qocsuing's Blog

IC Markets vs JustForex - Fees Review included

IC Markets vs JustForex - Fees Review included

IC Markets Trading Company was founded in 2007 in Sydney, Australia. The broker is licensed under the Australian Financial Services License (AFSL) and the Australian Securities and Investment Commission (ASIC). The broker is also a member of the Australian Financial Complaint Authority (AFCA), the governing body that sets the industry standard for the resolution of disputes between consumers and financial service providers, and regularly undertakes audits.To get more news about fxcm vs justforex, you can visit wikifx.com official website.

JustForex Broker (pronounced "Just Forex") is a brand of IPCTrade, an online Forex trading company that provides access to a variety of classic financial instruments. The broker is regulated by the Belize International Financial Services Commission (IFSC).

For getting helpful comparison results we strongly recommend you to pay attention to all maximum possible number of criteria. After you marked all brands you are choosing between and started to compare Forex brokers, please be sure to consider trader’s reviews as well as regulation availability. It’s is very important to control all possible risks by that. At the end of the table you can check out our unique section with Forex market data: swaps, spreads and quotes, which could be also useful for you.

By marking a corresponding checkbox on your left, our service will automatically hide all similar characteristics to make Forex broker comparison layout more convenient for your eyes. In addition, you can use the table settings to turn off or turn on the display of all company’s logos. Take your time and compare brokers very carefully!

Being full of nuances and pitfalls, trading on the market requires maximum attention for making the right choice when choosing a company for speculating. Be sure to compare Forex brokers using our functional section, and find the best intermediator that will offer you the most advantageous trading conditions. Fortunately, our table gives all traders a good chance of comparison brokers to choose the right firm since it contains a sheer amount of useful information. See as many details as possible to make the well-thought-out decision and trade on Forex gaining maximum profit from your account operating.

What are ‘pips’ in forex trading?

What are ‘pips’ in forex trading?

In forex trading, the smallest price change is the last decimal point. Given that most major currency pairs, such as those involving USD, EUR and GBP, are priced to four decimal places, a pip in this scenario is a price movement of 0.0001. For example, if GBP/USD moved from 1.4000 to 1.4001, it has moved by one pip. Comparatively, currency pairs using the Japanese yen (JPY) are only quoted to two decimal places. In this case, a pip is a price movement of 0.01. For instance, if GBP/JPY moved from 150.00 to 150.05, it has moved by five pips.To get more news about pips in forex trading, you can visit wikifx.com official website.

You can trade on the forex market through financial instruments such as spread betting and trading CFDs (contracts for difference). This involves opening positions based on the prediction that one currency will strengthen against another. For example, for every pip or point that a currency’s value varies, this will result in profits or losses for the trader, depending on the direction that the market heads.

How to use pips in forex trading

If a trader enters a long position on GBP/USD at 1.5000 and it moves to 1.5040, the price has moved 40 pips in the trader’s favour, potentially leading to a profit if the trade is closed. On the other hand, if the trader goes long on GBP/USD at 1.5000 and the exchange rate falls to 1.4960, the price has moved 40 pips against the trader, potentially leading to a loss on the trade if it is closed.

Similarly, if a trader goes long on GBP/JPY at 145.00 and it moves to 145.75, the price has moved 75 pips in the trader’s favour. If the exchange rate goes against the trader, and GBP/JPY falls to 144.25, the price would have moved 75 pips against the trader.

As well as measuring price movements and profits and losses, pips are also useful for managing risk in forex trading and for calculating the appropriate amount of leverage to use. For example, a trader can use a stop-loss order to set the maximum amount he is willing to lose in terms of pips on a trade. Having a stop-loss in place will help to limit losses if the currency pair were to move in the wrong direction.

Forex position size calculator

Pips can be used for the calculation of position size. If a trader’s combined position sizes are too large and they experience a number of losses, their capital could be wiped out. Therefore, trading with an appropriate position size is essential.

