sell it, or “ask” for it.

The bid and ask are typically shown as EUR/USD bid/ask, and the ask is represented with only the last two digits. For example, EUR/USD 1.12044/57 means that the bid is 1.12044 and the ask is 1.12057. You could sell 1€ for $1.12044 (the bid) and buy 1€ for $1.12057 (the ask).

The bid price is always lower than the ask price, and the tighter the spread, the better for the investor. Many brokers mark up, or widen, the spread by raising the ask price. They then pocket the extra rather than charging a set trade commission.

The last salient point about pricing is that the spread, earnings and losses are measured in a unit called a pip.

What is a pip?

Remember when we said forex trading was complex? We weren’t lying. In stock trading, you might hear or read that a stock's share price went up a point, or $1. A pip is the forex version of a point: the smallest price movement within a currency pair.A pip’s value depends on the trade lot and the currency pair. If you’re trading a pair that has the USD as the counter currency and you’re using a dollar-based account to buy and sell, the pip values are:

If the USD is the base currency, the pip value will be based on the counter currency, and you’ll need to divide these values for micro, mini and standard lots by the pair’s exchange rate.

To figure out how many pips are in the spread, subtract the bid price from the ask price: That gives you 0.00013 in our EUR/USD example. For most pairs, the smallest price movement happens in the fourth digit after the decimal, so the spread here is 1.3 pips, or $1.30 on a mini lot. That’s the cost of the trade.

Ten Forex Trading Tips for Beginners

The Foreign Exchange (Forex) market is where participants from around the world converge to trade currencies. It operates 24 hours a day, five days a week and - with a daily trading volume of $6.6 trillion in 20191 - it is the largest financial market in the world. To get more news about forex trading tips, you can visit wikifx.com official website.

For beginner traders, therefore, trading the Forex market can seem like a daunting prospect and it is difficult to know where to start. That’s why we have compiled a list of ten Forex trading tips for beginners in 2022! Whilst we focus mainly on the Forex market, these top trading tips can also be applied to trading other financial markets, such as stocks and commodities.

1) Choose the Right Broker

The first of our Forex trading tips for beginners does not have much to do with trading itself, but is a crucial starting point.

Don’t just settle for the first Forex broker you find online. Set some time aside to research different brokers, read their reviews and ensure that you choose the right one for you and your trading style. Here are some important factors to consider when choosing a broker:

2) Create a Trading Plan

The right broker successfully chosen, our next Forex trading tip is to create a trading plan.

Many Forex traders are guilty of being too eager to start trading straight away without setting out a clear plan beforehand. As the old cliché goes: “failing to prepare is preparing to fail..” and Forex trading is no different.

You can think of your Forex trading plan as a set of rules for you to follow when trading and how you will implement them. Defining these rules beforehand and writing them down will help you stick to them when you start trading. Here are some questions to ask yourself when creating your plan:

3) Educate Yourself

You cannot expect to be a successful Forex trader if you don’t dedicate time to learning about the Forex markets and how to trade them. The next of our Forex trading tips, therefore, is to make sure you educate yourself thoroughly on the art of trading!

Studying does take time and effort, but your trading will undoubtedly benefit. And the learning never stops. No matter how experienced you are as a trader, there is always more to learn. So, keep reading the news, analysing market trends and make sure you don’t forget the basics.

4) Start Gradually

As when learning any new skill, when you start trading, you need to begin with the basics and go forward from there.

Don’t be tempted to jump straight in with big money trades, but instead, start with small position sizes and build upwards from there, being sure to take your time doing so. Learn gradually from each step you take and don’t increase your position sizes until you feel comfortable doing so. Remember, it's not a race!

5) Get Used to Being Wrong

Even the most successful traders make mistakes and lose money occasionally so, as a beginner trader, you need to accept that you are going to be wrong from time to time, particularly at the beginning.

Being wrong and making mistakes are unavoidable consequences of learning to trade, and the sooner you accept this the better. If your last trade was a loss, try not to obsess over it and don’t let it impair your decision making process on the next trade. Instead, analyse your mistake and try to learn from it.

6) Keep a Trading Diary

Keeping a trading diary is an excellent way for both beginner and experienced traders to improve their trading strategies and develop their skills as a trader.

A good trading diary will record details about all your trades, regardless of whether they resulted in a win or loss. By regularly setting time aside to go through your historical trades, you can see and what you did right and, more importantly, what you did wrong.

7) Control Your Emotions

It is important to keep your emotions in check when trading, particularly your levels of stress. Make sure you have a clear head and are making informed, rational and unemotional decisions.

Reduce your stress levels by finding the cause of your stress and either removing it or reducing its impact on you. This is easier said than done, especially after a spell of losses, but it can prove to be the difference between a successful trader and an unsuccessful one.

8) Take Risk Management Seriously

If you only take one lesson away from our list of Forex trading tips, it should be this one. Good risk management is an absolutely crucial part of becoming a successful Forex trader.

