wisepowder's Blog

Relays: Electromechanical Switches for Control and Isolation

Relays: Electromechanical Switches for Control and Isolation

A relay is an electrically operated switch that plays a crucial role in various applications. Let’s explore the fundamentals of relays:To get more news about Relay, you can visit our official website.

1. What is a Relay?

A relay consists of input terminals for control signals and operating contact terminals. It can have different contact forms, such as make contacts (closed when activated) or break contacts (open when activated). Relays allow low-power signals to control high-power devices and provide isolation between input and output circuits1.

2. Basic Design and Operation

Electromagnetic Relay: This traditional type uses an electromagnet to open or close the contacts. It includes a coil, an iron core (solenoid), an iron yoke, and movable contacts.

Solid-State Relay: These relays use semiconductor properties for control without moving parts.

Latching Relay: Requires only a single pulse to operate persistently, making it useful in specific applications.

3. Applications of Relays

Relays find use in:

Home Automation: Controlling lights, fans, and appliances.

Automobiles: Managing various systems like headlights, wipers, and fuel pumps.

Industrial Equipment: Motor control, safety circuits, and process automation.

DIY Projects: Hobbyists use relays for custom applications.

Test and Measurement Equipment: Ensuring accurate measurements.

4. Importance of Isolation

Relays provide isolation between control and load circuits. This separation prevents interference and protects sensitive components.

NGINX Proxy: A Comprehensive Guide

NGINX Proxy: A Comprehensive Guide

Introduction

NGINX is a powerful web server and reverse proxy that plays a crucial role in modern web infrastructure. In this article, we’ll explore NGINX’s proxying capabilities, including how to configure it as a reverse proxy for HTTP requests. Whether you’re scaling out your infrastructure or need to pass requests to backend servers, NGINX can help.To get more news about nginx proxy, you can visit pyproxy.com official website.

Key Concepts

Reverse Proxy: NGINX acts as an intermediary between clients and backend servers. It receives requests from clients and forwards them to the appropriate server, handling load balancing and other tasks.

Proxy Directives: NGINX provides several directives for configuring proxy behavior. Some common ones include:

proxy_pass: Specifies the backend server’s address.

proxy_set_header: Sets custom headers for requests.

proxy_buffer_size: Controls the buffer size for responses.

Buffering and Caching: NGINX buffers responses from backend servers, improving performance by reducing the number of requests. You can also configure caching to store frequently accessed content.

Conclusion

NGINX’s proxying capabilities are essential for optimizing web applications. By understanding these concepts and using the right directives, you can build a robust and efficient infrastructure.

IP2World Proxy Services: Unlocking Global Access

IP2World Proxy Services: Unlocking Global Access

In today’s interconnected world, having reliable and secure proxy services is essential for businesses and individuals alike. IP2World stands out as a premier provider of residential proxies, offering a wide range of options to meet diverse needs.To get more news about ip2world proxy, you can visit ip2world.com official website.

What is IP2World?

IP2World provides an extensive proxy service, integrating vast resources with user-friendly software. Whether you’re conducting business analytics or simply browsing the web, IP2World has you covered.

Types of Proxies

Dynamic Residential Proxies:

These proxies rotate through a pool of residential IP addresses, mimicking real users. They allow you to adapt, scale, and explore the internet seamlessly.

Static Residential Proxies:

Hosted by data centers, these proxies provide stable and anonymous services. They’re ideal for tasks that require consistent IP addresses.

HTTP (S) and SOCKS5 Proxies:

IP2World offers both HTTP (S) and SOCKS5 proxy types. Choose based on your specific requirements.

Global Coverage

IP2World boasts over 90 million ethically sourced residential IPs across 220+ locations worldwide. Whether you need access in Canada, the USA, Brazil, the UK, India, or Japan, IP2World has you covered.

Residential SOCKS5 Proxies: Anonymity and Efficiency

Residential SOCKS5 Proxies: Anonymity and Efficiency

A Residential SOCKS5 Proxy is a powerful tool for internet users seeking anonymity and efficiency. Let’s dive into the details:To get more news about residential socks5 proxies, you can visit ip2world.com official website.