There are several steps involved in calculating position size:

A trader must determine the amount of capital they are willing to risk per trade. If this is 1% per trade, they could make a minimum of 100 trades before their capital is wiped out. If the trader’s account has a balance of $5,000 and they are willing to risk 1% per trade, this equates to $50 per trade.

Traders can determine a stop-loss in pips. For example, if a trader goes long on EUR/USD at 1.3600, they could place a stop-loss at 1.3550. This stop-loss equates to 50 pips.

The last step depends on what lot size is being traded. A standard lot refers to 100,000 units of base currency and equates to $10 per pip movement. A mini lot is 10,000 units of base currency and equates to $1 per pip movement. A micro lot is 1,000 units of base currency and equates to $0.10 per pip movement.

If the trader risks 1% of his $5,000 balance per trade for a micro lot ($0.10 per pip movement), the position size would be $50 / (50 pips x $0.10) = 10. Therefore, the trader’s position size would be 10 micro lots.

BEST MANAGED FOREX ACCOUNTS

BEST MANAGED FOREX ACCOUNTS

Trading is a difficult job, especially in markets that are open around the clock like forex. Paying attention to stocks is hard enough, and they only trade between 9:30 a.m. and 4 p.m. But currency markets can still be accessible to individuals short on time, and a managed account can offload the work to an expert. Let's take a look at the best managed forex accounts.To get more news about best managed forex accounts, you can visit wikifx.com official website.

Interactive Brokers has been providing trading and investment services to clients all over the globe for nearly half a century. Regulated in the U.S., Interactive Brokers allows users to access domestic and international markets, trade complex securities and derivatives and design their own APIs for automated trading systems. And while it doesn’t have copy trading or percentage allocation money management (PAMM) services, it does allow financial managers to open accounts and trade on behalf of clients.

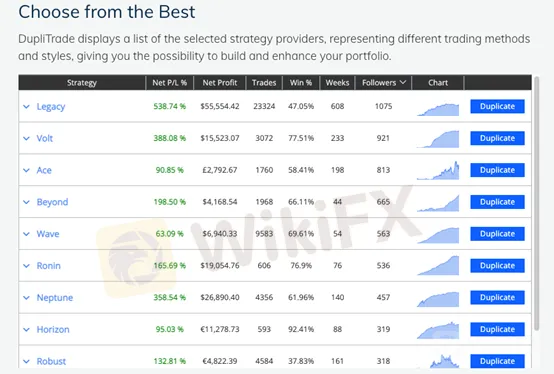

AvaTrade is a broker offering forex, cryptocurrency and contract for difference (CFD) trading. Clients can trade CFDs based on stocks, indices, commodities and bonds. But if you’re looking for a managed account, consider AvaSocial, a broad network of traders where clients can link their accounts to certain profiles and automate their strategy. Clients can also use popular copy trading products ZuluTrade and DupliTrade. AvaTrade supports MetaTrader 4 and 5 but also has its own WebTrader platform.

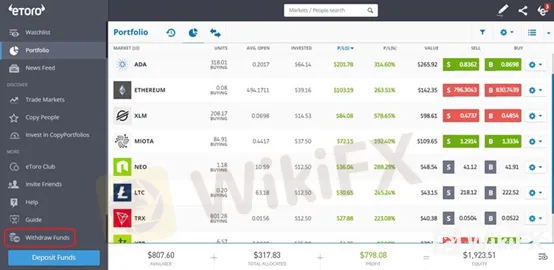

Forex traders in the U.S. often have limited options since many of the other securities on these platforms, like CFDs, are banned. But eToro is open to U.S. residents and has a robust copy trading service available to its clients. Copy traders can follow and mimic the portfolios of top traders on the network with no additional fee.

Pepperstone is an Australian-based broker known for its access to a variety of platforms, including MetaTrader 4 and 5. Pepperstone has three options for social traders: Myfxbook, MetaTrader Signals and DupliTrade. Spreads vary depending on your account type, but fees are minimal across the board and there’s no minimum to open an account.

Dukascopy is a Swiss financial services company offering a wide range of products from banking to CFDs to managed forex accounts. Dukascopy uses PAMM, which allows clients to devote different percentages of their portfolios to specific traders for copy trading. The firm also has a deep library of research and education materials for novice traders looking to learn about currency trading with market updates and news.