Risk management is all about identifying the risks which exist within Forex trading and taking steps in order to limit your exposure to these risks. Two key things which beginner Forex traders should take on board is to only ever risk a small portion of your overall capital on one trade and to always trade with a stop-loss.

9) Take Breaks

An essential Forex trading tip to follow daily is to remember to take some time away from your trading terminal.

This is particularly important when you are involved in a long, demanding trading session. When this happens it is beneficial to take a break and walk away from the computer for a while. Give yourself some time to collect your thoughts. When you return to your desk, you will be calmer and able to focus better.

10) Be Patient

Finally, our last Forex trading tip is to be patient, because there is no list of forex trading tips or secrets that will ensure quick success.

Many people new to trading have an unrealistic vision of becoming rich in a matter of days. The reality is that the journey to becoming a successful Forex trader requires, not just lots of effort, but also lots of time. You are not going to become a successful trader in a couple of weeks.

Markets.com Review 2022

Markets.com is a global online brokerage firm that allows trading CFD and Forex. The CySEC entity of Markets.com is operated by Safecap Investments Limited.To get more news about markets.com pros and cons, you can visit wikifx.com official website.

Markets.com is being regulated by financial authorities such as the Cypriot, CySEC, and the UK FCA. Currently, the company is in Nicosia, Cyprus.

The Markets.com website notes that it aims to add an ‘X Factor’ in trading activity by its state-of-the-art tools and services. It claims to empower the traders with upgraded offerings. Markets.com differs largely from the rest of the brokerage platforms when it comes to the lowest spreads in the market. Also, it provides VIP customer services.

If we dig more about the platform through Markets.com reviews, it charges a reasonable fee for inactivity on the trading platform. Markets.com is regulated in Cyprus, Australia, UK, B.V.I (British Virgin Islands). The platform doesn’t charge any withdrawal fee while it requires a minimum deposit amount of $100. It supports at least 9 types of currencies.

A bit of investment advice, CFDs are highly complex instruments and come with a high risk of losing money quickly because of leverage. 79.90% of retail investor accounts lose money when trading CFDs with this broker.

What Can be traded with this broker?

By using the Markets.com platform, the traders can select from a wide range of more than 2,200 assets. Traders have the choice to choose from 67 currency pairs and 25 cryptocurrencies.

Additionally, the cross-asset diversification process is enabled for 28 commodities, and approximately 2000 equity CFDs, which comprise the bulk of the assets.

Markets.com also offers the largest trading opportunities thereby offering 40 index CFDs, 13 blends, and 66 ETFs, and it also offers bonds for the traders.

On the whole, the asset selection offered by the Markets.com is ideal for both retail and professional traders.

Mobile trading

In addition to providing MetaTrader 4 and MetaTrader 5 for mobile, this broker also offers its proprietary mobile app; Markets.com Mobile, which is a counterpart to the web-based platform. The above-mentioned mobiles apps are all available for iOS and Android devices. Additionally, the Markets.com mobile app integrates many features that are found in the web-based platform, as a result, the display and layout is consistent throughout.

Accounts

Citizens of the following countries are not eligible to open an account with Markets.com : Brazil, Bahamas, Belgium, Botswana, Cambodia, Canada, China, Ethiopia, Ghana, India, Iran, Iraq, Israel, Japan, New Zealand, North Korea, Northern Mariana Islands, Pakistan, Puerto Rico, Panama, Russia, Serbia, Singapore, Sri Lanka, Syrian Arab Republic, Trinidad and Tobago, Tunisia, Turkey, United States, US Virgin Islands, Vanuatu, Yemen, Hong Kong & Taiwan.

Account Opening Process

The account opening process with Markets.com is simple and fast and this trading platform is suitable for new and professional traders. To start opening an account with Markets.com, the trader needs to click create an account, given on the Markets.com website, which leads them to the registration page.

From that point onwards, the traders will be redirected automatically to the Markets.com trading platform, and they will be asked whether they would like to go for a demo trading account for a live trading account. Registration is completed after the verification process.

Markets.com registration process consists of simple steps, as a trader you need to provide personal information, financial information, tax information, financial knowledge, and trading experience. When this is done, the traders can verify by uploading a proof of residence and a proof of identification document for further process.

Furthermore, the Markets.com trading accounts can be funded using various base currencies including EUR, USD & GBP, with a minimum deposit of 100 EUR/USD/GBP. Retail clients can trade with maximum leverage up to 1:300. Lower leverage limits apply to retail traders under the brokers UK (FCA), Australia (ASIC) and EU (CySEC) entities.

Alerts and notifications

We found from the Markets.com review that many traders like these broker’s features. With this, one can set up email, SMS notifications as well as price alerts. However, for order confirmation, there is no notification service.

Tools on the Platform for Analysis

There are four types of tools for analysis including fundamental, technical, sentiment and X-ray. Here, fundamental tools give you an all-around and in-depth view of the economic factors that may affect your trades. These tools basically contribute to the trade performance with greater transparency of the markets, and the ability to identify and act on trends as they happen.