qocsuing's Blog

Libertex review and test – Is it a good choice to trade?

Libertex review and test – Is it a good choice to trade?

What is Libertex? – The company presented:

Libertex is one of the most experienced brokers in the trading industry that is operating online and is a member of Libertex Group that founded in 1997. Libertex is a CFD Broker is based in Cyprus and has more than 2 million customers. Libertex offers trading in Contract For Difference. The companies main office is at 116 Gladstonos Street, Michael Kyprianou building, 1st Floor, Limassol 3032, Cyprus.To get more news about libertex review, you can visit wikifx.com official website.

Libertex platform has a large regular customer base and it has won more than 40 international awards. We have reviewed this broker and it gave us a good impression. The company’s online operations, products, and services are quite impressive. Basically, this company is legitimately operating with the majority of customers within the EEA area.

Is Libertex regulated? – Regulation of the broker

One most important thing a trader must remember is to make sure that the broker is regulated before trading. This regulation is basically proof that the broker is operating legally and has passed the criteria to gain a license to be a legit trading broker. Please be aware that CFDs and other trading products are usually regulated in the EU and may only be offered to end customers by licensed providers.

This broker keeps the funds of the customer separately from the company’s own money. Libertex can offer its products within the EEA area and in Switzerland. In addition, the platform of this broker is encrypted, so you do not need to worry about the security of your information shared with this company.

Review of trading conditions for traders – Trading CFDs with tight spread

You can trade on both in rising or falling prices with with Libertex. The maximum leverage for private traders is up to 1:30 and it varies according the underlying asset. All customers can use a demo account with virtual funds of up to €50,000 to test the trading platform themselves. The minimum deposit for a live account is only €100.

Furthermore, Libertex has a wide range of underlying assets. More than 250 different underlying assets are available with this broker. You can trade CFDs on stocks, currencies, cryptocurrencies, and more. We think that Libertex endeavors in adding new and interesting underlying assets to the platform.

There is one trade commission that must be paid per trade. Basically, this is how the broker earns money. The commission starts from 0.0003% per position and depends on the position size. Libertex has developed its own platform – the Libertex Web platform and Libertex Mobile App Platform. Also, the broker offers the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) Platform. These platforms will be discussed later on in this review.

The Libertex Web Platform has 10 different languages and offers traders a good overview of all functions. This platform enables traders to trade directly from a browser and doesn’t require downloading any software. You can have access to over 250 underlying assets and be able to trade CFDs with tight spreads. Libertex Web Platform has given a good impression to us due to its user-friendly interface. It has good indicators, and tables traders to manage their capital.

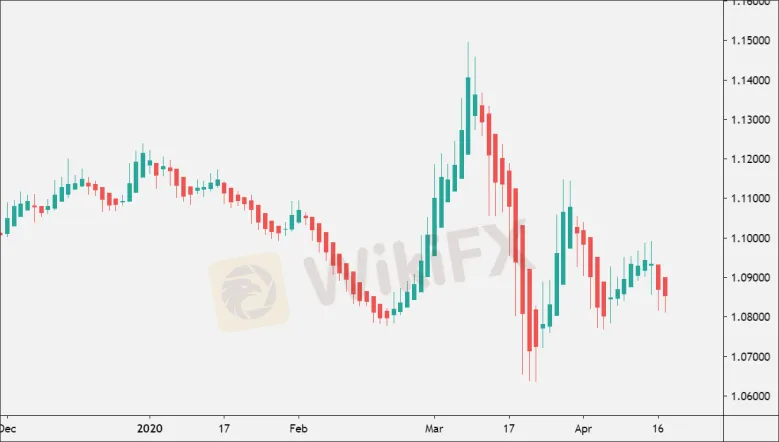

As you can see in the center of the picture of the Libertex Web Platform, there is the chart and the current market. For better analysis, charts can also be shown on a full screen. You will find several tradable markets offered by Libetex on the search option. The tradable markets are on the left side, and on the right are the current positions or account balances. In our opinion, this Libertex Web Platform is quite impressive due to its well-improved charting that has been developed over the years. One more good thing about this platform is that it offers traders extensive information on every underlying asset. The news and information section are published by Libertex.

Mobile trading is possible with Libertex through its Libertex Mobile (App) Platform. This platform is developed by Libertex and has the same functions the Libertex Web Platform offers. The only difference is that this platform requires a download of the App. This App is available in AppStore for iOS and GooglePlay for Android. This is a hassle-free option for traders to trade wherever they are and whenever they want as long as connected to the internet.