What is a Managed Forex Account?

A managed forex account is one where the owner outsources trading decisions to a third party, often a more experienced trader with a solid history in the market. Managed forex accounts can be set to copy all trades by other investors through linking, or the account owner can divvy up portions of their portfolio to different traders for strategic diversity.

Who Managed Forex Accounts are Best for

If you fit any of the criteria below, you may want to consider a managed forex account:

Busy individuals who can’t watch the market: Forex markets operate 24 hours per day during the week, and that’s far too much time for most individuals to study the market. If you have a demanding career or family obligations, a managed forex account lets you outsource some (or most) of the work.

People who prefer to let someone else do the trading: Maybe it's not the time but the experience that worries you. Are you a novice in the currency markets and want to learn from an expert first? A managed account will provide you with a trading history to study for a deeper understanding.

You don’t have the psychological makeup of a trader: Trading isn’t for everyone. Money tends to make people emotional, and the last thing you want is to become overly aggressive when trading. A managed forex account will remove emotion from the equation and allow you to focus your energy elsewhere.

Anyone who wants to plan for the future: A managed account provides access to different types of experts and can provide a basis for forex market education. If you have long-term plans in currency markets, why not take some time to learn different techniques from experienced traders?

Best Copy Trading Platforms In The U.S. February 2023

Best Copy Trading Platforms In The U.S. February 2023

Copy trading is a type of online trading that allows investors to follow and automatically copy the trades of more experienced and successful traders. With copy trading, investors can save time and effort by relying on the trading strategies of others, rather than trying to develop their own. To get more news about best copy trading brokers, you can visit wikifx.com official website.

In recent years, copy trading has become increasingly popular, particularly among novice traders and investors. In this article, we will explore some of the best copy trading platforms available in the U.S., including options for both forex and cryptocurrency markets.

What Is Copy Trading?

Copy trading is a form of online trading that allows investors to automatically replicate the trades of more experienced and successful traders. This is done through a copy trading platform, which connects investors with top traders and allows them to choose which trades to replicate based on the trader’s performance history.

Copy trading can be a useful tool for novice traders and investors, as it allows them to learn from more experienced traders and potentially improve their own trading performance. However, it is important to note that copy trading carries its own risks and investors should thoroughly research and understand the risks before entering into any copy-trading arrangement.

What Is The Best Copy Trading Platform In The U.S.?

There are many copy-trading platforms available, but not all of them are created equal. Some of the best copy trading platforms in the U.S. include eToro and Tradeo.

eToro: eToro is a popular platform that is known for its social trading network, which allows investors to see the trades and performance of other users in real-time. This can be a useful tool for identifying successful traders to follow and replicate. In addition to its social trading network, eToro also offers a wide range of trading instruments, including stocks, forex, and cryptocurrencies. This makes it a versatile platform for investors with diverse portfolios.

One potential disadvantage of eToro is its fees and commissions, which can be higher than some other platforms. However, the platform does offer a range of tools and resources to help investors improve their trading skills, which may be worth the additional cost for some users.

Tradeo: Tradeo is another top copy-trading platform that offers a range of features for investors. In addition to the ability to copy trades, Tradeo also offers a social trading network, real-time market analysis, and a range of educational resources. Like eToro, Tradeo offers a wide range of trading instruments, including forex, stocks, and indices.

One potential advantage of Tradeo is its lower fees and commissions compared to some other platforms. However, the platform’s social trading network may not be as extensive as some other platforms, which could limit the number of traders available to follow and replicate.

When comparing these two platforms, it’s important to consider the specific features and tools that each platform offers, as well as the range of trading instruments available. Investors should also consider the fees and commissions associated with each platform, as well as the overall reputation and reliability of the broker. Ultimately, the best copy-trading platform for an individual investor will depend on their specific needs and goals.

What Is The Best Forex Copy Trading Platform In The U.S.?

