qocsuing's Blog

What’s new in BricsCAD® Mechanical V22.2

What’s new in BricsCAD® Mechanical V22.2

The BricsCAD® Mechanical V22.2 release includes several notable enhancements. This update acts as a vital component of our long-term strategy to assist product design and production professionals in their digital transformation. Check out the features and updates below to see how your workflows with BricsCAD® Mechanical in V22.2 will be enhanced!To get more news about mechanical cad, you can visit shine news official website.

Mechanical Block Workflow

This release delivers the initial implementation of our new architecture for assembly structure. To recall, this flexible architectural update allows users to define assembly structure and mechanical browser items using a wide variety of component types including native blocks, inserted blocks, and stand-alone solids.

![]()

The enhanced approach resolves issues with update, REFEDIT, and BEDIT scenarios, as well as provides a fresh view of in-place editing for mechanical parts. Access the new structure method, users must turn on the MechanicalBlocks setting. Once activated the BMNEW command will create a mechanical root block instead of a root component by default. In this update, commands BMEXPLODE, BMEXTERNALIZE, and BMFORM support the new architecture.

Drawing Views

Performance improvements are a constant focus for each update. For BricsCAD V22.2 we have introduced an innovative approach that enables faster update and display of drawings with multiple Drawing View.

If a drawing sheet has several views, then computations for each view will be done in parallel, allowing BricsCAD to achieve 2x-3x display time reduction. The behavior is controlled by the DrawingViewFlags setting and is the first step of planned actions to improve performance in this area.

For the Mechanical 2D direction, the Bricsys Team prepares a huge functional update for BricsCAD V23. For the current BricsCAD V22.2 we cover reported issues for AMSURFSYM, AMWELDSYM commands and symbols.

Sheet Metal introduces two major enhancements: neutral surface policy improvements and a new approach to select geometry using Ctrl-switch. The neutral surface concept plays a key role in the unfolding of Sheet Metal parts, directly influencing dimensions of the flat pattern as well as relative positions of the geometry details.

To honor user requests, we provide the possibility to assign neutral surface parameters per bend which gives extra flexibility compared with the previous Bend Table per solid approach. To cover possible scenarios, the user can override Bend Allowance, Bend Deduction, K-Factor or Bend Table in the Mechanical Browser properties of each bend feature. However, we suggest to operate the Bend Deduction option first which is the most consistent for our view.

Ctrl-switch introduces a new selection mode for Sheet Metal parts. It simplifies the selection of edges for further treatment by the Sheet Metal command. On the given example below, we hover our selection over a chosen region of a Sheet Metal part, toggle Ctrl, and select special mode. Due to this mode, we select only the edges for the external side of the part. The further SMFLANGEDGE command can then be directly called on this selection.

Service Robots

Service Robots

Service Robots are one of those robots which behave and do work like that of humans and are quite interactive. These robots can do those jobs which sometimes humans are not reluctant to do which includes cleanliness jobs, some dangerous activities, and also includes household chores like dishwashing, cloth washing, etc. Service Robots are programmed in such a way that they perform all the operations automatically based on the algorithms on which they are trained. Service Robots are known for their ability to do activities and taking decisions like any human being. One of the major objectives of service robots is to assist humans in a highly possible way. Their functioning is solely based on programming is done by the Engineers which is done with the help of many programming languages and frameworks. To get more news about GRS, you can visit glprobotics.com official website.

Personal Service Robots –

Personal service robots are those robots that are used for personal use mainly. These robots are mainly brought for self-assistance and for performing non-commercial tasks only. Some of the commonly used Personal Service Robots includes Robots as a domestic servant, automated wheelchair, personal mobility assist robot, and pet exercising robot.

Professional Service Robots –

Professional Service Robots are those robots that are used for professional use only. These robots are mainly brought for commercial use and for performing those activities which involve some dangerous tasks. These Robots are usually operated by Professionally trained operators who are solely dependent on the overall efficient functioning of these robots. They are meant to provide service in companies and offices and public places. Some of the commonly used Professional Service Robots includes cleaning robots for public places, Delivery Robots, fire-fighting robots.