What is SOCKS5?

SOCKS5 stands for “SOCKet Secure.” It’s the latest version of the SOCKS protocol, offering an additional layer of security.

Unlike HTTP proxies, which work at the application level, SOCKS5 proxies operate at the transport layer. They handle various types of traffic (including web browsing, torrenting, and gaming) more efficiently.

Residential Proxies: What Makes Them Unique?

Residential proxies have IP addresses associated with ISPs providing internet to private homes. This association makes them appear more natural and less suspicious.

Residential proxies are ideal for tasks like web scraping, data mining, and bypassing geo-restrictions.

Advantages of Residential SOCKS5 Proxies:

Anonymity: Residential proxies offer better anonymity compared to datacenter proxies.

Performance: Whether you’re using residential or datacenter proxies, you’ll experience seamless performance.

Unlimited Bandwidth: Our dedicated, shared, residential SOCKS5 proxies provide unlimited bandwidth, allowing you to use them without any concerns.

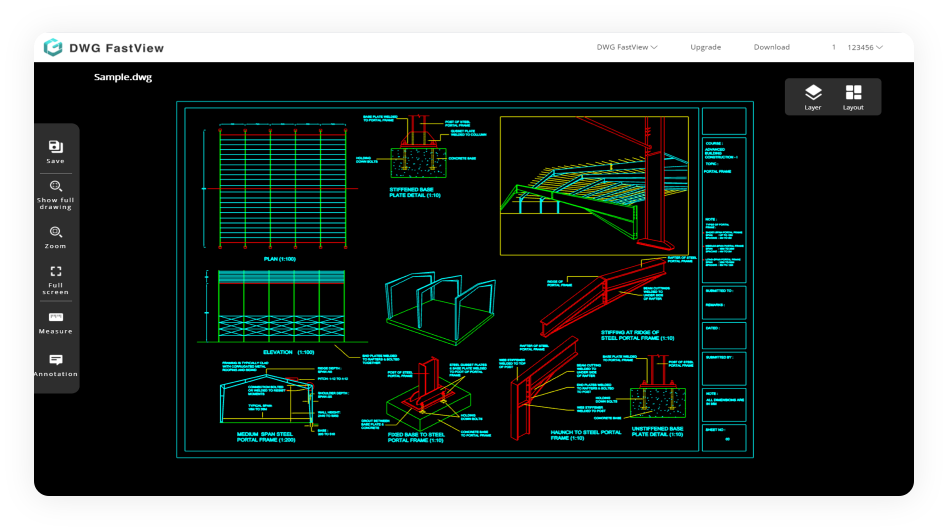

Exploring the Best Free 2D CAD Software for 2024

Exploring the Best Free 2D CAD Software for 2024

When it comes to 2D computer-aided design (CAD), there are several excellent free options available. Whether you’re a hobbyist, student, or professional, these tools can help you create technical drawings, schematics, and more. Let’s dive into two standout choices:To get more news about best free 2d cad software, you can visit gstarcad.net official website.

1. LibreCAD

Price: Free (no commercial restrictions)

Operating System Compatibility: Windows, macOS, Linux

Supported File Formats: DXF, DWG, JWW, LFF, CXF, SVG, BMP, and more

LibreCAD is a mature and feature-packed 2D CAD application. It’s open-source, meaning you can download and use it freely. With a layout similar to AutoCAD, it offers essential sketching and drafting tools. Additionally, it provides CAM preparation tools for CNC software export. Ideal for mechanical drawings and laser cutting designs.

2. QCAD

Price: Free trial and free reduced Community Edition

Operating System Compatibility: Windows, macOS, Linux

Supported File Formats: DWG, DXF, DGN, CXF, BMP, JPEG, and more

QCAD boasts an intuitive user interface and a comprehensive range of powerful CAD tools. It’s suitable for creating technical drawings, plans, and diagrams. The large part library and scripting interface make it a versatile choice.