Copy trading and forex copy trading are similar in that both involve the act of replicating the trades of more experienced traders. However, there is a key difference between the two: the type of market being traded.

For investors interested in copy trading in the forex market, some of the best platforms include eToro and Tradeo, as mentioned above. Both of these platforms offer a wide range of currency pairs and allow investors to copy trades from top forex traders.

Another top forex copy trading platform is ZuluTrade, which allows investors to connect with a network of over 10,000 traders and automatically replicate their trades. ZuluTrade also offers a range of analytical tools and educational resources to help investors improve their trading skills.

1. eToro

eToro is one of the best copy-trading platforms in the U.S., and it allows its traders to choose from a wide range of assets, including cryptocurrencies like Bitcoin and Ethereum. eToro is a multi-asset platform, but it has a reputation in the industry for being very beginner-friendly.

According to eToro, CopyTrader is its “most iconic feature.” CopyTrader, a proprietary platform, lets traders choose from signal providers with successful track records. Signal providers, including those who are copy trading crypto, are chosen based on their return rate, strategy, risk score, and a number of copiers. You can filter through providers based on these criteria, and, once you choose a trader, you can set an amount that you want to trade. The minimum required for copy trading at eToro is $200.

2. Tradeo

Tradeo is a leading social trading platform that allows traders to follow and copy the trades of other successful traders on the platform. One of the main reasons why Tradeo is considered the best forex copy trading platform is its advanced copy trading technology. The platform has a range of features that make it easy for traders to find and follow top traders and diversify their portfolios. For example, Tradeo has a feature called “Top Traders Leaderboard” that ranks traders based on their performance, so traders can easily find and follow the most successful traders on the platform.

Tradeo also provides advanced trading tools and features to help traders make informed decisions and improve their trading performance. For example, the platform has a range of technical analysis tools, such as charting tools and indicators, that can be used to analyze market trends and identify potential trading opportunities.

3. ZuluTrade

ZuluTrade is a platform that allows traders to connect their brokerage accounts and copy the trades of other traders. The platform is beginner-friendly and offers a wide range of educational tools to help traders learn about copy trading.

ZuluTrade offers a variety of asset classes, including forex, cryptocurrencies, and CFDs on stocks and commodities. Crypto trading is available 24/5 on the platform. When choosing a trader to follow on ZuluTrade, you can filter by various criteria such as performance, risk level, and trading style. The platform also provides ranking systems to help you find the most successful traders to follow. Overall, ZuluTrade is a convenient and user-friendly platform for traders looking to get started with copy trading.

Best Forex Brokers For Scalping

Best Forex Brokers For Scalping

This article outlines the world of scalping in the forex market. We have created a list of the ultimate forex brokers that allow scalping through our objective user reviews and expert research. Looking for a broker that allows scalping? To get more news about best scalping brokers, you can visit wikifx.com official website.

The Exness Group was founded in 2008 and has licences from the UK Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC) and the Financial Services Authority (FSA) of Seychelles whose services this review is based upon. The group has more than 120,000 active traders and posts key performance indicators on its website.

Exness offers users the ability to trade on a wide range of asset classes covering Forex and CFDs on Crypto, Metals, Energies, Stocks and Indices across five core trading accounts. Professional Accounts are called Raw Spread, Pro and Zero with account leverage of up to 1:2000 on MT4 and unlimited leverage on MT5, no trading commissions on the Pro Account and 3.5 USD commission per lot, per side for Raw Spread and Zero Accounts. Standard accounts are called Standard and Standard Cent which are both commission-free. Demo accounts and Islamic swap-free accounts are also available.

Swissquote Bank Ltd. is an online forex, CFD and derivatives trading broker that offers what may be called a total trading package that goes beyond forex or CFDs. Swissquote Bank is part of the Swissquote Group Holdings Ltd, and represents the Swiss-based trading division of the company. Swissquote Bank operates from Gland, Switzerland and commenced operations in 1996.

The Swissquote website is a multi-lingual portal which offers 10 languages, giving it a wide linguistic spread that can accommodate traders from various countries. Swissquote is a sponsoring partner of Manchester United Football Club, the most successful domestic club in the UK.