TMGM Review

TMGM Review

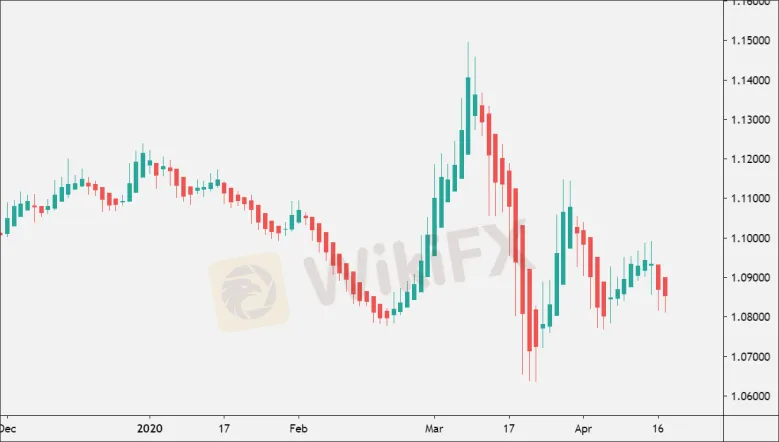

TMGM stands out for its impressive education toolset, though it still trails behind the best brokers in most categories. TMGM offers a small range of markets via the MetaTrader 4 (MT4) platform. While primarily a MetaTrader broker, it also offers the more exclusive IRESS platform – though the platform-specific requirements will limit who can use it.To get more news about tmgm review, you can visit wikifx.com official website.

TMGM provides access to dozens of forex pairs and CFDs across its brands regulated in Australia, New Zealand, and Vanuatu, all available via its MetaTrader platform offering. Select clients gain additional access to share trading on its IRESS trading platform.

Cryptocurrency: CFDs are available across 12 cryptocurrency pairs against the U.S. Dollar, including bitcoin, ethereum, link, uniswap, and other popular crypto assets.TMGM offers competitive commission rates for its Edge account with low spreads and no requotes.

Account types: Trading costs at TMGM will depend on whether you choose the spread-only Classic account, or the commission-based Edge account. The Edge account would be my choice, as it only charges a small commission of $3.50 per side ($7 per round trip), in addition to low prevailing spreads.

Interest-free accounts: Islamic finance customers seeking Sharia-compliant accounts must choose the Edge account, as swap-free accounts are not available with the Classic option.

Mobile trading apps

With no proprietary mobile app available, TMGM trails behind industry leaders such as IG and Saxo Bank. For our top picks among trading apps, read our guide to Best Forex Trading Apps.

Apps overview: Since TMGM is a MetaTrader-only broker, iOS and Android versions of the MT4 app come standard and are both available for download from the Apple App Store and Android Play store, respectively. While TMGM primarily offers the MetaTrader 4 (MT4) mobile app for forex trading, it also offers the IRESS mobile app which contains its full range of CFDs. For this review we focused on TMGM’s MT4 app.

TMGM is primarily a MetaTrader broker, offering the standard, out-of-the-box MT4 experience. Unfortunately, there are no notable add-ons to help TMGM stand out among the best MetaTrader brokers. MetaTrader 5 (MT5) is not available although is expected to be made available at TMGM sometime in 2022.

Platforms overview: The MT4 desktop platform is available for the macOS and Windows operating systems straight from the developer, and is provided by TMGM as an installable file once you open a live or demo account. The IRESS platform is primarily for share-trading – it is not optimized for forex trading.

Charting: MT4 is known for offering robust charts with versatile functionality. Zooming in and out and rearranging windows and tabs is a breeze on MT4. It also supports the ability to drag and drop from the default list of nearly 50 indicators.

Trading tools: Forex Virtual Private Servers (VPS) are available at TMGM for traders who are running algorithmic strategies on MT4, and who want to host their platform in a cloud environment that can run 24-7 without interruption. The basic service is free if you deposit $3,000 or trade at least 7 standard lots per month if you are a new client, or deposit $20,000 if you are a high-frequency trader (HFT).

TMGM trails behind the industry average with its research content, and offers little to no market commentary beyond the excellent suite of third-party tools from Trading Central. TMGM’s blog has a good foundation for growth, but many of its articles (besides the Technical Outlook series) lack the images, charts, and tables that typically are found in market analysis updates provided by the best brokers in this category.

Research overview: Much of the research content at TMGM is powered by Trading Central (TC), including the Market Buzz and Economic Insight tools. Market Buzz depicts a sentiment-guided heatmap of instruments, whereas Economic Insight is a TC-powered economic calendar. Look to TMGM’s blog for additional features such as pre-session outlooks and fundamental forecasts.

