wisepowder's Blog

Nike's Jordan brand gets a boost from ESPN

Nike Inc.'s Jordan brand of basketball shoes has gotten a bump in interest and sales thanks to "The Last Dance," a 10-part documentary that aired in May. The documentary, co-produced by Netflix Inc. NFLX, -0.78% and Walt Disney Inc.'s DIS, +0.73% ESPN, takes a closer look at NBA icon Michael Jordan and the 1997-1998 Chicago Bulls basketball team. To get more news about cheap air jordan shoes china, you can visit nkspaces official website. nkspaces2010 !

The documentary is currently available to replay on the ESPN app and on Netflix outside of the U.S. "'The Last Dance' series added incremental interest in vintage Jordan styles, particularly Jordan V," wrote Cowen analysts in a note published Tuesday.

Cowen analysts also credit Nike's digital transformation and the SNKRS app with growing the athletic company's e-commerce business and strengthening the connection the brand has with its customers. Cowen rates Nike stock outperform with a $110 price target. Sneaker enthusiast sites GOAT and StockX both report an increase in traffic and sales of Jordan sneakers since the documentary aired. And sales of Chicago Bulls memorabilia has jumped since the series premiered. Nike stock is up 2% for the year to date while the Dow Jones Industrial Average DJIA, +0.54% has fallen 4% for the period.

What is Nike's Jordan Brand worth to the sportswear company?

NBA legend Michael Jordan’s endorsement deal with Nike, most recently chronicled in ESPN’s documentary series “The Last Dance,” has proven to be one of the most lucrative partnerships of its kind in the history of sports.To get more news about cheap air jordan, you can visit nkspaces official website. nkspaces2010 !

Jordan’s ties to Nike date back to 1984, when he signed a five-year deal worth $500,000 a year, the richest sneaker deal in the NBA at the time. The first “Air Jordan” sneaker was released that year and became an instant hit, generating more than $100 million in sales in the 12 months after its release.Jordan Brand grew even more successful as the longtime Chicago Bulls star’s on-court exploits established him as one of the most celebrated American athletes of all time.

Former Nike CEO Mark Parker disclosed last December that the Jordan imprint had recorded its first-ever $1 billion quarter. “What’s most exciting is we’re still in the early stages of diversifying the Jordan portfolio,” Parker said at the time. The Jordan Brand generated $3.1 billion in sales in Nike’s 2019 fiscal year, which ended last May. That total accounted for about eight percent of the apparel giant’s overall sales.

As detailed in “The Last Dance,” Jordan signed with Nike despite preferring its top rival, Adidas. Unlike Adidas, Nike was willing to give the former University of North Carolina standout his own signature sneaker. He agreed to meet with Nike only after his agent, David Falk, enlisted Jordan’s mother to convince him. Nike executives ultimately sold Jordan on their plan for his brand. "Go into that meeting not wanting to be there, and Nike made this big pitch," Jordan said on the documentary. "My father said, 'You'd have to be a fool not taking this deal. This is the best deal.'

US GDP slumped 4.8% in the first quarter

US gross domestic product fell at a 4.8% annualized rate in the first quarter, according to Commerce Department figures released Wednesday. The report showed that the longest-ever economic expansion that started following the Great Recession has officially ended. Now, economists are watching to see how bad second quarter GDP may slump as the coronavirus pandemic continues in the US.Visit Business Insider's homepage for more stories.To get more news about WikiFX, you can visit wikifx official website.

The longest-ever US economic expansion is officially over. US gross domestic product fell at a 4.8% annualized rate in the first quarter, according to Commerce Department figures released Wednesday. Economists expected that GDP would shrink by a 3.8% annualized rate in the first quarter, according to Bloomberg data. The slump from January through March reflects the sharp economic impact of country-wide shutdowns to curb the spread of Covid-19. In March, most of the US went into lockdown mode — states banned non-essential business, sent workers home, and told residents to practice social-distancing.“Today's first quarter numbers are just the deeply unappetizing appetizer,” wrote Ian Shepherdson, chief economist of Pantheon Macroeconomics, in a Wednesday note.

The GDP contraction has ended the longest-ever economic expansion that took place in the US after the Great Recession of 2007-2009. During the record expansion, the unemployment rate fell to a 50-year low of 3.5%, and the US economy added jobs for 113 months in a row.