Embracing Excellence: The Spirit of ‘YYDS’

Embracing Excellence: The Spirit of ‘YYDS’

In the realm of digital vernacular, few phrases capture the essence of unwavering admiration quite like ‘YYDS’. Originating from the fervent online communities of gaming and entertainment, ‘YYDS’ has transcended its initial context to become a universal accolade for anything or anyone embodying the pinnacle of excellence.To get more news about y y d s, you can visit shine news official website.

The term ‘YYDS’, an acronym for ‘永远的神’ (Forever Godlike), echoes through the corridors of cyberspace, a testament to the timeless feats achieved by individuals who have left an indelible mark on their respective fields. It is a celebration of the extraordinary, a recognition of those who have soared beyond the ordinary confines of capability and talent.

‘YYDS’ is not merely a phrase; it is a cultural phenomenon that encapsulates the collective aspiration for greatness. It is the chant that resonates when an athlete shatters records, the whisper of awe when an artist unveils a masterpiece, and the roar of approval when a pioneer innovates against all odds.

In this article, we delve into the spirit of ‘YYDS’, exploring its origins, its impact on popular culture, and the individuals who have earned this title through their exceptional contributions to society. From the electrifying arenas of esports to the hallowed halls of academia, ‘YYDS’ is the ultimate tribute to those who inspire, innovate, and lead the way forward.

As we navigate through an ever-evolving world, the spirit of ‘YYDS’ serves as a beacon, guiding us toward the pursuit of excellence in all our endeavors. It reminds us that within each of us lies the potential to achieve the extraordinary, to become a ‘Forever Godlike’ presence in the annals of history.

Understanding the Chinese Visa Costs for US Citizens

Understanding the Chinese Visa Costs for US Citizens

The process of obtaining a Chinese visa for US citizens involves several steps and costs. The visa fee is a crucial part of this process. The cost of a Chinese visa for US citizens is generally the same, regardless of the type of visa or the number of entries desired.To get more news about chinese visa cost for us citizens, you can citynewsservice.cn official website.

The Chinese Embassy in the United States has outlined the visa processing fees on their official website. The fees are applicable from a specific date in December 2023 to the end of December 2024. It’s important to note that visa applications submitted before this date cannot enjoy the fees reduction.

For regular service, the cost for a single entry visa, double entries visa, multiple entries for six months, and multiple entries for twelve months or more are all the same for US citizens. There is also an express service available, which requires an additional fee.

The processing time for the China visa application is typically four working days. However, this can be shortened if an extra charge is paid.

It’s also worth noting that the requirements and procedures for Chinese visa applications are updated periodically3. For instance, starting from January 1, 2024, the Chinese Embassy and Consulates-General in the United States simplified the application documents required for a tourist visa.

In conclusion, while the cost of a Chinese visa for US citizens is fixed, it’s essential to stay updated with the latest requirements and procedures to ensure a smooth application process. Always refer to the official resources or consult with a visa expert for the most accurate and up-to-date information.

Understanding Viagra: A Comprehensive Guide

Understanding Viagra: A Comprehensive Guide

Viagra, scientifically known as sildenafil citrate, is a widely recognized prescription medication used to treat erectile dysfunction (ED) in adults. This blue pill has been a trusted solution for over two decades, prescribed by healthcare professionals across the globe.To get more news about wearable dildo, you can visit herbal-hall.com official website.

Viagra functions by aiding in achieving and maintaining an erection. It does this by inhibiting a protein known as phosphodiesterase-type five (PDE-5) from acting too quickly. This process allows for an increased blood flow into the penis, facilitating an erection. Typically, Viagra starts working within an hour after ingestion, and its effects can last for several hours.

In the United States, Viagra is available in oral tablet form. The cost for this medication can vary depending on the pharmacy you visit. It’s important to note that there are also generic forms of Viagra, such as sildenafil, which may be a more cost-effective option.