Market news and analysis: TMGM’s blog includes daily market commentary and provides technical and fundamental analysis. Articles are generally consistent in authorship and format. The video content on TMGM’s official YouTube channel lacks variety, consisting mostly of promotional commercials along with a small handful of tutorials and webinars. Expanding the scope of articles and videos would help elevate TMGM’s research offering closer to the industry average.

MultiBank Review 2023

MultiBank Review 2023

Established in 2005, MultiBank Group has successfully stamped its authority in the world of trading. It has a valid impact in the foreign exchange industry with providing exemplary products, services, and trading platforms. With a paid-up capital of over $322 million, MultiBank Group is recognized as one of the largest only financial derivatives providers worldwide.To get more news about multibankfx review, you can visit wikifx.com official website.

On first acquaintance with MultiBank Group, I got a feeling that it wasn’t like the other trading firms I dealt with. The trading terms were clear and obvious: information on the funds’ withdrawal, specifications for contracts for all trading assets and more. Also, the trading terms are very favorable compared to other brokers in the market. They offer spreads below the market average with a minimum deposit of only $50. At Multibank Group, they value their partners and offer competitive packages and rebates for IBs.

The technical part is also very clear and transparent. According to traders, it is easy to add custom indicators or Expert Advisors created in the standard MQL code to them. On the other hand, the social trading platform is a little harder to understand, but with their dedicated customer service support, everyone can understand and use it thoroughly.

Clients might seem a little skeptical at first because of the 1:500 leverage provided but the fact that it is licensed from over 10 regulators around the world assures you that there is nothing unclear or misleading about it.MultiBank Group services an extensive client base of over 320,000 clients across the globe. The Group provides an extensive range of 20,000+ financial products across various asset classes including Forex, Metals, Commodities, Indices, Shares and Cryptocurrencies. In addition, MultiBank Group offers opportunities for clients who are seeking additional income by its Partnership Programs.

The Group provides an excellent opportunity for traders to join and trade via a social network and profit from the knowledge of trading experts. They can earn passive income by copying transactions of successful traders or, conversely, become a signal provider.

MultiBank Group’s trading conditions will vary according to the trading account or platform used. Orders will be executed in accordance with trading conditions or spreads at the time. MultiBank Group provides stop-out level, where trading platforms are set to automatically close positions whenever such level is reached. With a low minimum deposit and a leverage of up to 1:500, clients can implement a high number of trading strategies to multiply their profits. According to trading conditions, the minimum spread starts at 0.0* pips on FX.

MultiBank Group positions itself as a pure ECN, Non-Dealing Desk broker that works directly with liquidity providers, offering optimal spreads and commissions. They are globally recognized for its Introducing Broker’s Program, with a network of over 30,000 IBs. They value their partners and guarantee the best market prices for order execution without slippage.

Clients can choose from the MT4 and MT5 platforms, where they can access flexible charting variations for each market. You can open a maximum of 5 live accounts under the same account holder’s name.

BLUEBERRY MARKETS Review

BLUEBERRY MARKETS Review

Blueberry Markets is a market-maker, founded in 2016 by Dan Hyde, a former AxiTrader executive. There are now 30,000 traders at Blueberry Markets, and the broker has been named one of Australia’s most trusted brokers. At the Finder Awards in both 2020 and 2021, Blueberry Markets was named a “Finalist” in the “Best Online Customer Service” category.To get more news about blueberry markets review, you can visit wikifx.com official website.

Judging from the educational tools offered by Blueberry Markets, this broker is suitable for beginner, intermediate, and advanced traders. There are trading programs for each of those experience levels, and this inclusiveness means new traders won’t feel too overwhelmed. Additionally, this broker’s customer service has gotten great reviews, a boost for novice traders who require extra help.

Top BLUEBERRY MARKETS Features

Partnerships. The Brokers Program at Blueberry Markets is a partnership program that gives you features like lifetime rebates on preferred clients, fast payouts on rebates, and customized marketing and lead campaigns. The program is for people who have a trading community or want to leverage their current client portfolio. This partnership program is one of the best in the industry. You can join as an Introducing Broker, Affiliate, or Fund Manager, depending on your qualifications.

Forex VPS. If you want to ensure low latency when you trade, Blueberry’s Forex VPS can help. You won’t have downtimes caused by connectivity issues, and you can execute trades in one to three milliseconds. Apply via a form on the Blueberry website, and the brokerage will contact you to talk about setting up a VPS.