FP Markets is the brokerage arm of First Prudential Markets Pty Ltd, an Australian firm that was established in 2005. In over 14 years of brokerage operations, FP Markets has grown to become a foremost online forex and CFD broker.

The Head Office is located in Sydney, Australia. The brand has won multiple industry awards in areas like; customer service, trader education and trade execution.

FBS is a brand name of FBS Markets Inc which is authorised and regulated by the International Financial Services Commission (IFSC) of Belize and the Financial Sector Conduct Authority in the Republic of South Africa (FSCA). In the EU and the UK, FBS is operated by Tradestone Limited, which is authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC). In Australia, FBS is operated by the Intelligent Financial Markets Pty Ltd with the Australian Securities and Investments Commission regulation (ASIC).

FBS offers the ability to trade on multiple asset classes covering CFDs on Forex and Stocks, Indices, Metals and Energies on the MetaTrader 4 and MetaTrader 5 trading platforms for PC, Mac, Web, Android and iOS operating systems. Moreover, clients from the countries under IFSC, FSCA, and CySEC regulations have an opportunity to trade in FBS Trader app, all-in-one trading platform. Clients from the countries under IFSC and FSCA regulations can also access copy trading services via the FBS CopyTrade app.

FxPro is a forex and CFDs broker that was established in 2006. To better serve its international clientele base, FxPro has established offices in major cities around the world. With its quality 24/5 customer support service, traders at FxPro can be assured that all their trading needs will be catered to by this broker. The broker offers both true ECN (non dealing desk) and dealing desk access a the trader prefers.

LED STRIP LIGHT ACCESSORIES

LED STRIP LIGHT ACCESSORIES

In the fields of basic research, evolutionary developmental biology, and genetics in particular, a weak light dose is required for many model organisms, including Drosophila, Caenorhabditis, and zebrafish, to thrive. This also applies to moss and the seed germination of higher plants.To get more news about led neon rope light, you can visit htj-led.com official website.

LED strip lights from BINDER are ideal for use in biological applications for which the luminous intensity needs to be reduced. They are available in lengths of 30 cm, 50 cm, and 90 cm, and can be flexibly used in all incubators, cooled incubators, and climate chambers from BINDER. The strip lights are splash-proof (IP 65) and can be operated at between -5°C and 60°C. They have an illuminance of 600 lux. In many cases, a day/night cycle also proves hugely beneficial when natural conditions need to be recreated for research with living organisms. The settings can be programmed using the corresponding LED strip light control unit, which has a built-in timer. The luminous intensity can be adjusted between 0% and 100% using a dimmer. Up to four strip lights can be connected to one control unit, which is magnetically attached to the outer housing side panel with ease.

LED strip lights are sold as accessories in two types of packs. The starter pack contains two strip lights, a control unit, and fastening materials including clips and power strips, while the expansion pack comes with two strip lights and the fastening materials. The strip lights feature high-quality white LED modules with a color temperature of 6,500 K (cool daylight) that are cast in an aluminum profile rail. They can be flexibly placed in the interior of chambers and connected to the control unit with a cable, which will ideally be laid through an access port, but can also be fed through the door gasket.

North Ridge PA Series Immersed Triple Screw pump

North Ridge PA Series Immersed Triple Screw pump

The PA series of triple screw pump is specifically designed for applications where there are space limitations. This range can be submerged in the oil and is excellent for lubrication and cooling applications. It can handle various hydraulic and lubricating oils ranging in viscosities from 10 to 400cp. The PA range can produce flow rates up to 51m³/hr and high pressures up to 50 bar.To get more news about screw pump stator, you can visit hw-screwpump.com official website.

This submersible screw pump can be fitted with either standard BSP connections or can come supplied with a filter on the suction port to protect the pump.

Our screw pumps have numerous benefits over other positive displacement pumps such as gear pumps. They produce low noise levels, are compact as no gearbox is required, produce low pulsations, are excellent at self-priming and can handle fluids containing trapped air.