GCG Asia Review – Report a Scam

GCG Asia Review – Report a Scam

People are getting excited about cryptocurrency. However, where there is excitement, there is often danger. Unfortunately, the number of fraudulent crypto brokers is greater than regulated and legitimate financial services. Because of the increase in online trading and deals on social media, crypto scams have found more ways to reach people who want to make fast money and are new to cryptocurrencies.To get more news about gcg asia review, you can visit wikifx.com official website.

Unfortunately, many of these brokers use these opportunities as a way to trick people out of their crypto coins. After investigating these suspected crypto scams carefully, we are adding GCG Asia to the blacklist.

We don’t like accusing brokers of being fraudulent or jumping to false conclusions. However, after reading countless reviews, looking at regulators’ sites, perusing their alerts, keeping up with news about fraudulent crypto brokers, and using our proprietary investigation methods, we have concluded that consumers should stay away with GCG Asia because it seems to be a crypto scam.

We urge people who hold an account with GCG Asia to close it and to demand an immediate withdrawal of all of their funds. However, brokers who are involved in fraud will not release funds and will make excuses or charge huge fees for the right. If this happens, report to ChargeBax right away and we will guide you on your next steps.

Chargebax understands how to deal with fake brokers and cryptocurrency schemes. We have the expertise and the right strategies to make your chargeback, wire recall, or crypto recovery case successful. We consult with clients and develop strategies to bolster your claim and help you recover your funds. Talk to our professionals today.

How Crypto Frauds Work

GCG Asia may seem like any other broker. It may have a nice website or active social media page, have a friendly approach, claim to have a valid license, and gives you an offer you don’t feel you can refuse–perhaps 1% return a day on bitcoin trades. You do the math and realize that soon you will be seeing triple-digit returns.

So what can you lose? All of your money. Not all crypto scams are blatant. They may seem professional and legitimate at first. However, they have a way of pulling people in, holding their money hostage, and persuading them to keep investing more. Sooner or later, customers do not want to believe that brokers like GCG Asia are cheating them because they have invested so much of their money already that want the bad dream to be over.

However, with fraudulent brokers, the only end to the bad dream is successful fund recovery, because they do not return money to their victims willingly. That can only start by ending the denial, closing the account, and if that doesn’t work, enlisting the aid of fund recovery professionals like Crypto Trace.

Why We Think GCG Asia Is Probably a Crypto Scam

We make it our business to investigate crypto brokers and to determine whether or not they are legitimate. Sure, you could just consult customer review sites, but there is no way of verifying if these reviews are created by actual customers.

Often these reviews are generated by those associated with shady schemes to bolster their reputation. Other reviews may be a smear campaign against competitors. This isn’t to say that customer reviews should be ignored–they certainly should be taken into account–but they should not be a sole source of information about brokers.

We have done a deep dive into information from regulators, details about the site have applied our tested method, and have determined that GCG Asia is a suspected crypto broker.

No License or Offshore License

Having a license is like a driver’s license. You would not step into a car of a taxi driver that does not have a driver’s license. Similarly, you should not sign up with a broker that does not have a license.

However, not any license will do. The license must be up-to-date and genuine. Plenty of brokers falsely claim to have a license and may even present a thoroughly counterfeit image. This is why it is important to verify all licenses on regulators’ websites.

Third-rate or offshore licenses may seem satisfactory to some consumers, but they are not worth the virtual paper they are written on. These fake regulators grant licenses in exchange for fees and do not perform any inspections or deal with customers’ complaints.

GCG Asia has been called out for not having adequate licensing. Any of the above scenarios may be the case with GCG Asia. The bottom line is that this broker does not have an adequate license.

Titan Capital Markets Releases Key Analysis of AI Market Outlook And Trends For 2022

Titan Capital Markets Releases Key Analysis of AI Market Outlook And Trends For 2022

TITAN CAPITAL MARKETS PTY LTD, an AFSL-licensed and ASIC-regulated integrated educational financial group in Australia that helps members to improve their financial thinking and forex trading skills through extensive online and offline financial education courses and systematic social trading training programs, recently released a comprehensive report on AI market outlook and trends for 2022. US stocks ended the first quarter of 2022 with the worst performance in two years because of the Federal Reserve raising interest rates and political conflicts. TITAN CAPITAL MARKETS owners believe that traders can still make a breakthrough in the second quarter of 2022. The report revealed that the key to pursuing the right medium and long-term trends is Artificial Intelligence. To get more news about titan capital markets review, you can visit wikifx.com official website.