Wide Asset Range. There are over three-hundred instruments from which to choose at Blueberry Markets. These include Forex, Share CFDs, Crypto CFDs, Commodities, Metals, and Indices. This wide asset range will be attractive to traders who want a lot of variety.

Analytic Features. Another top feature of Blueberry Markets is its analytical offerings. It provides market news and analysis, a look at the “week ahead” in the industry, an economic calendar and weekly newsletter, and information on trading hours at the various global exchanges.

There are quite a few trading and investment tools to note with Blueberry Markets. These include the broker’s educational tools, as well as Premium Trader and DupliTrade.

At Blueberry Markets, there are educational resources designed to guide you through trading, from basic concepts to advanced indicators. There are three levels of Blueberry’s trading school: beginner, intermediate, and advanced. Beginners who are “venturing into Forex” can learn the basic concepts of selling and buying, while intermediate traders can learn how to level up their basic understanding. Advanced traders will be taught risk management and how to identify hidden opportunities.

Blueberry Markets also provides short how-to guides about trading on the MetaTrader platform. They give clients FAQs about MT4 and MT5, too. Finally, there are video tutorials for traders who want to expand their knowledge of trading, whether they are advanced or at a beginner level.

Blueberry Premium is for high-volume traders who want instant execution and great pricing. Blueberry Premium offers tailored spreads, commissions, and pricing to create an environment that suits a specific trading style. There are advanced research and trading tools, insights, and market alerts with Blueberry Premium. To become a Premium Trader, you have to cross a Volume Per Month threshold. For Forex, commodities, and shares, this volume is $10 million notional volume (in USD).

Doo Prime review – Is it safe to trade with this broker?

Doo Prime review – Is it safe to trade with this broker?

Doo Prime is definitely not a new kid on the block, judging from the fact that it’s a subsidiary of a rather large Group Holding in Hong Kong. However, despite it being a subsidiary, our Doo Prime review found out that the brokerage has some grey areas it wants to hide.To get more news about doo prime review, you can visit wikifx.com official website.

Doo Prime at a glance

When visiting the website, it’s not really difficult to be impressed with all the CSS and Javascript gimmicks of the brokerage. They decided to go with the “one page” website layout, which to be honest, is not as user-friendly as one may imagine. Having all the information segmented into their separate pages is a much better resource for better transparency.

Speaking of transparency, the first aspect that raised the questions about the Doo Prime scam is the disclosure of the broker’s awards. It may seem that the company is quite honest with its operations by disclosing info about being a subsidiary, but when it comes to the rewards that it claims to possess, there is no evidence.

For example, Doo Prime claims that they’re the owner of the 2017 best MT5 broker award, which they don’t link to, and Google says that it’s actually the FxPro Forex broker and not Doo Prime.

With all that being said, we don’t want to call someone a scam without further researching their platforms. Besides, transparency issues alone don’t strictly suggest that Doo Prime is a fraudster.

Doo Prime regulation and license

When digging through the footer of Doo Prime’s website, where legal information is usually located for Forex brokers, we found out that they are a subsidiary of Doo Holding Group Limited, located in Hong Kong. However, the Doo Prime Forex broker itself is in the Cayman Islands.

But, the trick here is that they’re not licensed by the Monetary Authority of the Cayman Islands, they’re just registered there. This ultimately makes them an unlicensed offshore broker, which are hardly the words you want to hear when choosing a Forex brokerage firm.

Once again, this further diminishes the reputation of the Doo Prime Forex broker. However, it’s worth noting that we’ve seen many offshore brokers that follow strict financial guidelines, regardless of the absence of the government regulator.

In the next section, we’ll discuss how Doo Prime entices traders to register with them and whether its features are worth your time and effort.

Doo Prime trading conditions

In terms of trading conditions, Doo Prime does not strike as an amazing deal. Being offshore and unlicensed should provide them with unlimited possibilities to market to their potential customers, but their real capabilities fall short compared to even the most strictly regulated companies in Europe.

Doo Prime Forex broker promises leverage up to 1:400 on major currency pairs, alongside a spread that goes as low as 1 pip and a minimum deposit of $100 and $5000 on its two trading accounts respectively.Let’s start with leverage. As you may or may not already know, this feature is used to increase the initial trading funds substantially. For instance, with Doo Prime’s leverage rate, you can increase your trading capital by x400 times, which is just bonkers.