The manager of the best small-cap fund of the past 20 years explains why he's betting big on a consumer recovery — and shares his top 4 stock picks in the struggling sectorNow, it's likely that a coronavirus-induced recession started in the first quarter. A slew of economic indicators point to extreme fallout in the US economy.In just five weeks, 26 million Americans have filed for unemployment claims, effectively erasing more than a decade of job creation in just over a month. In addition, industrial production has fallen, retail sales have declined at a record pace, and housing sales have slumped.

While some economists mark the beginning of a recession as two consecutive quarters of GDP contraction, official arbiters have a more comprehensive approach. The National Bureau of Economic Research says a recession is “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.” Any official call will take some time, as the bureau's Business Cycle Dating Committee weighs whether a recession began in March, when much of the US was shut down amid the coronavirus pandemic, or if the economy started trailing off at the end of February. Going forward, economists will be watching to see how bad the situation becomes and weigh what shape a recovery might take. The worst may be yet to come — first quarter GDP could be revised even lower as more data is collected.In addition, second quarter GDP is expected to fall at an even sharper annualized rate. Economists expect major slumps, ranging from Bank of America's -30% estimate to JPMorgan's -40% forecast.

Hertz car-rental company reportedly prepping for possible bankruptcy

Hertz is preparing for a potential bankruptcy filing, The Wall Street Journal reported Wednesday.The situation is fluid, sources told the paper, as the company hopes to reduce lease payments by May 4.The company laid off 10,000 employees — more than a quarter of its total workforce — in April.Visit Business Insider's homepage for more stories.To get more news about WikiFX, you can visit wikifx official website.

Car-rental company Hertz is preparing for a potential bankruptcy filing, The Wall Street Journal reported Wednesday, as the coronavirus pandemic brings nearly all travel to a standstill.People familiar with the matter told the paper that Hertz is working to reduce its debt payments and is in talks on a forbearance agreement that could help it avoid bankruptcy. The situation remains fluid, according to the Journal's sources.Hertz did not immediately respond to a request for comment from Business Insider. Shares of Hertz declined more than 15% in trading Wednesday, as broader indices rose, following The Wall Street Journal's report.

The news of a possible bankruptcy arrives two days after Hertz on Monday said in a regulatory filing that it “did not make certain payments” on its operating lease as it remains in discussions with lenders to reduce its payments. If those discussions aren't fruitful by the first week of May, “Hertz could be materially and negatively impacted,” it said.Earlier in April, the company laid off 10,000 workers — about 26% of its workforce at the end of 2019 — “in an effort to align staffing levels with travel demand.”Ryan Brinkman, an analyst at JPMorgan, theorized on April 23 that government assistance could help Hertz remain solvent. “We do think a potentially large amount of cash could be made available to Hertz from the federal government, potentially solving any liquidity concerns, although we are also uncertain with regard to the terms,” he said in a note to clients.

Big banks have been temporarily locked out of the small business

The Small Business Administration is currently only accepting loans from banks that have assets of $1 billion or fewer.The move may address concerns that small lenders that primarily work with businesses owned by people of color would have to compete with larger banks.Minority-owned banks were already concerned that businesses owned by people of color would miss out on loans because they were going up against big banks.Visit Business Insider's homepage for more stories.To get more news about WikiFX, you can visit wikifx official website.

The Small Business Administration on Wednesday said it would be temporarily closing its Paycheck Protection Program (PPP) for small businesses hurt by the novel coronavirus to all but the country's smallest lenders, in a bid to give them fair access.The agency said it would only accept loans from banks with assets of $1 billion or fewer as of 4 p.m. EDT (20:00 GMT) on Wednesday, lasting through to midnight.“SBA and Treasury will evaluate whether to create a similar reserved time again in the future,” the SBA said.The move appeared to be aimed at addressing fears that very small banks, and lenders that predominantly serve businesses owned by people of color, would have to compete with big banks for the program's more than $310 billion pot of cash, after they exhausted a pot of money ring-fenced for them on Tuesday.

There are approximately 3,862 commercial banks with assets of less than $1 billion, according to regulatory data as of 2019, although many credit unions and other small community lenders would also be small enough to use the new reserve window.But the decision is likely to anger big banks such as Wells Fargo, Bank of America, Citi, and JPMorgan, which are sitting on hundreds of thousands of applications from small businesses.The last-minute SBA change is the latest twist for the program, which has been beset by technology and paperwork issues, and subject to intense scrutiny following reports some large companies and hedge funds wrongfully secured loans.US bankers began another race to grab $310 billion in fresh small-business aid released by the SBA on Monday, after the program's first $349 billion in funds was exhausted in less than two weeks.