Whether an investor focuses on innovation or not determines their winning rate in forex trading. Artificial Intelligence or AI has the feature to help enterprises boost their competitiveness and growth potential, as well as deliver on a better-than-average growth. As mentioned in the latest report released by TITAN CAPITAL MARKETS, the world is still in the early stage of 'AI’s disruptive innovation cycle'. AI is being brought into play in many fields, including virtual assistance, health care, agriculture, finance, and even the much-discussed metaverse. The key point revealed in the report is that in a disruptive and ever-changing market environment, those who can make maximum utilization of AI will be able to usher in the future trends in their industries for the next five years.

To connect the forex trading strategies and trading experiences between each member and master traders, TITAN CAPITAL MARKETS has built the "Titan Wealth Ecosystem", which allows members to conduct automatic transactions by using the top AI copy trading system developed by TITAN and achieve their goals in life. With such an innovative business model, TITAN CAPITAL MARKETS has gained great popularity and recognition in both the business and financial industries.

As per the report, governments and big corporations are making AI layouts in advance to boost the win rate in trading. As the prevalence of AI gradually increases, the governments of major countries around the world, including Canada, China, the United States, Japan, and the European Union, have been making layouts in the AI industry by actively cultivating AI talents and formulating related policies. In addition to that, many influential technology companies have been taking active steps to develop AI technologies, integrate AI applications into their products and services, and even acquire related companies. According to experts, the global AI market size is projected to expand at a compound annual growth rate (CAGR) of 43% from 2022 to 2025, and the global AI market value is projected to reach $6.4 trillion by 2025, nearly triple the value in 2020.

In the face of the fluctuations in global stock market prices, major central banks around the world are trying to diminish the monetary policy uncertainty. Although this may help create more friendly stock and foreign exchange market environments, TITAN CAPITAL MARKETS advises traders to use transparent and robust social trading platforms, so as to better prepare for future challenges and boost the win rate in trading.

XSocio Markets Review

XSocio Markets Review

Looking at XSocio Markets website, it shows that they are owned by XSocio Markets Ltd. XSocio Markets Ltd is located in Saint Vincent and the Grenadines, a well-known offshore zone and a preferred location for shady brokerage. XSocio Markets is an unregulated broker. Problem with unregulated brokers is that they are not reliable and abuse the regulations. Make sure to stay away from this broker as they are anonymous and that they can disappear any time without notice.To get more news about xsocio markets review, you can visit wikifx.com official website.

To make sure you are dealing with a regulated and known broker, you should be able to find easily who is the CEO of this brokerage firm, who is running it etc. Lack of information is a big red flag since you dont know who will be dealing with YOUR MONEY. This is the reason why XSocio Markets is a dangerous broker to deal with.

With such lack of information and XSocio Markets being unregulated, funds are not safe. Security of funds is a huge problem with unregulated brokers. A red flag that we noticed is XSocio Markets is withholding vital information to users.

XSocio Markets could go bankrupt from one day to another since there are no banking information about this broker.

XSocio Markets is a forex broker registered in Saint Vincent and the Grenadines, a popular offshore jurisdiction where forex brokers are not regulated by the government. The broker offers ultra-high trading leverage of up to 1:2,000, and trading on the classic MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms.

In terms of trading instruments that are available, XSocio Markets has a fairly basic selection, with around 45 forex pairs, the most popular stock indices, as well as commodities such as precious metals, oil and natural gas. The broker does not offer any single stocks, nor any crypto pairs, bonds or other popular instruments.

Besides these four main types of trading accounts, there are also PAMM Manager and PAMM Investor accounts available for XSocio’s clients. PAMM stands for percentage allocation management module, and is a special type of account for traders who manage money on behalf of others, and thus operate a sort of fund.

To deposit money into a trading account with XSocio Markets, clients need to use either a Visa or MasterCard payment card, or one of the e-wallet services FasaPay, FPX, PayTrust, Walao Pay, Skrill or Neteller. There is also an option listed on the website to pay with crypto through a service called B2BinPAY.

What’s worth noting is that clicking any of the payment icons on the broker’s website redirects users to an unfinished website that promotes a blockchain network and token called Hoverex. The Hoverex website appears to be a scam, and we advise everyone to avoid using any of the services offered there.