However, we need to point out that many reliable brokers tone this feature down quite a bit. In the US and EU, brokers are restricted to only 1:30 leverage for customer safety. So, can Doo Prime be trusted, considering its overzealous leverage offering? Well, we cannot say for sure that it’s a scam but it certainly raises some questions.

Moving on, let’s talk about the spreads. While the minimum spread of 1 pip is more or less decent, other brokers go as low as 0.1 or even 0.01 pips, which indicates that Doo Prime isn’t as competitive as its counterparts. Besides, the average spread markup is far higher than 1 pip – around 17 pips on most pairs.

We weren’t able to find any information about the methods that traders will have in terms of Doo Prime withdrawals and deposits, but judging by the fact that they promote a “partnership” between banks like the Bank of America and HSBC, it’s easy to believe that they use Wire transfer and credit cards the most.

Once again, we don’t know about the fees on these deposits or withdrawals, yet we can speculate that there will be some charges on the transactions you make, simply because Doo Prime doesn’t really strike us as a customer-oriented brokerage.

ZFX Broker Review 2023

ZFX Broker Review 2023

The ZFX is an NDD, STP, and ECN broker headquartered in London. It has been providing online FX and CFD trading services since 2016. It is regulated by the British FCA and Seychelles supervisory authority FSA. Traders from Europe, Asia, and Africa can trade currency pairs, indices, stocks, and commodities on the ZFX platform. The broker is part of the Zeal Group of fintech companies specializing in liquidity solutions for regulated markets in major regions of the world.To get more news about zfx review, you can visit wikifx.com official website.

The ZFX broker is part of the Zeal Group and is only five years old with its headquarters in London. During that time, the brokerage has opened a representative office in Seychelles and several offices in Europe and Asia. However, its management limits the sphere of activity of each subdivision. The broker is regulated by FCA as well as FSA Seychelles.

The ZFX brokerage strives to meet the needs of traders of all experience and asset levels. Cent accounts from $50 and up are available to beginners and traders wishing to test the broker's terms and services. More experienced traders can make transactions on Standard accounts after depositing $200. The broker also offers ECN accounts to both retail traders and professionals.

The ZFX broker offers favorable conditions for active trading and passive investing. Its MT4 terminal allows traders to work with PAMM and MAM accounts. Thus beginners without experience can earn passive income by trusting their capital to competent and professional managers.

Any ZFX client interested in investing profits can sign an agreement with the chosen asset manager in which the performance fee is agreed upon in advance. The MAM account includes performance, management, and trading fees. In this case, the broker himself does not participate in the MAM, but only acts as a custodian of the funds and a guarantor that the manager and the investor receive the agreed percentage. The investor can fully control his account.

To determine what trading fees ZFX charges its clients, the broker's trading conditions were analyzed by experts at the Traders Union. There is no fixed brokerage commission at ZFX, and the spread depends on the account type and currency pair. The tightest spreads (from 0.2 pips) are on ECN and Professional accounts. On the Standard STP trading account, spreads start from 1.3 pips, and on the Mini Trading Account, they start from 1.5 pips. Additional commissions may be charged for transactions on ECN accounts. Depositing and withdrawing funds are free of charge, but a commission may be charged by payment systems or the receiving bank.

The ZFX brokerage is an STP and ECN intermediary which offers non-dealer executions, competitive spreads, and the full range of classic MetaTrader 4 features. The company is headquartered in London but has offices worldwide such as in Moscow, Abu Dhabi, Hong Kong, Bangkok, Taipei, Ho Chi Minh City, and Jakarta. ZFX has a relentless focus on finding the best prices in the institutional markets by using cutting-edge technology and guaranteeing clients transparent pricing.

The company seeks to provide favorable trading conditions for beginners and professionals, private and institutional clients, and active traders and passive investors. Its clients can trade currency pairs (major, minor, and exotic) and CFDs on shares and indices. Transactions with CFDs on commodities, including oil and precious metals, are also available. The terminal provided by the ZFX broker supports not only market orders, but also trailing stop, buy limit, buy-stop, sell limit, and sell-stop indicators.

ZFX offers MetaTrader 4 desktop and mobile platforms that support a wide range of technical indicators, including charting, and one-click trading. Automated trading managed by expert advisors is also available. The broker does not provide web terminals, so its clients must download and install MT4 on a PC, laptop, or mobile device to start trading.