Created as part of a $2.3 trillion congressional economic relief package, the program allows small businesses hurt by the epidemic to apply for government-guaranteed, forgivable loans with participating banks.During the second round, Congress ring-fenced $30 billion of the funds for banks with less than $10 billion in assets and other community lending groups which predominantly service minority-owned businesses, amid fears that the country's biggest banks would suck up the funds.With so much pent-up demand, that pot of cash was exhausted on Tuesday, requiring smaller lenders that didn't get through to compete with larger firms for loans.Reuters reported on Wednesday that community banking groups and minority-owned banks said they are worried businesses owned by people of color may miss out on much-needed loans as a result.

Small World of Warcraft is a Blizzard-y take on a beloved board game

A videogame/board game mashup of two '00s classics is now out and about: Small World of Warcraft, which is one of those brilliant names that I'd suggest but which publishers rarely choose. It's a World of Warcraft-themed skin on the board game Small World, with a set of mechanics and clever twists to make the game of rising and falling empires new and fresh for the Alliance and Horde. To get more news about Buy WoW Items, you can visit lootwowgold official website.

Small World is a perennially popular 2009 board game from Days of Wonder. In it, an empire made up of a random combination of "Race" and "Special Power" conquers territory and clashes with other empires, conquering ever-more territory before going into decline. When an empire goes into decline, that player just picks up a new species and gets to conquering all over again. The winner is the person who had the most successful empires over the course of the game.

The World of Warcraft twist comes in the empires to play and the random powers they can have, so this has your Azeroth critters: Blood Elves, Draenei, Dwarves, Ethereals, Forsaken, Gnomes, Goblins, Humans, Kobolds, Naga, Night Elves, Orcs, Pandaren, Tauren, Trolls, and Worgen. The special powers are also WoW-flavored, including things like Archaeologist, Beast Master, Herbalist, Blacksmith, and my favorite: Fishing. There are also artifacts like the Doomhammer, or the famed Ashes of Al'Ar, which is probably the closest you'll ever get to seeing those in any game.

I've had the chance to sit down with Small World of Warcraft, and it's definitely above-average for mashups and branded games. It's designed by original Small World designer Phillipe Keyaerts. Actually, because it incorporates the lessons of 11 years of development on the original game and its expansions in one box, this is probably my new go-to version of the game. It plays a bit like a curated best-of Small World mechanics, plus a few new things like rules to make Horde and Alliance races prefer fighting each other.

Tips to Make more Gold in WOW Classic

In WoW Classic professions are an integral part of the game and will be important in every phase. While some professions can help to make items that you will use for raiding and PvP professions are also an excellent way to make gold. If your primary goal is to make gold.To get more news about wow classic buy gold, you can visit lootwowgold official website.

The Auction House is one of those hidden gems that can help you earn lots of gold in WoW. The basic premise is buying low and selling high. The other thing to do is to corner the market. Buy up all of an item (usually a trade skill item—herbs, metal, etc.) and resell them at a much higher price. It requires constant commitment, though.

To get the flow of gold going, you will have to let your items expire and then re-list them immediately. You have to find new items to buy depending on what is the demand at the time, so ensure you keep up with the trends of what item is needed at any given time. A new patch can throw the market into chaos, which is the best time to pick up a lot of gold or a lot of items cheaply.

The Auction House has gone through a lot of changes to prevent scams, so while it may not be the gold mine it once was, it can still be profitable.Gathering professions are generally a good pick for making gold in vanilla WoW. In the professions section of the guide we will go over methods to make gold with all professions.

Skinning is a very good choice to go with while leveling and if you farm a lot. If you are trying to get your mount at level 40, you can easily make some extra gold just by skinning while leveling and vendoring everything.Skinning is also very good for Mages as they can AoE farm and kill/skin a lot of mobs quickly.

Mining is another solid pick for making gold, and especially while leveling. Just mine whatever ore you come by as you level up.

Herbalism is not as good as mining and skinning while you are leveling up, although still decent. At max level this is perhaps the best gold farming profession.Enchanting is also a good profession to have, but don’t have it on your main. Have it on you bank alt, which we will talk more about in the next segment.In World of Warcraft, ‘farming’ is the process of repeatedly killing enemies, ideally in large groups, to ‘farm’ them for experience or loot.