As far as trading platforms go, XSocio Markets supports both MT4 and MT5, two classic and still-popular trading platforms among retail forex traders. The platforms are available in versions for both Windows and Mac computers, as well as mobile versions for Apple and Android devices.

In addition to the trading platform itself, the broker also supports certain social trading and copy trading tools directly from its website. For example, a rating of different social trading “providers” is available, with details of each trader’s profits, drawdowns and equity.

In summary, we see XSocio Markets as a forex broker that is trying to offer its services to a global audience but with very limited resources. The broker has a limited selection of trading instruments, is unregulated, and has a very unclear relationship to the Hoverex blockchain project, which to us looks like a scam. There is also little to no information about the founding team behind the broker, which we believe is very unfortunate.

Quotex review

Quotex review

Quotex is an innovative broker offering binary and digital asset trading. The company offers a wide array of trading assets, easy one-click trading, and multiple methods of banking. Read our expert review and see if Quotex match your trading style.To get more news about quotex review, you can visit wikifx.com official website.

Quotex is owned and operated by Awesomo LTD. Address: Suite 1, Second Floor, Sound & Vision House, Francis Rachel Str., Victoria, Mahe, Seychelles ID: 221042.

Awesomo Limited is a member of the IFMRRC (number TSRF RU 0395 AA V0161). The IFMRRC is an independent third party dispute resolution service and not an official regulator.

The websites services not available to persons under 18 years of age.

Payment method restrictions may affect traders in the US, Canada, Hong Kong and Germany but they can still deposit using cryptocurrency.

Quotex is a platform for trading digital options on a wide variety of underlying assets (over 400). The term digital option refers to trades based on simple up and down price movement with predetermined costs and fixed outcomes.

There is no download required, the platform is completely web-based.

The platform supports trading of options on securities (companies), forex, commodities, and some indices like the S&P 500.

The expiry durations are fairly diverse as well with 1 minute, 2 minutes, 5 minutes, one hour, and on up to a month or more in some cases.

Payouts

The payout percentage varies based on the asset, and time frame.

Returns will also vary on existing trade information, for example if a large proportion of traders are all speculating in the same direction, the payout is likely to reduce for new positions – conversely, those taking the contrarian view are likely to see a larger than expected payout %.

Education

The best method to learn the system is to utilise the demo account (more on that below). In addition however, Quotex does provide guidance videos and market news.

Trading signals are also offered, but these only become available on the full account – they cannot be accessed on the demo version.The app is quick, responsive and user friendly. It offers all the functionality of the web version, and finding markets and placing trades follows the same process.

Deposit, Withdrawal, And Bonuses

The minimum deposit at Quotex is only $10 and can be done made in dollars, euros, pounds, and even Bitcoin.

Deposits can be made by credit card, eWallet, wire transfer or cryptocurrency and are usually available within minutes of depositing.

eWallet options include AdvCash and Perfect Money.

Withdrawals are made back to the same source unless a secondary source is verified. There are no fees for withdrawing or depositing but some methods may incur fees not associated with the platform.

5 Best Forex Brokers & Trading Platforms in Pakistan 2023

5 Best Forex Brokers & Trading Platforms in Pakistan 2023

While there are no reputable international Pakistani Forex brokers, there is no restriction on Pakistani traders opening a trading account with Forex brokers from other countries. Therefore, there are thousands of choices, as most, if not all, cater to Forex traders from Pakistan. There are two facts to consider when searching for a Forex broker. and for the top Forex broker in Pakistan. First, there are unlikely to be any accounts in the Pakistani rupee, the official currency of Pakistan. Therefore, currency conversions when conducting financial transactions may apply. Second, Urdu is the official language, but most international Forex brokers may not offer Forex trading in Pakistan in Urdu. It should not pose a significant challenge, as many Pakistanis speak English well, and more Pakistani Forex traders are offering their services in Urdu.To get more news about v5 forex global review, you can visit wikifx.com official website.

With a population above 220,000,000, Pakistan represents an enormous growth market, not just for Forex brokers, but for all types of industry.