The PA series can be fitted with an Atex motor for installation in non-safe areas. It is marine type approved by ABS, BV and RINA and can be marine witness tested by various classification bodies if required.

The PA series of triple screw pump can be manufactured in various grades of cast iron and can be utilised for various applications within the marine and industrial markets.

Albany Pumps have recently sent a sales engineer to Belgium to meet with a customer who, unfortunately ordered a pump for the wrong application. Due to the time sensitive nature Albany were able to receive the gear pump back into the Lydney workshop, change the direction of the pump and deliver it back to the customer in Belgium within 24Hrs.

The customer said “Thank you very much for all your quick help and good customer service in these pump story, with a positive outcome.”

Bulletproof Vest Market Size

Bulletproof Vest Market Size

Global “Bulletproof Vest Market” the research report includes an in-depth information of the current market environment, market size, share, geographical regions and new developments. This report a combination of qualitative and quantitative data, including 126 number of pages, list of figures, tables and charts. This report is a must-read for industry players, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the market in any manner.To get more news about Camouflage Bulletproof Vest, you can visit bulletproofboxs.com official website.

Chapter 1 mainly defines the market scope and introduces the macro overview of the industry, with an executive summary of different market segments ((by type, application, region, etc.), including the definition, market size, and trend of each market segment.

● Chapter 2 provides a qualitative analysis of the current status and future trends of the market. Industry Entry Barriers, market drivers, market challenges, emerging markets, consumer preference analysis, together with the impact of the COVID-19 outbreak will all be thoroughly explained.

● Chapter 3 analyzes the current competitive situation of the market by providing data regarding the players, including their sales volume and revenue with corresponding market shares, price and gross margin. In addition, information about market concentration ratio, mergers, acquisitions, and expansion plans will also be covered.

● Chapter 4 focuses on the regional market, presenting detailed data (i.e., sales volume, revenue, price, gross margin) of the most representative regions and countries in the world.

● Chapter 5 provides the analysis of various market segments according to product types, covering sales volume, revenue along with market share and growth rate, plus the price analysis of each type.

● Chapter 6 shows the breakdown data of different applications, including the consumption and revenue with market share and growth rate, with the aim of helping the readers to take a close-up look at the downstream market.

● Chapter 7 provides a combination of quantitative and qualitative analyses of the market size and development trends in the next five years. The forecast information of the whole, as well as the breakdown market, offers the readers a chance to look into the future of the industry.

● Chapter 8 is the analysis of the whole market industrial chain, covering key raw materials suppliers and price analysis, manufacturing cost structure analysis, alternative product analysis, also providing information on major distributors, downstream buyers, and the impact of COVID-19 pandemic.

● Chapter 9 shares a list of the key players in the market, together with their basic information, product profiles, market performance (i.e., sales volume, price, revenue, gross margin), recent development, SWOT analysis, etc.

PANIC AT THE PUMPS

PANIC AT THE PUMPS

News of a ransomware cyber attack May 7 that shut down the Colonial Pipeline and a potential gas shortage sent a flurry of buyers to the pumps in Western North Carolina beginning Monday. The pipeline is the primary fuel pipeline for N.C. and much of the Southeast.To get more news about progressive cavity pump, you can visit brysonpump.com official website.

Workers at the Hot Spot in Bryson City said it was unlike anything they had ever experienced, as they scrambled to organize the long lines of cars at the pumps.

Before long, the panic buying at gas stations throughout WNC led to some gas stations running dry and others setting limits on purchases.

At Hot Spot on Tuesday afternoon, the station still had lines outside at the pumps and no limits on gas, but the station had already run out of regular unleaded.

Stephanie Jenkins, who was working the register, described the frenzy at the station on Monday. “There was a line going in both directions into the road, we had to make people park over here, there and over here,” she said, pointing across the street and at both sides of the station.

“It was constant,” she added.

With fear of a shortage setting in, people filled up. Jenkins confirmed it was far beyond a usual fill up for many of the buyers. “People were coming in filling up all their family vehicles, gas cans —the whole nine yards.”