If making money if your goal, then it’s the latter you’re most interested in. Whether it’s out in the world or within a dungeon, pulling groups of enemies, downing them with AOE, and repeating can net you both raw gold and a variety of items to sell.

When it comes to specifics, it’s going to be a case of what works best for you. You can blast through lower-level content alone, or group up to tackle tougher opponents. Some farming strategies aim for uncommon gear drops to sell on the auction house, while others will be more reliable in offering coin and crafting materials like cloth.

Some classes are stronger at farming than others – Mages particularly excel due to their huge range of AOE and kiting tools – and so your class choice will also influence what might be best to farm for you, and whether you group up or go it alone.

With so many potential locations in which to farm, it’s worth trying out a few different approaches without sinking too many hours into them initially to get a sense for what you find easiest, most enjoyable, and most profitable.

Farming is also a very effective levelling strategy if you’re working in content that’s within your level – either world monsters or dungeons with a group – so if you’re all about that endgame then it’s definitely worth considering along the way. For others, it might only come into play when you specifically need to make money for a big payment like a mount.

aliforex refused investor's withdrawal after getting US$300

Badmus is a forex beginner without experience of forex trading, and he lost all money when trading at ExpertOption for the first time. So he decided not to trade any more. On February 5th, 2020, he came across the same person, who worked for ExpertOption but now works for ALIFOREX. Badmus was attracted by this guys investment advertisement on YouTube and was invited to join a Telegram group, which provided customer service support to investors.To get more news about WikiFX, you can visit wikifx official website.

He invested 31USD BTC on ALIFOREX at the beginning and got 34.5USD after 24 hours. He felt good and decided to invest some BTCs worth of 276USD. According to investment levels, he would get 7% profits after 24 hours.

Badmus did not receive the money for a long time after submitting the withdrawal application, so he reported this issue in the Telegram group, and was told that the system error led to his failure of withdrawal, and they could do nothing about it. They added that the only solution was that Badmus needed to deposit again, then he can withdraw all the money in his account. Badmus felt confused and shocked. When the investor complained directly in the Telegram group, he was kicked out of the group.

Badmus chatted with a live support representative about how to withdraw, and was told that if he invites three people to invest 200USD each to them, he can withdraw. He had no choose but to ask his friends to invest on ALIFOREX. Unfortunately, the same issue also happened to his friends, who were unable to withdraw unless they deposited more .

Those kind of investment plans are obviously their tricks. They try to attract more people to join the scheme by showing high profits. But high profit is always accompanied with high risk, which is not quite legal in the field of investment.

Warning!!!

Per checking WikiFX App, ALIFOREX has a poor rating of 0.99, and the broker currently has no valid regulation, bearing great risks. The broker is currently active on large social network such as Telegram and Facebook, please stay away!

WikiFX&8+ Must-have Forex Markets Insight Tools

After WikiFXs investigation, traders are more interested in the latest forex news and forex analysis articles. This article will present the eight functions of WikiFX APP in details so that users can better understand the APP and acquire the forex knowledge they need.To get more news about WikiFX, you can visit wikifx official website.

Go to the APP home page and click “ALL”to select News Express, which displays two items, New Flashand Calendar. Click News Flash, and you will see the screen scrolls with the latest real-time forex information in 24 hours. The information is showed in two colors, red and black, indicating the degree of importance of the information.

Calendar shows the Economic News of each country on the same day, and you will see detailed information and explanations for every piece of financial information.

WikiFX has invited 15+ gurus with highly reputation in the forex industry, and they have long-term cooperation with WikiFX and continuously bring the latest forex information on WikiFX official website. Their articles focus on the current investment environment analysis. For example, the influence of epidemic on forex; why is oil cheaper than water, etc.

3. WikiFX Forum

This is a very good place, where you can post your opinions, articles and questions about forex whether you are a trader or broker. To attract more people to follow your posts. Even you can get comments and suggestions from strangers. Each post will be reviewed by WikiFX staff in order to prevent advertisements, false investment advertisements and any information from illegal brokers and make sure that the forum is a safe and reliable place for you to speak freely.

4. Spread Comparison

Go to the APP home page and click “ALL”and choose “Spread”, you will see 85 brokers, with the spread of EUR/ USD, gold and crude oil. The list is a good reference for you when you are going to choose brokers. You can know the real-time price and choose the best broker to trade.