Therefore, the outlook carries a positive bias with incomes expected to increase. The tech-savvy, young population will likely use part of their spending power to invest and trade, with Forex among the most sought-after markets due to its low capital requirements in starting a portfolio. It can create an entire ecosystem from Forex brokers, signal providers, portfolio managers, analysts, accounting services, and Forex trading in Pakistan legal advice. The Forex market offers countless possibilities to make a distinctly positive impact on the everyday life of traders. Our Best Forex Broker in Pakistan list will provide traders with a head start in selecting the right broker and starting their Forex journey.

Forex trading in Pakistan is no different than in other countries, and new traders must follow the same steps to master Forex trading successfully.

Opening a Forex Account in Pakistan

An online application handles the account applications at all brokers and usually takes only a few minutes to complete. Regulated brokers must comply with AML/KYC requirements. A copy of the trader’s ID and one proof of residency document no older than three months generally satisfies them.

Risks of Forex Trading in Pakistan

The Forex market is the most liquid market globally, and nearly $7 trillion exchange hands daily. Therefore, liquidity remains a risk for all traders, but it also brings opportunities. New retail traders may struggle with the technical terminology, but a glossary will bridge the gap. The most significant risks to trading come from the trader and include lack of discipline and patience, insufficient trading capital, unrealistic expectations, and a lack of attention, focus, and appreciation for Forex trading.

Forex Regulations in Pakistan

The Securities and Exchange Commission of Pakistan (SECP) is responsible for regulating Forex trading in Pakistan. The SECP operates out of Islamabad and also oversees the banking and insurance sectors, together with other sub-sectors of the financial system. International brokers do not require a license from the SECP to accept Pakistani Forex traders unless they have a physical office in Pakistan.

Verifying SECP Authorization

The SECP does not maintain an online database like most regulators, but traders can contact the SECP to verify if a company is authorized.

Conclusion

Pakistan represents a tremendous growth market for Forex trading and improving economic conditions can boost the growth rate of online Forex trading in Pakistan. While the potential attracts many new retail traders, it equally does so with scammers.Finding the best trading platform in Pakistan may be challenging but it is possible.Therefore, if something sounds too good to be true, especially from an unverified or unregulated source, remain cautious. Conduct proper due diligence when selecting a Forex broker or pick one from our Best Forex Broker in Pakistan list.

In case you are unsure about legal aspects, you should consult a professional skilled in Forex trading in Pakistan legal services. Most Forex brokers accept traders resident in Pakistan. Invest in your education, ensure you have sufficient trading capital, and create a deposit plan. Patience and discipline will assist you in your journey to become a profitable Forex trader, but you must leave unrealistic expectations out of your trading strategy.

Effective Connectivity and Bias Entropy Improve Prediction

Effective Connectivity and Bias Entropy Improve Prediction of Dynamical Regime in Automata Networks

Biomolecular network dynamics are thought to operate near the critical boundary between ordered and disordered regimes, where large perturbations to a small set of elements neither die out nor spread on average. A biomolecular automaton (e.g., gene, protein) typically has high regulatory redundancy, where small subsets of regulators determine activation via collective canalization. Previous work has shown that effective connectivity, a measure of collective canalization, leads to improved dynamical regime prediction for homogeneous automata networks. We expand this by (i) studying random Boolean networks (RBNs) with heterogeneous in-degree distributions, (ii) considering additional experimentally validated automata network models of biomolecular processes, and (iii) considering new measures of heterogeneity in automata network logic. We found that effective connectivity improves dynamical regime prediction in the models considered; in RBNs, combining effective connectivity with bias entropy further improves the prediction. Our work yields a new understanding of criticality in biomolecular networks that accounts for collective canalization, redundancy, and heterogeneity in the connectivity and logic of their automata models. The strong link we demonstrate between criticality and regulatory redundancy provides a means to modulate the dynamical regime of biochemical networks.To get more news about costra-fx review, you can visit wikifx.com official website.

Introduction

The collective behavior of coupled automata is governed by the interplay between structural and dynamical parameters [1,2,3,4,5,6]. Tuning a small number of these parameters can lead to dramatic changes in the emergent properties of interlinked automata. A foundational example that illustrates this is the random Boolean network (RBN) models of gene regulation introduced by Kauffman [7], which have sustained interest over the intervening five decades (reviewed in [8,9]). In the Kauffman model, each of N Boolean automata (nodes) receives inputs from exactly K other nodes, chosen uniformly at random. An update function for each node is randomly generated by independently and randomly assigning an output value to each of the 2K possible input configurations, such that the output is 1 with probability P. The probability of activation of each input, P, is shared among all nodes in a network and is known as bias.