Before starting any medication, it is crucial to consult with a healthcare professional. They can provide the most accurate information based on your health condition and needs. Always adhere to the safety information provided and ensure that the pills you receive are the brand-name Viagra.

In conclusion, Viagra has proven to be a reliable treatment for erectile dysfunction. Its effectiveness and safety have been demonstrated over the years, making it a go-to solution for many. As with any medication, it’s essential to use it responsibly and under the guidance of a healthcare professional. Remember, your health and well-being should always be your top priority.

Unveiling the Hidden Dangers of Lang Yi Hao

Unveiling the Hidden Dangers of Lang Yi Hao

Lang Yi Hao, a product promoted for sexual enhancement, has been found to contain hidden drug ingredients that pose significant health risks. The Food and Drug Administration (FDA) advises consumers not to purchase or use Lang Yi Hao due to these hidden dangers.To get more news about dildos, you can visit herbal-hall.com official website.

The product was identified by the FDA during an examination of international mail shipments. Laboratory analysis confirmed that Lang Yi Hao contains sildenafil, the active ingredient in the FDA-approved prescription drug Viagra, used to treat erectile dysfunction (ED). This undeclared ingredient may interact with nitrates found in some prescription drugs such as nitroglycerin and may lower blood pressure to dangerous levels. Men with diabetes, high blood pressure, high cholesterol, or heart disease often take nitrates.

Health care professionals and patients are encouraged to report adverse events or side effects related to the use of this product to the FDA’s MedWatch Safety Information and Adverse Event Reporting Program. This notification is to inform the public of a growing trend of dietary supplements or conventional foods with hidden drugs and chemicals. These products are typically promoted for sexual enhancement, weight loss, and body building and are often represented as being “all natural.”

The FDA is unable to test and identify all products marketed as dietary supplements that have potentially harmful hidden ingredients. Consumers should exercise caution before purchasing any product in the above categories. The Therapeutic Goods Administration (TGA) also advises consumers to stop taking Lang Yi Hao tablets, which contain sildenafil and chloramphenicol, and to report them to the authorities. The tablets are illegal, unapproved and unsafe for health. The TGA is working with the Border Force to stop future shipments of the product.

Embracing the Two-Day Japanese Diet for a Healthier Lifestyle

Embracing the Two-Day Japanese Diet for a Healthier Lifestyle

The Japanese diet has been gaining popularity worldwide due to its potential health benefits and unique eating habits. This diet is based on the traditional Japanese cuisine, also known as “washoku”, which emphasizes fresh, seasonal, and minimally processed foods.To get more news about rose clitoral vibrator, you can visit herbal-hall.com official website.

The traditional Japanese diet is rich in fish, seafood, and plant-based foods, with minimal amounts of animal protein, added sugars, and fats. It is known for its low-calorie content and high levels of antioxidants, making it an excellent choice for weight loss and overall health.

One of the key aspects of this diet is the emphasis on small meals eaten multiple times throughout the day. This eating style not only helps curb cravings and overeating but also promotes better digestion and sleep.

The typical Japanese meal consists of a staple food combined with a soup, a main dish, and a few sides. The staple food could be steamed rice or noodles. The soup is typically a miso soup made with seaweed, shellfish, or tofu and vegetables in a fermented soybean stock. The main dish usually consists of fish, seafood, tofu, or natto with optional small amounts of meat, poultry, or eggs. The side dishes include vegetables (raw, steamed, boiled, sautéed, grilled, or pickled), wild plants, seaweed, and raw or pickled fruit.

The Japanese diet is not just about what you eat, but also how you eat. The dishes are eaten in small bites with chopsticks, as this method is believed to create a rich harmony of flavors. Moreover, Japanese cuisine is known for its use of high-quality ingredients and the principle of harmony between nature and people, which favors seasonal ingredients.

In conclusion, the two-day Japanese diet is a great way to introduce yourself to this healthy eating lifestyle. It allows you to experience the benefits of the diet without making a long-term commitment. So why not give it a try and see how it can improve your health and well-being?