GlobeX360 Review 2023

GlobeX360 Review 2023

GlobeX360 is a broker established in 2017 that focuses on traders from the African continent. It is a provider of online trading services for Forex and CFDs on stocks, indices, cryptocurrencies, and commodities. GlobeX360 is registered with the Companies and Intellectual Property Commission (CIPC) and is regulated by the South African Financial Sector Conduct Authority (FSCA). In 2020, International Business Magazine was named Fastest Growing Forex Broker and Most Innovative Broker.To get more news about globex360 review, you can visit wikifx.com official website.

GlobeX360 is a newcomer to the Forex market. However, in a short time, this broker has already managed to open several representative offices not only in African countries, on which it focuses but also in South America and Australia. The company allows clients to make deposits in both local currencies and GBP, EUR, USD, CHF, as well as open multiple accounts in different currencies, and then easily transfer money between them.

GlobeX360 offers a wide range of currency pairs and CFDs, high leverage, and an MT4 terminal. However, the broker’s spreads are not the lowest on the market. Even on professional accounts, they start at 1.2 pips. Considering that other companies keep almost zero spreads, GlobeX360 is inferior to them in terms of optimal trading conditions.

The broker strives to ensure the safety of its clients and their funds. At the initial stage of cooperation, the trader is provided with leverage of up to 1:300. Only in the process of trading can he request leverage of up to 1:500. At the same time, the GlobeX360 risk department constantly monitors the trade of all clients. If a trader exceeds the acceptable risk indicators, then the company reduces the leverage on his account.

The GlobeX360 broker offers investors standard solutions that are available in the MT4 terminal. Its clients can copy trades after following a signal provider, they can connect to the MAM service, and also use robotic advisors for automated trading. The company does not offer ready-made diversified portfolios of assets, however, experienced investors can form them on their own from instruments of varying volatility. The referral program is also good to earn additional income.

GlobeX360’s solutions for passive investors

GlobeX360 provides its clients with an MT4 terminal, the functionality of which allows you to earn money without independent trading. The choice of an investment program primarily depends on the experience and knowledge of the investor, as well as on the preferred method of trading, which includes the help of a person or an algorithmic program. So, to receive passive income, a GlobeX360 client can choose:

MAM service. With the help of a Multi-Account Manager, both an investor and a successful trader who has become a manager of several accounts can earn money. MAM works like this: the investor makes a deposit and connects to the manager’s account; after this, his transactions are copied to the subscriber’s accounts. After a successful transaction, the manager receives a part of the investor’s profit.

Signals from the MQL5.com website. The investor connects to the social trading service and selects a provider whose signals are copied to his account. As in the previous case, not only a passive market participant but also an active trader with a successful trading strategy can earn additional income here.

Expert Advisors (EAs). It is a solution for investors who trust a trading robot rather than a living person. GlobeX360’s clients can install Expert Advisors for automated trading from various developers.

Investing in MAM and connecting to the trade copy service is available to all GlobeX360’s clients. At the same time, only a trader who demonstrates a stable increase in the deposit can become a signal provider, and only a professional market participant can become a MAM manager. The use of Expert Advisors is allowed on both Standard and Professional accounts.

Expert Review of SurgeTrader

Expert Review of SurgeTrader

SurgeTrader is a classic prop company that allows traders to work with investors' money. The core of the proposal is as follows: are you confident in your abilities and your experience? Then you need to choose one of the company's course exam packages, get trained, and confirm your knowledge by passing the SurgeTrader Audition. Unlike other companies, SurgeTrader does not have a 30-day trial period. If you pass the test, within 24-48 hours you are assigned the appropriate status. This is one of the key advantages of the company.To get more news about surgetrader review, you can visit wikifx.com official website.

The second advantage of SurgeTrader is high trading commissions. The trader receives an account from USD 25,000 to $1 million under management, depending on the initially chosen package. And 75% of the profit is the trader's income. But to get it, the trader must adhere to fairly strict trading rules regarding the maximum daily loss and drawdown. Although the company is loyal to non-critical violations and can be flexible with the trader, for major violations it has a zero-tolerance policy, which includes the cancellation of the “SurgeTrader” status and the need to re-pay the cost of the course.