At each time-step, the vector of node variable values, called the network configuration, is synchronously updated according to these update functions.

The response of RBNs to perturbations has been of particular interest and is traditionally measured by the Derrida coefficient, δ. This parameter is defined as the separation (Hamming distance) after one time-step between two network configurations that initially differ in only one node value [10,11]. In the thermodynamic limit, N→∞, RBNs undergo an order to chaos phase transition characterized by the critical boundary δ=1. In the ordered regime, when δ is below this threshold, trajectories are characterized, on average, by short transient lengths and quickly vanishing perturbations. In the chaotic regime, when δ is above this threshold, transient lengths are long and perturbations grow in time, on average. Along the critical boundary, δ=1, on average, perturbations neither grow nor decay.

Contributions to the Derrida coefficient from an individual automaton can be measured using its sensitivity, which is defined as the number of inputs that can individually toggle the output of the automaton, averaged over all possible input configurations . The average sensitivity of the automata in a Boolean network gives the Derrida coefficient. In the thermodynamic limit, sensitivity can be computed as 2KP(1−P), which gives rise to the classical critical boundary:

A particularly relevant interpretation of Equation (1) is that it decomposes the Derrida coefficient into two contributions: average in-degree (K), which describes the average number of inputs nodes have, and bias-variance (P(1−P)), which describes how much spread there is in the distribution of activation probability (for all automata nodes in the network or ensemble.) The infinite-size limit in which the thermodynamic theory applies is an idealization, nevertheless, characteristics of the order to chaos transition can be observed in networks of eukaryotic cells [13], gene transcription [14], and other empirical databases [15,16] that have many fewer nodes than the typical number of protein-coding genes in an organism.

Various extensions of the Kauffman model have been studied to examine features of biomolecular networks that are not emphasized in the traditional model. For instance, gene regulatory networks tend to exhibit high modularity and power-law degree distributions. As such, modifications to the network structure of the Kauffman model have been considered for any in-degree distribution [17], power-law in-degree structure [8,18], and others [19]. Furthermore, in the Kauffman model, all update functions with the same activation bias are equally likely, but the regulatory logic of real biological networks is known to have a highly non-random structure [20]. To account for this, random Boolean models that use alternate methods for generating update functions, such as nested canalizing Boolean functions [21,22] and random threshold networks [23,24], have been proposed.

Here, we take structural heterogeneity into account directly by constructing RBNs with a truncated power-law in-degree distribution. Additionally, we consider the dynamical impact of regulatory logic through the lens of collective canalization. Broadly, the term canalization, coined by Waddington [25], refers to the ability of a small subset of variables (sometimes just a single variable) to determine the outcome of a regulatory process. Various measures have been proposed to quantify this behavior [26,27,28,29]. These measures are not necessarily in agreement about which Boolean functions are more or less canalizing than others. It is generally agreed, however, that the concept of canalization is closely related to robustness to genetic perturbations, which has been shown to play a crucial role in the ensemble properties of RBNs [7,12].

Collective canalization [20,26,28,30] refers to the degree to which a small subset of jointly activated inputs renders other inputs redundant. Effective connectivity, ke, has been proposed to measure this effect by computing the average size of the subset of inputs necessary to determine the output of an automaton [20,28]. It is obtained by computing the set of all prime implicants of a Boolean function (or the automaton’s look-up-table), which yields a maximal set of irreducible conditions for dynamical transition (see Appendix A for formal definition). This is equivalent to identifying and removing dynamical redundancy [28]. In other words, effective connectivity is the dual concept of dynamical redundancy in the logic of (collectively) canalized automata transitions. Bounded from above by in-degree, k, ke attains this maximum only when every input state must be known to determine the automaton’s next logical state. This only occurs for the parity functions (such as the case of a non-constant function of one variable or the XOR function of two variables). These are situations without any logical redundancy (or collective canalization). In the case of tautologies or contradictions (i.e., constant Boolean functions), ke=0 by definition, which denotes that all inputs are fully redundant.