The station usually sees the truck once a week that refills the store’s supply of fuel. While Jenkins said the store is supposed to see another truck this week but they aren’t sure.

Other stations throughout town were just as busy Monday. In the western part of the county Monday night, the gas station lots were full after word that the two stations in town had already run out of gas hit social media.

On Tuesday afternoon, Shell in Bryson City was still without fuel and BP Local had set a $20 limit on fuel and was required drivers to pre-pay. Prices in town remained steady, with regular unleaded priced at $2.89 a gallon on average.

On Monday evening, North Carolina Gov. Roy Cooper declared a State of Emergency in response to the temporary shutdown of the pipeline. The order allows for fuel transportation waivers.

By Wednesday morning, Gas Buddy reported nearly 25% of gas stations in North Carolina were without fuel and that metro areas like Asheville were particularly hard it. Surrounding states also served by the pipeline including Virginia and South Carolina, were seeing fewer shortages, at about 14% reporting they were out of fuel.

Security in the smart home: considerations for device makers

Security in the smart home: considerations for device makers

When people think of home security they usually think of an alarm system with a keypad next to the door. These days, however, home security should have two meanings. I’m here to talk about the second: cybersecurity. In other words, security in the smart home.To get more news about smart home security products, you can visit securamsys.com official website.

A recent investigation found that a shocking number of leading smart home devices contained outdated SSL libraries. An outdated SSL could leave the door open for malicious actors to listen in on network traffic. In the smart home context, that traffic could include extremely personal information such as when you’re at home or away. This kind of security threat is far from being the only one; consumer device security breaches are consistently in the news. Clearly, this is a significant issue.

Cybersecurity in the consumer space

Cybersecurity has long been a weak point for the smart home industry. Typically, smart home devices are made on a tight budget and a fast development cycle. This doesn’t leave a lot of room for “extras” like security. What’s more, these devices aren’t being used in safety-critical or high-value environments. The consequences of a smart toaster being compromised don’t begin to compare to the consequences of a factory robot being compromised. These facts have led to a certain complacency in the industry.

While the industry may have gotten away with some complacency until today, the consequences of poor cybersecurity in the smart home are much higher today than they were ten years ago.

Big data = personal data

The amount of data generated by the typical smart home today is orders of magnitude larger than it was five or ten years ago. Most smart homes these days have multiple microphones and cameras on the inside of the home, something that would have been unthinkable in the 2000s. Additionally, many devices contain a variety of cloud services and applications, each with their own associated data sets.

This data enables some of the most advanced functionality we’ve seen in the smart home to date. Take ambient computing as an example of the possibilities offered by a large set of data from interoperable devices. Unfortunately, this data is also the reason that smart home cybersecurity matters now more than ever. A compromised smart home opens up a world of possibilities for bad actors – it could lead to identity theft, devices becoming part of botnets, or leaking of private information such as videos from inside the home.

How companies should respond

The problem may be widespread, but the good news is that companies operating in this space can very easily avoid making their devices a soft target for attackers. Companies should apply regular updates to their application and OS and should ensure that devices are properly isolated.

Robust and regular over-the-air updates

The first step towards having secure devices is having a robust update policy. Many devices in today’s smart homes do not receive updates without manual intervention by the end user. Realistically, that means they do not receive updates at all. This leaves the door open to an unknowable number of future threats.

Both application and OS updates are important here. Application vulnerabilities will be specific to each device, and it is up to the device maker to find and solve potential vulnerabilities to this software. Patches to OS vulnerabilities, on the other hand, will need to come from the maintainer of the operating system. In the case of Ubuntu and Ubuntu Core, Canonical can provide security maintenance and a number of other services.

Isolated systems

A second measure companies can take to protect their devices, especially in newer-generation devices that potentially run many applications and services, is to ensure that each of these applications is fully isolated so that vulnerabilities cannot spread. Ubuntu Core, for example, enforces this isolation system-wide, removing any such security threat.

With enough time and resources, attackers can likely access any system. Most likely, they will try to exploit the low-hanging fruit. The key for businesses in this space is to make the cost of attacking their devices higher than the benefit to attackers.