The first impression of SurgeTrader is positive. The terms of trade are formulated very clearly, and there are not many of them. The price of the courses is relatively high, but this is offset by the nonexistence of a test period, loyalty to random errors, and the opportunity to reach your full potential. There are no restrictions on the strategies used.

SurgeTrader is an investment company in and of itself, ready to invest in professional traders. SurgeTrader works with a venture investment fund that is ready to transfer money to the management of the traders who have proved their professionalism on a test account.

The prop trading model of SurgeTrader works as follows:

The trader pays for testing. The fee was introduced to eliminate beginners and traders without experience who are not ready for long-term cooperation. The amount depends on the chosen tariff plan. Tariff packages differ in the requirements for the target profit transferred to the management of the deposit.

Within a few minutes after the payment, the trader gets access to the account on the EightCap broker platform. The task is to earn money following the trading rules.

After passing the test mode, the trader gets access to a funded account. Its conditions are fully consistent with the conditions of the test mode. If a trader has paid for the exam package with access to USD 50K, in case of successful completion of the exam, he will receive a funded invoice for USD 50K.

There is a demo account for testing the trading platform. On it, you can go through test trading before paying for the exam. The trader's profit is 75% of the money earned. In case of major violations, the trader's account is disqualified, after which it is offered to pay for the exam with a 20% discount and take it again.

To obtain the status of an affiliate, you need to send an application by email, after which the company will provide access to the affiliate account. The account tools allow you to track affiliate statistics and the effectiveness of a marketing campaign. Remuneration payments are made at the beginning of each month.

ATFX Review 2023

ATFX Review 2023

ATFX is a Forex and CFD broker and is a part of AT Global Markets, an international investment holding company. The company is licensed by the FCA (UK), CySEC (Cyprus), FSC (Mauritius), and FSA (Saint Vincent and the Grenadines). The broker offers beneficial trading conditions for active traders as well as passive investors. ATFX service quality has been recognized by the many awards the broker has received, including Fastest Growing Forex Broker in Europe in 2017, and a 2018 Best Forex CFD Broker award from UK Forex Awards.To get more news about atfx review, you can visit wikifx.com official website.

The FCA and CySEC licenses are what attracted me to ATFX. I decided to try to work with the broker, but that didn’t work. The broker does not accept traders from Ukraine, so my application for opening an account was rejected after the registration. I managed to open an account only after I moved to Germany. I traded there for several months, but never earned a big profit.

The spread is too high on the standard accounts. In order to avoid paying sky-high commissions, you can deposit $5,000 on the account, but I’m not prepared to do that yet. I can say that this broker is suitable only for professionals, who have a large amount of free capital.

I read on one of the forums that ATFX was planning to launch a copy trading service. I decided to try it, but couldn’t find any information about it on the website. Customer support operators kept promising that the platform would soon become available. While I waited, I decided to open a demo account to test the service. The platform operates quickly, the deals are closed at the best price, but that is a demo account, so it’s understandable. I found a broker with better spreads, which is why I never opened a live account on ATFX.

Adrian Brooks,

ATFX customer support is rather unwelcoming. They don’t respond to the questions about the trading conditions and insist that you need to register. They promised to provide a personal manager once I opened an account, but why would I do that when I don’t really know their conditions? There is no information about PAMM and the copy trading platform on the website. Liquidity providers are concealed, the bonuses are available only to customers from five or six countries, and the commissions of the payment systems are not specified. After studying the website closely, I lost any desire to open an account here.

ATFX positions itself as a customer-oriented broker that is focused on the trader’s interests. Automation and flexible work are the key components of the successful operation of the company on the Forex market. ATFX provides technical and fundamental analysis, market forecasts, and trading rates from financial experts with vast experience of working both in the retail and institutional environment.

ATFX promptly reacts to the evolving needs of the customers and launches custom-made products to meet them. In particular, recently the company introduced ATFX Connect, a new division that was set up to service institutional professional customers. Also, in 2020, the broker introduced a proprietary social trading platform titled ATFX TeamUp.

The company updated the website, adding new useful sections – Trading Strategies and Market News. The information published in them will help beginners and professionals improve the quality of their trading skills.ATFX is a broker with conditions designed for active traders. The company also provides an opportunity to earn passive income without being personally involved in trading. The number of investment programs of ATFX is limited: the customers can invest in a PAMM account and earn a partnership reward under the Introducing Broker program. In 2020, the broker launched TeamUp, a proprietary social trading platform, which allows investors to copy trades of successful traders.