Removing dynamical redundancy has already been used to reveal an alternative dynamically effective structure that includes collective canalization effects and is useful to characterize control in biochemical signaling and regulatory pathways [4,20]. Certainly, network controllability is an important aspect of automata models of biochemical regulation [31,32]. It is equally important to understand how perturbations spread in such models. Therefore, we focus here on the relevance of effective connectivity in determining the dynamical regime of Boolean networks and characterizing the critical boundary between order and chaos. Revising Equation (1) to utilize effective connectivity (ke) instead of in-degree (k), previous work has shown a significant improvement in dynamical regime prediction (as chaotic, critical, or ordered) of finite-size RBNs with homogeneous in-degree [33]. In other words, collective canalization (as measured by effective connectivity) explains the dynamical regime better than the apparent (structural) connectivity of such networks.

Here, we build upon that work to study RBNs with power-law in-degree distributions and study a larger set of experimentally validated Boolean network models of biomolecular processes. We show that in finite random networks and experimentally validated models, effective connectivity and bias-variance provide a better prediction of the dynamical regime—as measured by the Derrida coefficient and sensitivity—than the classical boundary of Equation (1) defined by the in-degree and bias-variance in the thermodynamic limit. We also show that the prediction of the Derrida coefficient is further improved in random networks by measuring the spread in bias using the entropy instead of the variance. In empirical models, the difference between the entropy and the bias is less pronounced, and the two measures perform similarly in predicting the dynamical regime.

Millenium MPS-1000 electronic drum kit review

Millenium MPS-1000 electronic drum kit review

Roland’s VAD range is arguably the front runner, but other brands such as ATV, EF-Note, Jobeky and more have also been creating hybrid acoustic-shelled electronic drum sets for a while. To get more news about millenium one review, you can visit wikifx.com official website.

The latter helped fuel many acoustic conversions during the lockdown, which remains an affordable way of achieving the same thing, as long as you’re willing to spend some time doing the modding.A recent newcomer to the market, though, may put paid to some of the heavy lifting of converting your own kit. You're probably already familiar with Millenium thanks to its affordable-yet-quality products which span everything from hardware to acoustic kits, snares and electronics.

The latest to come from Millenium is the MPS-1000: a ‘full-size’ acoustic-looking electronic kit comprising five mesh head-equipped acoustic shells, an acoustic stand-mounted hi-hat, two crashes and one ride cymbal pad.

As well as this, it includes all of the hardware you need to get set up straight out of the boxes, including cymbal stands, hi-hat stands, a dedicated module stand and a bass drum pedal.

They even throw in some sticks, although you will need your own stool. But the real headline here is the price. As currencies fluctuate, so do Thomann’s prices, but at the time of writing you can bag all of the above for £833, including delivery and you don’t need to worry about import duty, VAT or any other charges. The price you see is the price you will pay. So, at roughly a quarter of the price of Roland’s VAD 506 setup, is it too good to be true?Our kit arrived in a number of boxes, shrink-wrapped on a pallet. Be prepared for a lot of cardboard, but helpfully, everything is packaged in its own internal box which is also labelled so you can easily find everything while you’re setting up.

The MPS-1000 is full size, but it’s essentially a fusion-size kit, that means a 20” bass drum, 10”, 12” and 14” toms and a 13” snare drum. This is roughly the same sizes as Roland’s VAD 506 setup, with the exception of the snare drum.

The whole kit is wrapped in a silky Grey Line finish, and each drum is fitted with mini-tube lugs, which is nice to see considering Millenium could have easily opted for cheaper, more standard-style units at this price. The triple-flanged hoops are covered with rubber shrouds to keep the noise down while the bass drum hoops are finished in a matching wrap.

The toms are post-mounted to the bass drum using a Pearl-style tube. Obviously there’s no tonal debate to be had over drilling vs virgin bass drums here, and bass drum-mounted toms really do come down to preference for most people.

If you’d prefer, you can obviously remove the post entirely and hang the toms from a cymbal stand for more flexible placement, but it’s worth noting that the holder only rotates on one axis rather than giving you an ‘omni’ rotation from a ball-socket.

Now, we said these are full-size fusion pads, however the depth of both rack toms is the same at 6-inches. Once again, this has no bearing on anything other than placement and look, but it does essentially mean that you’re playing a ‘fast-size’ setup, with matching depths across the top bringing back a slight reminder that these things started out life as pads, not acoustic drums.The cymbal pads also offer plenty of realism, too, with Millenium opting for ‘odd’ sizes on the hi-hat and crashes at 13” and 15” diameter respectively. Both are dual-zone, with a choke function, referred to as ‘stop’. The ride cymbal is 18”, and features three zones - bow, edge and bell as well as being choke-able too.