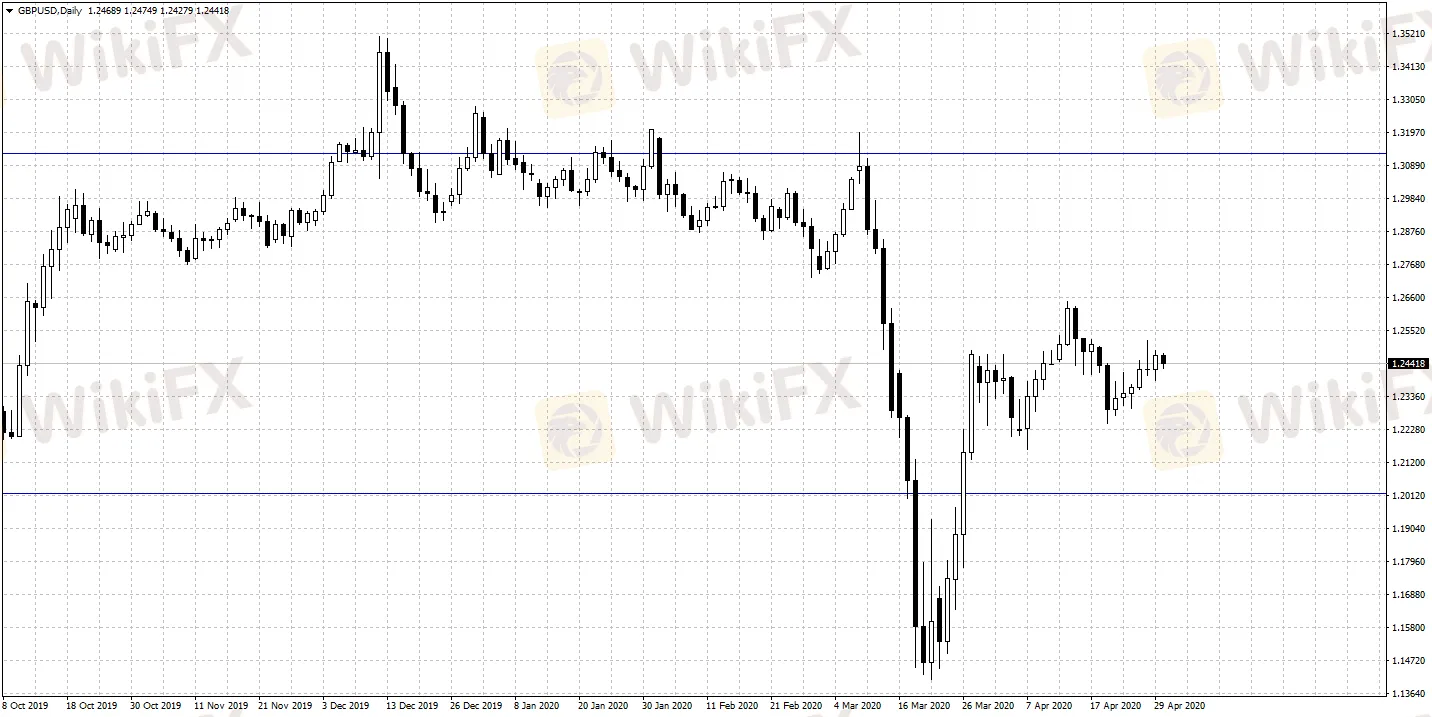

GBP/USD Will See More Volatile Market Trend

If Britain and the EU fail to make some progress in the two rounds of week-long trade negotiations,scheduled on May 11th and June 1st respectively, it will have some noticeable impact on the pounds fluctuation before mid-2020.To get more news about WikiFX, you can visit wikifx official website.

After a month of jittering in March, April has been rather peaceful for the pound. GBP/USD once plunged to a 35-year low of 1.1413 in March, while GBP/EUR also fell to 1.0527, a record low in 11 years. But both pairs have experienced some rally afterwards.

The EU-Britain negotiation regarding new trade measures introduced since January 1st has recently come to a deadlock. June 30th will be the deadline for extending the negotiation, yet the British Prime Minister Boris Johnson has repeatedly emphasized that an extension is unlikely to take place.

Latest statistics from CFTC show that as of the week ending April 21st, speculators at Chicagos International Monetary Market(IMM) are holding net shorts in pound for the first time in the past 12 months. During the last 6 weeks, speculators have been reducing holdings of GBP long positions.