They’re coated across 360-degrees with rubber, which is smooth to the touch and each cymbal mounts to the stand using Millenium’s mounting system which also prevents spinning and they have a nice natural swing to them.

Flexible LED Strip light buying guide: How to choose LED strip Lights

Flexible LED Strip light buying guide: How to choose LED strip Lights

The use of flexible LED strip lights is rapidly rising in modern lighting design around the world. Architects and lighting designers are implementing LED strip lights into residential, commercial, and industrial projects at an increasing rate. This is due to an increase in efficiency, color options, brightness, and ease of installation. A homeowner can now design like a lighting professional with a complete lighting kit and an hour or two. To get more news about led bar decor, you can visit htj-led.com official website.

There are many options on the market for LED strip lights (also called LED tape lights or LED ribbon lights) and there is no clear-cut standard for how to choose LED strip lights. We have created this guide to educate experts and newcomers alike.

Lumen is the measurement of brightness as perceived to the human eye. Because of incandescent lighting, we are all accustomed to using watts to measure the brightness of light. Today, we use lumen. Lumen is the most important variable when choosing which LED strip light you need to look at. When comparing lumen output from strip to strip, note that there are different ways of saying the same thing.

The questions you should be asking is “Lumens per what? Per foot, meter, or reel? How long is the reel?”

Different projects require a certain amount of brightness to achieve a desired look. Our advice is to always go brighter than needed and add a dimmer. Running your LEDs below their full power and brightness can also increase lifespan.

CCT (Correlated Color Temperature) refers to the color temperature of light, measured in degrees Kelvin (K). The temperature rating directly affects what the white light will look like; it ranges from cool white to warm white. For instance, a light source that has a 2000 – 3000 K rating is seen as, what we call, warm white light. Warm white light looks very orange and/or yellow. When increasing the degrees Kelvin, the color will change from yellow to yellowish white to white and then a bluish white (which is the coolest white). Although the varying temperatures have different names, it should not be confused with actual colors such as red, green, or purple. CCT is specific to white light or rather, the color temperature.

All CCTs are not created equal. You may notice that some lights that are "cool white" may not look pure white. They may give off a greenish, purplish, or bluish hue to them. This is because the LEDs have been selected from a presorted pile (bin) that is far from true white, in order to save money. It is important to ask the manufacturer of the LED strips how they BIN their LEDs and what their selection process is. Our strips are always selected from the same bin, to make sure every batch is the same and there are no color differences.

Here is an example of the same bedroom under 2700k, 3500k, 4200k, and 6200k lights. Notice how lighting changes the mood and style of the space! The aesthetic, function, or emotion of a space may change depending on the color temperature you use. Choosing the right color temperature is not difficult, but make sure you take into consideration the colors of your walls, the floor, what you will be illuminating, what activities will be completed in the area, or if there are local regulations telling you what CCT to use (Like California's Title 24).

A Novel Applicator for Hemostatic Agents

A Novel Applicator for Hemostatic Agents

Even though mechanical suturing, clips, and staples remain the mainstay of bleeding prevention, they are not always practical during laparoscopic and endoscopic procedures with limited access for larger instruments, and where bleeding dramatically decreases visualization of already small operative field. In response to this need, the field of intraoperative hemostatic adjuncts continues to increase and improve. The number of various agents can either provide a lattice to encourage hemostasis and/or activate the clotting cascade. Many of these agents, however, are applied manually and then held in place, usually under a gauze or sponge, thereby holding direct pressure on the bleeding wound. This practice poses several inefficiencies, including directionality and accuracy of placement and maintenance of position over the bleeding tissue. Moreover, maintaining applied focal pressure to the bleeding surface over time is a key component to successful use of hemostatic agent. Eventually, the release of the applied pressure often results in dislodgement of the hemostatic agent allowing the area to potentially re-bleed. Thus, there is a need for improved methods of delivering hemostatic agents to patients.To get more news about IFaks, you can visit rusuntacmed.com official website.

In an effort to improve the application of hemostatic agents with dexterity and simplicity as well as to be able to use them for a larger bleeding area, Dr. Robert Uzzo, Chairman of the Department of Surgical Oncology at Fox Chase Cancer Center, has developed a novel hemostatic agent applicator – “HematoDart”. This new applicator allows not only to contact a bleeding surface and apply manual pressure to the wound, but also to release the delivery component from the handle, thereby leaving the hemostatic agent attached to the surface and overcome the potential risk of re- bleeding.